Mach

DP Veteran

- Joined

- Oct 13, 2006

- Messages

- 27,745

- Reaction score

- 24,087

- Gender

- Male

- Political Leaning

- Slightly Liberal

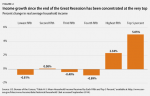

Gosh, a constant use of power by the ultra-wealthy to ensure they get *even more* at the expense of everyone else. I wonder where else I've seen that trend evidenced...Exactly.Those who don't get the tax cut - the middle-class.

BUt look at the folks in this thread saying like a broken record - tax is theft! Robbing the rich to give to the poor!

Those poor ultra-wealthy people are so persecuted I tell ya, we're all lucky we have such white knights here to defend their persecution!