- Joined

- May 3, 2005

- Messages

- 15,254

- Reaction score

- 580

- Gender

- Male

- Political Leaning

- Very Conservative

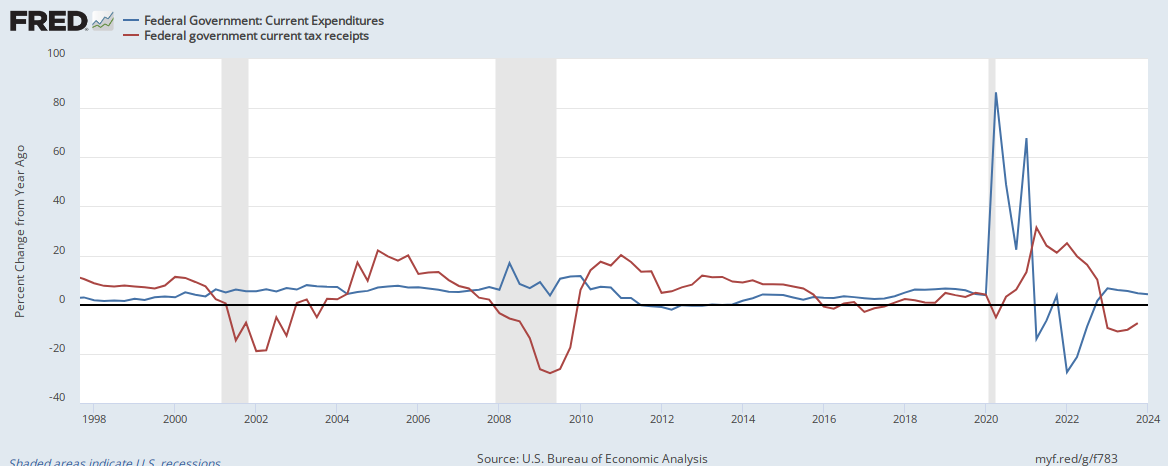

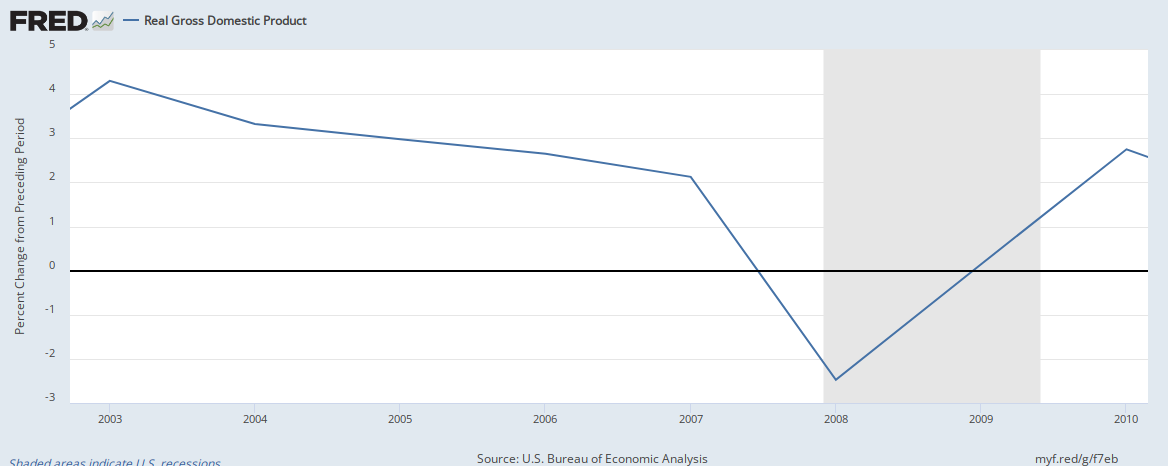

What caused higher deficits in 2008 and 2009 wasn't anything that Democrats or Republicans did. It was the economy.

Revenues fell dramatically, not expenditures rising.

Spending increased 9% in 2008 and then on top of that 18% in 2009. That's a 29% increase in just two years..............naw that didn't have anything to do with it.