- Joined

- Jun 10, 2005

- Messages

- 26,879

- Reaction score

- 12,684

- Location

- Highlands Ranch, CO

- Gender

- Male

- Political Leaning

- Independent

I have no more friends in the Republican Party than I do in the Democrat Party.

I think I know more Republicans than Democrats. My Dad is a Republican who believes every fringe Right-wing conspiracy until he moves on to the next. My wife's a moderate Democrat. Her family on the Mom's side are Democrats, but they are mostly all idiots. Her family on the Dad's side are all Republicans, but they are bull-headed. My whole neighborhood is virtually all Republican, but they are all frustrated and don't know what they are supposed to support from day to day. I have a neighbor who flies the Ukrainian flag, married to a Ukrainian who attends protests against Russia, but he is a staunch Republican who still believes the election was stolen from Trump and remains blindly loyal to a Party that rages over supporting Ukraine. I mean...just unreconcilable and dumb.

Time and again it has been shown, that there is not enough money in the private sector to cure the government spending ills.

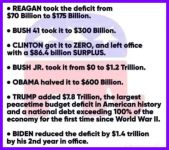

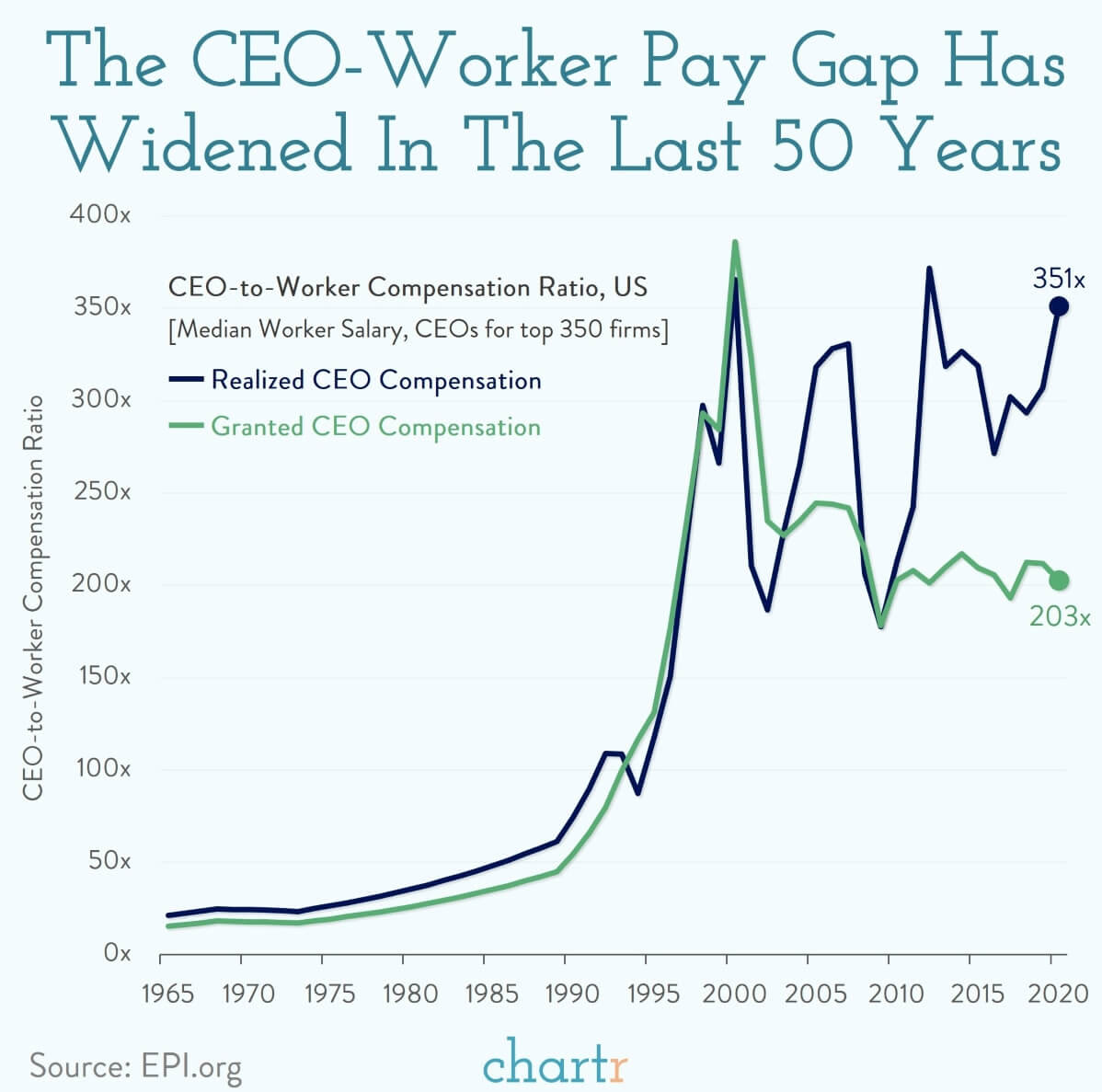

This is not true at all. You said it yourself, the country was doing fine until Bush's debt. It was also doing fine before Reagan. That Bush debt cannot be blamed on spending alone, because America loves war. We managed to fight two World Wars, a Korean War, and a war in Vietnam without sinking into a hole of massive never-ending debt. This was because we understood that wars need to be paid for. New Deal programs carried on; and the wealthy still bought their mansions, their vacation homes, their yachts, their private airplanes, etc. for decades. But after Reaganomics and the start of gross tax-cuts (which actually started with Kennedy's Revenue Act of 1964), "spending" was the sudden problem. Never mind that we saw the creation of the 1%. We now have a 1% within the 1%! How did this happen? And Bush simply decided that he was not going to pay for his wars with American money, the first President to do this in American history.

There has always been the plenty of money in America. We are the most powerful and richest country in human history. Perverting the tax-code is what put us into this. And only correcting it will get us out. But good luck telling all those wealthy donors that they may no longer hoard the massive bulk of the country's wealth in their coffers. I don't know that, without the massive economic disaster that the Great Depression introduced, if we can ever return to normalcy.

Last edited: