- Joined

- Oct 21, 2010

- Messages

- 3,188

- Reaction score

- 1,082

- Location

- Dallas Texas

- Gender

- Male

- Political Leaning

- Independent

First of all... I like to have discussions and I am intrigued by disagreement. But sarcasm in the form of personal attacks are something I will not tolerate.So, you do not understand that Bitcoin is a form of cryptocurrency? Frequently referred to by the term "crypto?" Good to know.

Of course I know that people use the term "crypto" to enclose all cryptoassets of which BTC is one. I am making the point that Bitcoin is special amongst that set. Like a square is a special rectangle. And there are many old school Bitcoinners who see a clear difference between Bitcoin and the vast vast majority of other crypto asset projects.

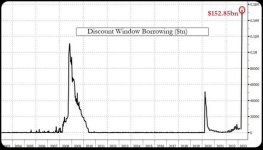

What commodoty or property does NOT have these properties? If the value of my house goes from 500k to 10k the FDIC is not going to bail me out. Same with gold, collectables, and so on. If you want insurance on them then you have to pay for that insurance with something. The Fed funds their insurance with inflating the supply.And as a reminder...

• BTC has no depositor insurance whatsoever

• BTC spent most of the past year melting down

• The Fed has not and will not rescue BTC

• BTC has been involved in a variety of scams and frauds

Granted, stocks share some of these features (e.g. no deposit insurance; occasionally crashes). But at least that stuff is regulated, and you don't have to worry about the CEO of the NYSE stealing your stocks and taking off for Bermuda.

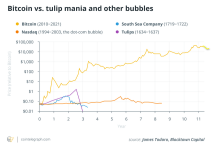

YOURS is selective. You selected 3 years. And just like almost any 3 year peiod you pick in Bitcoin you will have more value at the end than at the beginning.Or, not. I noticed that your comparison chart was awfully selective about its dates.

MY graph was the entire chart from inception to the time the chart was made. I could fill in the little dip since then too if I wanted to.

It is my responsibility as to what I do with my coins. If you leave them on some idiotic exchange then you might lose them. They were not yours in the first place. And if you lose your keys that is also kind of touugh luck.Tell that to the people who got wiped out because the exchange they used failed... or [/url=v]because they accidentally threw the hard drive with their private key in the trash.[/url]

Bitcoin is a decentralized digital bearer asset (first ever). Just like a pocket fuull of $100 bills if you lose it, you have lost it.

What do I need to insure them against? Theft? Loss? Devaluation? Inflation?You've got less than $250k in Bitcoin. Those coins aren't insured by anyone. And that's your idea of a hedge against bank failures. But you know that $250k in cash would be insured. What the what?

• If someone ever gets more than 51% of BTC, you're screwed (that happened to Bitcoin SV in 2021)

That 51% attack was on a fraud chain. "Bitcoin SV" is a fraud like almost all crypto. It is a particularly bad one though in many regards/ Not the least of which is the fact that so few people mine it that it CAN be 51% attacked. Bitcoin cannot be successfully, really. It is a technical explanation that I am not going to waste my time on assuming we will remain at odds on this issue.

Yes. Particularly if it can withstand them.So your idea of a good hedge is an asset class that's under repeated attacks from governments?

It will stabilize when it's value is too large for the sorts of swings we see today. Gold shares many properties with Bitcoin, and has a fairly stable price. It is also worth 15-20x by market cap.Unless it goes to $0, BTC will never stabilize. It can't. It has no mechanism to stabilize its exchange rates or purchasing power.

Of course. But I bet you a bitcoin it will never drop to that price.Can I laugh at you when it drops to $10, too?

:max_bytes(150000):strip_icc():focal(749x0:751x2)/ty-warner-1-1-2130c37ee3064d21a18020658410551e.jpg)