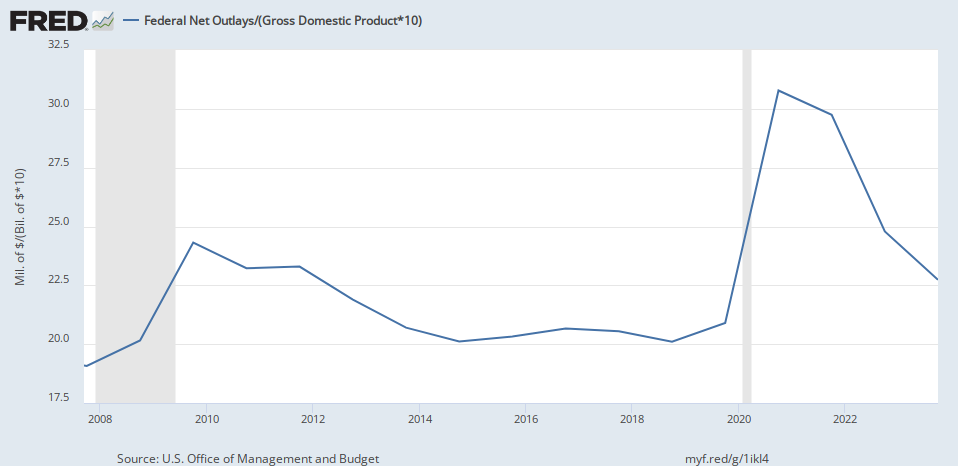

Give me $9 trillion and I’ll grow real GDP, too. Nvidia stock and Bitcoin will shoot to the moon and back. We’ll worry about the debt hangover later.

Do you think Wall Street and its Washington Beltway apologist pals give a shit about the cost of steak and potatoes in Flyover Country? As long as they get richer by buying up everything they’re happy. Give the masses Facebook and YouTube and they’ll be fine.

What I want is for government to stop lying to people while pandering for votes. Stop selling people on the idea that government can solve all of their problems if it just prints more money to give them “free” shit and raises taxes on rich people to pay for it. It has no intention of paying for it other than by monetizing it, because

it’s spending money faster than it can grow its way out of this snowballing debt tsunami it’s sending our way. Stop trying to make things more “affordable” by subsidizing them. That only works in a lunatic’s reality.

Reality?

Reality is our banks are sitting on a tender box of commercial loans that will never be repaid, and yet the Fed just ended its BTFP lending facility because banks were using it like just another piggy bank. Both Powell and Yellen say, “We can handle it.”

A real estate CEO predicts hundreds of banks will fail or be taken over by 2026