- Joined

- May 22, 2012

- Messages

- 104,410

- Reaction score

- 67,635

- Location

- Uhland, Texas

- Gender

- Male

- Political Leaning

- Libertarian

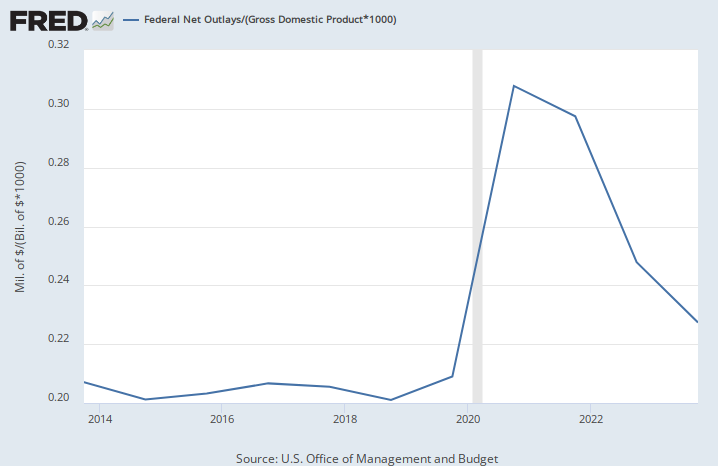

Biden has decreased the deficit and his proposed budgets cut it even more.

Really? The FY2019 deficit was about $984B, then was about 1.376T in FY2022 and about $1.694T in FY2023. Biden brags about his miraculous deficit reduction after the COVID pandemic years (FY2020 and FY2021), but that’s political spin.