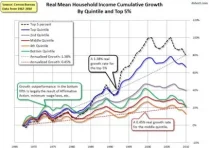

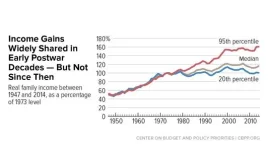

I never claimed the rich were born rich. What I'm observing is the fact that in recent DECADES, the vast amount of gains have gone to a small sliver at the top.

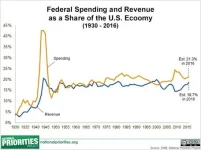

And I'll make this simple - if you believe the rich are taxed too much, then the middle class should have their tax rates raised (be made poorer, after decades of anemic or no wage gains as a group) so that Buffett et al. who have enjoyed nearly all the gains in recent decades pay less in taxes and are made wealthier, to be fair.

Fine, let the GOP run on raising taxes on the middle class and poor so the poor, oppressed rich with all the levers of power in this country get wealthier.

That's a bad example because the NFL is close to pure socialism. They share in TV revenues, the worst teams get first pick in the next draft with the best teams the last picks, there are salary caps, unions for the players, etc. So there is an immense effort to level the playing field before the Super Bowl.

And it's just simplistic to say that it's "fair" for a guy working 3 jobs with 2 kids and a wife at home barely making expenses to pay the same rate as Buffett. It's only "fair" if you define fair with the result - everyone paying the same rate. You'd be taking food or clothes off the backs of the poor, but shoveling more wealth and income to a guy who couldn't spend his existing wealth in several lifetimes.

Sure, but that's happening less and less, which is the problem, for lots of reasons. And just for example, you say you're for "equal opportunity" but that's just words if the daughter of a rich person goes to the best public or private HS, gets their pick of colleges they attend, graduate debt free, can do things like go to DC and take a low wage job as intern or lowly staffer to make contacts for three years, with rent paid for by daddy in Georgetown, and then five years later parlay those contacts from college and the staff job into something bigger. None of that is possible for someone poor or middle class who might graduate $150k in debt, and when out can't take that job with Sen. Daddybucks because it doesn't pay the D.C. area rent and service on the school loan. It's just one example of many where "equal opportunity" doesn't exist in reality.

Well, we can't solve all those advantages and wouldn't want to because it would require MASSIVE wealth redistribution. But if you're not willing to consider ways to solve SOME of those inherent disadvantages (such as providing public funding of post K-12 so we're not all graduating with decades of college debt) then "equal opportunity" is just a platitude, meaningless. It doesn't exist and you're not willing to support anything to even begin to make it a reality on the ground.