- Joined

- Dec 4, 2013

- Messages

- 36,706

- Reaction score

- 35,790

- Gender

- Male

- Political Leaning

- Liberal

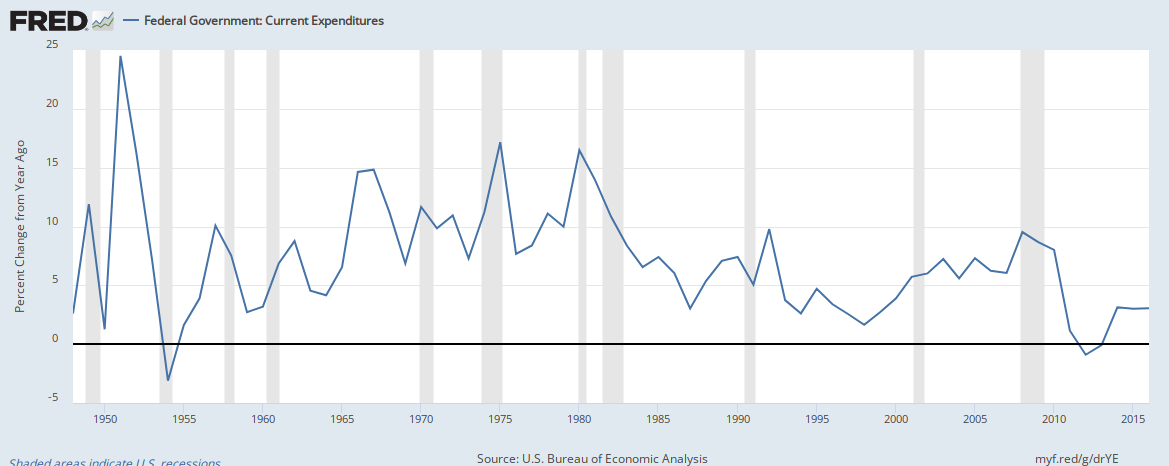

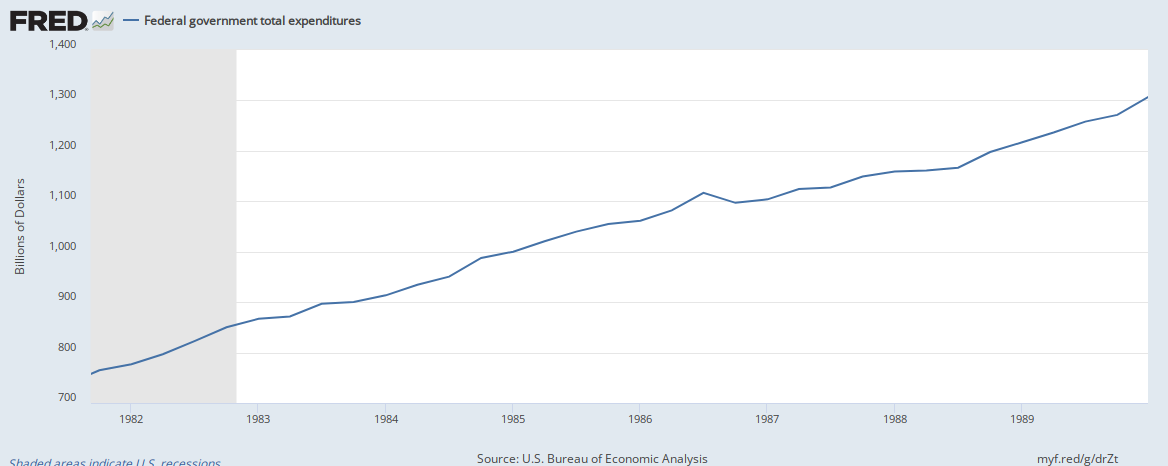

Same warning, "when they make assertions about numbers, they should look at the numbers before they make the statement."If liberals would agree to stop increasing spending then the tax rate we have would be adequate.

But government keeps demanding more

Bush was President from 2001 until Jan 2009. Obama was President from Jan 2009 through Jan 2017. Who increased spending more?