- Joined

- Apr 18, 2013

- Messages

- 111,748

- Reaction score

- 101,980

- Location

- Barsoom

- Gender

- Male

- Political Leaning

- Independent

The tax-cut package is extremely unpopular, and it's not hard to see why

The GOP tax reform proposals are as Middle America unfriendly as the failed GOP healthcare reforms.

Related: Tax reform proposal would hurt all segments of higher education, critics say

By Ben White

November 17, 2017

Republicans' biggest problem is not getting this tax-cut plan approved. Their problem is that the public mostly despises what they are doing and may give them no political reward for it in 2018 or beyond. The latest survey from Quinnipiac out this week found that just 25 percent of voters approve of the GOP tax-cut plan while 52 percent disapprove. A majority of voters, 61 percent, believe the plan will benefit the wealthy, while just 24 percent view it as good for the middle class. The Quinnipiac survey merely confirms previous polls showing very low support for the tax-cut plan. A recent NBC News/Wall Street journal poll also found that just 25 percent of voters view the GOP plan as a "good idea." Public opinion surveys consistently show Americans, including in Trump's blue-collar base, believe corporations and the rich should pay more in tax, not less.

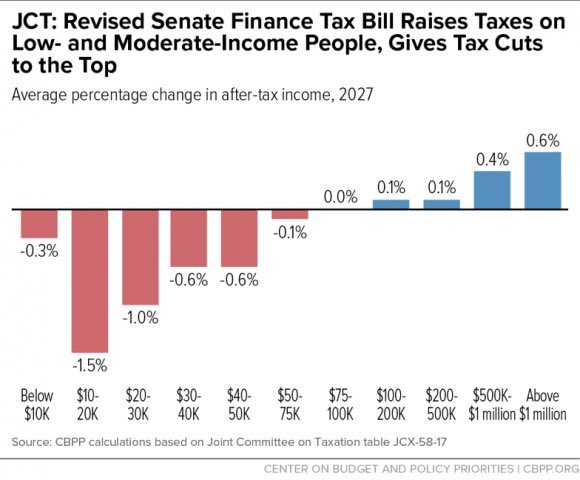

The numbers are even worse on the Senate side, where the state and local deduction is eradicated entirely and individual tax cuts expire in 2025 while a less-generous measure of inflation remains and will push people more quickly into higher tax brackets. By 2027, according to the JCT, everyone earning less than $75,000 on average would face a tax increase. And those earning between $20,000 and $30,000 would see a 25 percent hike. So Republicans could wind up celebrating enactment of a tax bill that the public despises. They will get some benefit of saying they got something done. And the donor class, which is leaning hard on the GOP to slam this bill through, will probably keep the money flowing to Republican candidates in ways they would not if the bill failed. But they will also be handing a potentially powerful weapon to Democrats who are already enjoying significant momentum heading into the 2018 midterms. This is because Democrats want to be able to say next year that Republicans slashed rates for the rich and corporations while offering relatively little to the middle class and hitting some voters with significant tax increases. Right now, the public is receptive to those arguments. And coupled with Trump's historic low approval ratings, this could be a ticket to sweeping midterm wins for Democrats.

The GOP tax reform proposals are as Middle America unfriendly as the failed GOP healthcare reforms.

Related: Tax reform proposal would hurt all segments of higher education, critics say