- Joined

- Dec 16, 2011

- Messages

- 74,426

- Reaction score

- 32,650

- Location

- Florida

- Gender

- Male

- Political Leaning

- Liberal

Why is it no surprise that another leftist has no idea how to read a chart.

Why is it no surprise that another leftist has no clue about the information in the chart

and why it ends up like that?

no one should be and we aren't because this is like the 1000 time he has posted this same thing and the 1000 time he still doesn't understand it.

Productivity is mutually exclusive to wage. The only time that productivity and wage connects is in the persons skill to do a job.

I have used this before because it fits.

If you come to work to cut trees and i pay people 200 dollars per tree and you use an ax to chop tree's then your productivity isn't that good.

I will still pay your 200 a tree though. Now i hear about this new invention that will cut trees automatically. I go out and buy these things called

chainsaws. I put out thousands of dollars in time and money to buy and train people how to use them.

now though I am only paying 150 unless you bring your own chain saw. why? I have to recoup my costs.

now if you already know how to use a chain saw and you bring your own i will still pay 200.

I have additional costs in maintaining the saws etc now. so while your productivity might increase your labor is not as valuable.

automation and engineering has increased people's ability to do a great deal that doesn't mean that their labor value has increased.

During the 80's 2 things happened.

interest rates plummeted and the markets broke open with better technology and investments. computers replaced typewriters.

printers did as well.

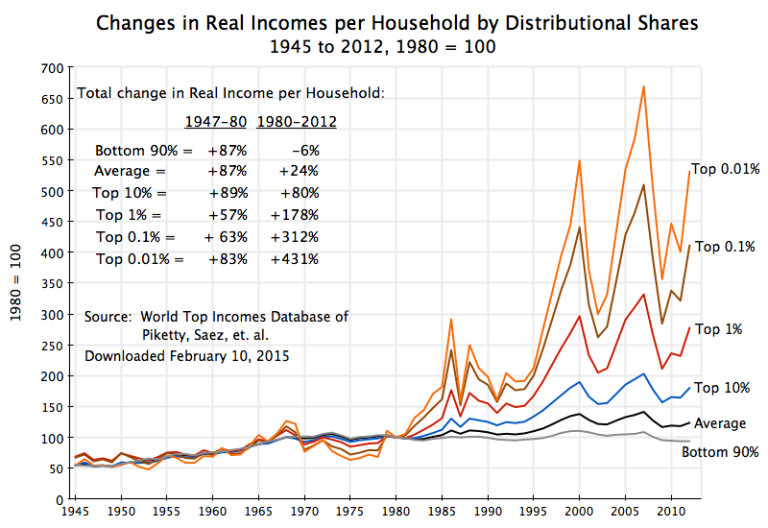

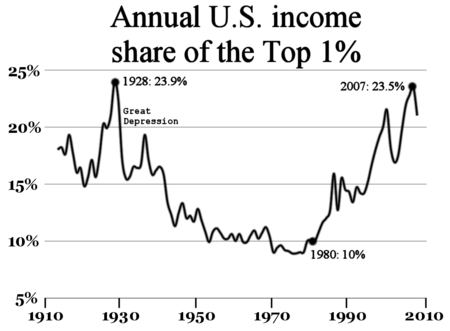

And CEO's worked 300 times as hard as before so they deserved to take the employee's share of the increased profits? But when workers can do 10 times as much work that means they deserve less money? That is what happened and that is why our GDP growth has slowed ever since Reagan cut the CEO's tax rates and broke the unions back. You seem to like slow growth and the fact that 2 people working full time cannot even equal the quality of life that one earner had for his family in the 1950's - 70's. Those things pale in the face of the wonder of the top 1% socking away billions that they never can possibly spend. What fascinates you about that?