Individual

DP Veteran

- Joined

- Aug 20, 2013

- Messages

- 16,581

- Reaction score

- 5,021

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

Why would a business want to need more people for any reason than to produce output to meet demand? Without taking government into account, no sane person would start a business simply for the purpose of employing peopleExactly so... so the question then becomes - what is the best way of expending the needs of business so that they need to employ more people? Supply vs. Demand.... which side to stimulate? Back at the beginning of the 20th Century we had an extreme supply-side investment-oriented economy. It built the industrial age and caused America to become an economic super-power. But it also led to an enormous underclass. The poor lived crowded into tenement housing and worked long hours for little pay. Lot of Supply, little Demand. The result was the Great Depression.

Then came the New Deal, and we turned things in the other direction... it became about the common man. More protections, higher wages and all the rest. Focus on demand and the supply will be found to meet it. The result was the consumer age of the 50's and 60's. However, by the 1970's, this, too, had played itself out.... more and more demand met less and less ability for supply to match it, and the result was stagflation.

Then came the Reagan Revolution.... we turned the needle back to the supply side again. More incentive was given to investment. Business boomed and the technological revolution re-made society. However, now we're reaching the limits of that... demand can't sustain more supply and it's taking more and more stimulus to produce even meager growth.

Demand and supply are the air and fuel of our economic engine. You need both in the right mixture for the conditions you find yourself in order to make things run efficiently. Right now we just happen to be running too rich.

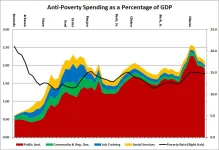

Subsidizing the problem has not turned out to be a fix for the problem.You've got my vote for understatement of the year. So what's the answer? Do we keep'em out of sight and out of mind? Or do we do what LBJ tried to do in the 1960's? See a problem and try to hit it head-on and try to fix it?