- Joined

- Dec 9, 2009

- Messages

- 134,496

- Reaction score

- 14,621

- Location

- Houston, TX

- Gender

- Male

- Political Leaning

- Conservative

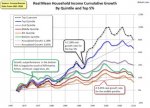

well selfishly, which conservatives seem to understand best, my business would be more profitable with a middle class with more disposable income.

i might pay more taxes but taxes are just a cost of doing business. a big tax bill is a good thing. means you are making.money.

taxes are never stealing. somebody has to pay the bills for this great country. obviously those who benefit most should not be adverse to paying their fair share. only the greedy rich want to keep it all.

truth is with a middle class making.more money that tax base will be larger and as revenues rise it could relieve some of that tax burden off the upper earners.

right now we are just kicking the can down the road. adding astronomical amounts to the national debt just to continue to enrich the rich.

just as an afterthought on Trump's tax cut it added less than a $100 a month to the average american's income.

Oh my, never discuss how your tax dollars are spent or how SS and Medicare funds are nothing but IOU's today but keep focusing on raising taxes and never answering the questions posed to you. $100 a month means a lot to some people but you judge everyone else by your own standards.

You want the middle class to make more money, what is stopping them?

Seems you have no problem with the bills our Federal bureaucrats are paying or the votes they are buying or the dollars leaving the state and local governments because of higher federal taxes. Just goes to show how easily it is to influence and indoctrinate some people