- Joined

- Jul 28, 2013

- Messages

- 27,250

- Reaction score

- 27,618

- Location

- Ohio

- Gender

- Female

- Political Leaning

- Undisclosed

I can think of a number of reasons that brings on poverty.

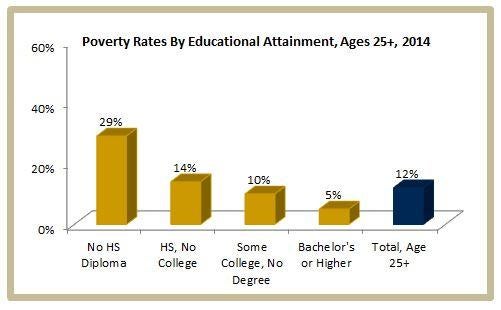

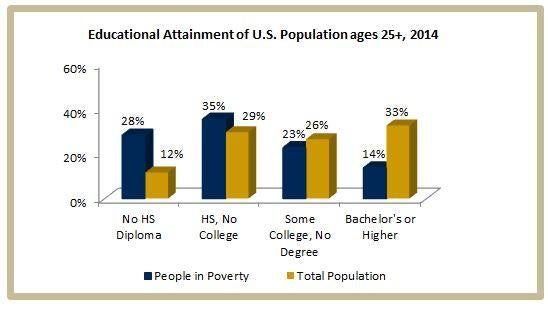

Poor life choices for starters. Those who didn't even commit to a HS education provided to them free on the public's dime causes poverty.

Single mothers whether it be reproducing out of wedlock or divorced parents creates poverty.

When a spouse within a family or single, gets addicted to drugs it causes poverty.

When a person who worked hard all their life gets sick and didn't prepare for such a thing, it causes poverty.

When someone lives beyond their means and loses their job or can't keep up, it causes poverty.

And sometimes there are situations where a person tried to plan in advance and what they were hit with to drive them into poverty was no doing of their own.

Poor life choices for starters. Those who didn't even commit to a HS education provided to them free on the public's dime causes poverty.

Single mothers whether it be reproducing out of wedlock or divorced parents creates poverty.

When a spouse within a family or single, gets addicted to drugs it causes poverty.

When a person who worked hard all their life gets sick and didn't prepare for such a thing, it causes poverty.

When someone lives beyond their means and loses their job or can't keep up, it causes poverty.

And sometimes there are situations where a person tried to plan in advance and what they were hit with to drive them into poverty was no doing of their own.