Fact Check, The Budget and Deficit Under Clinton

By Brooks Jackson

Posted on February 3, 2008 | Updated on February 11, 2008

Q: During the Clinton administration was the federal budget balanced? Was the federal deficit erased?

A: Yes to both questions, whether you count Social Security or not.

FULL ANSWER

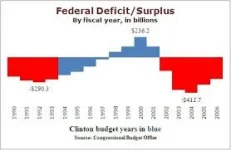

This chart, based on historical figures from the nonpartisan Congressional Budget Office, shows the total deficit or surplus for each fiscal year from 1990 through 2006. Keep in mind that fiscal years begin Oct. 1, so the first year that can be counted as a Clinton year is fiscal 1994. The appropriations bills for fiscal years 1990 through 1993 were signed by Bill Clinton’s predecessor, George H.W. Bush. Fiscal 2002 is the first for which President George W. Bush signed the appropriations bills, and the first to show the effect of his tax cuts.

The Clinton years showed the effects of a large tax increase that Clinton pushed through in his first year, and that Republicans incorrectly claim is the "largest tax increase in history." It fell almost exclusively on upper-income taxpayers. Clinton’s fiscal 1994 budget also contained some spending restraints. An equally if not more powerful influence was the booming economy and huge gains in the stock markets, the so-called dot-com bubble, which brought in hundreds of millions in unanticipated tax revenue from taxes on capital gains and rising salaries.

Clinton’s large budget surpluses also owe much to the Social Security tax on payrolls. Social Security taxes now bring in more than the cost of current benefits, and the "Social Security surplus" makes the total deficit or surplus figures look better than they would if Social Security wasn’t counted. But even if we remove Social Security from the equation, there was a surplus of $1.9 billion in fiscal 1999 and $86.4 billion in fiscal 2000. So any way you count it, the federal budget was balanced and the deficit was erased, if only for a while.

The Budget and Deficit Under Clinton - FactCheck.org

View attachment 67260330