jonny5

DP Veteran

- Joined

- Mar 4, 2012

- Messages

- 27,581

- Reaction score

- 4,664

- Location

- Republic of Florida

- Gender

- Male

- Political Leaning

- Libertarian

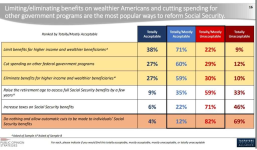

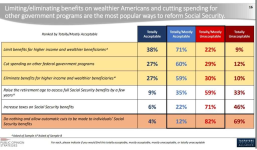

Of course what they want is the rich to pay for it. No surprise. Meanwhile, had I put the money they take from me for my lousy benefit if a live to 65, I could have near a million dollars in my retirement account. Its time to privatize SS. I pay about $800 a month in SS. Average return on that in a mutual fund would be 7 million dollars.

Its time to privatize SS

reason.com

reason.com

Its time to privatize SS

87% of Americans want politicians to do something before Social Security runs out of money

Entitlement reform has long been considered a third rail in American politics, but that perspective might be changing.