I've already made that point numerous times in this thread. The purpose of the easement is to maintain the historic character of the property. To that end, he cannot divide the land up into chunks and develop it - that was the fear the city council had, and why they agreed to make an exception to the zoning for use of the property as a club - they allowed him to do that on the condition that he preserve the home as a landmark.

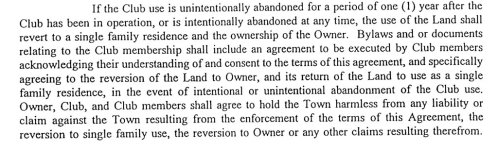

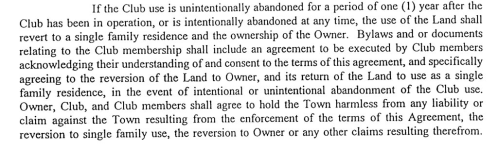

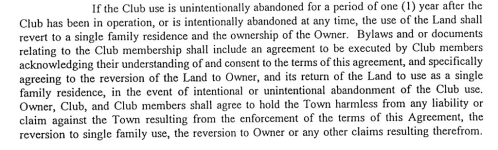

It doesn't mean the home can't be used as a single family residence. In fact, they specifically wrote into the contract that if the business fails or he decides to end it, the home automatically reverts to single family home status (though the preservation easement is there forever).

Why you would do that, I don't know. The home has more value as a club than as a single family home. It's an enormous property, and the fees pay for all tbe upkeep while turning a considerable profit (not to mention tbe tax benefits). It's an asset that brings in tens of millions a year - as such, it is worth far more than $18 million dollars.

I don't think you understand any of this. He granted the easement (1995 I think) that forever obligated him to keep much of its current structure, prohibited dividing or subdividing the property for MASSIVE property tax breaks. He then signed a Deed of Development Rights that FURTHER restricted his use, which again lowered the value for property taxes. That worked great to reduce his annual property taxes, because the value of a "club" is the cash flow it can generate, the value of this club what it can generate looking like it does now, with those buildings in place, as they are now, not what the land is worth or the replacement cost of the building sitting on it. Someone running a business pays for the discounted value of free cash flow. That's all that matters, and they can't jack up the sale price at the end for the estimated land value, based on nearby comps, because those nearby comps aren't burdened by the easement and the further restrictions signed by Trump in 2002.

Now Trump and you are arguing, well, the easement and then the "Deed of Development Rights" signed in 2002, that extinguished any remaining rights to develop the property as anything but a

club are meaningless. But they are not. If someone wealthy buys that home, they're severely restricted on what they can do, they can't gut the interior and make the big ballroom suitable for a private residence. They can't raze the building and put up the nice house they might want. They can only "develop" that property as a "club." That's right there in the deed signed by Trump in 2002. So at best this very wealthy family signs up to keep the structure basically as is, PLUS the huge maintenance costs, for their $600 million or $1,500 million purchase. Why would they do that?

And you say it's an 'asset' that 'brings in tens of millions a year.' True enough - so now we're back to the discounted value of the cash flow. Well, providing services to wealthy people so that they'll part with $10s of millions per year to visit your club also costs $10s of millions, from the food, e.g. the cost of prime grade beef, fancy wine and liquor, tons of wait staff and cleaning staff, the grounds maintenance, the building maintenance on a very old structure, the insurance from storms and hurricanes, and the TAXES. So what's the net cash flow to Trump today, per year? I haven't seen the financials and what matters is what the club brought in when he made the assertions, not what it's worth today based on current cash flow, that got a big bump when he was elected POTUS. Trump immediately raised the initiation fee for access to himself from 100k to 200k. And, again, if someone just bought property zoned "club" use, they could do all kinds of things to generate more revenue. As is they cannot do most of those things because of the deed restrictions. Point is there's a hard cap on what a private club AS IS, CAN bring in at that location, with the deed restrictions and conservation easement in place. How many years of profits does it take to pay off an e.g. $600 million purchase price? Then turn a real profit? Well, if your loan or discount rate (the return you require to invest in THAT property versus $600m in other properties) is at 5% (prime rate is now 8.5%), interest alone is $30m per year. Good luck I guess!!!

And, again, all those considerations are made 100x worse for a commercial buyer because normally that buyer can bank on the liquidation value of prime beach front real estate in Florida going up, or maybe gutting the place and configuring it completely differently to maximize revenue, but the deed restrictions and conservation easement make that IMPOSSIBLE.