A multimillionaire in California is subject to the top tax bracket of 39.6% for the vast majority of his money, and California's state taxes peak at 12-13%. Assuming a minor state credit for federal liability, you're still paying damn near 50%.That's not a misconception. You're just plain wrong.

Look... I hold a CPA certificate (though not active) I do know a little bit about taxes. You, OTH, are falling into the very misconception I am talking about... confusing the highest marginal rates (taxes paid on last dollars) with effective rates (total tax paid to total income). The common misconception is that you can add one marginal rate to another and say 'see, I am paying half my income in taxes'. Not true!

Effective tax rates are always considerably lower marginal rates (some income is not taxed at all, tax returns have tons of deductions, most passive income is all taxed at 15-20% and the first $300 - 400K of earned income is taxed at lower rates). Multi-millionaires (which is a statement of wealth, not income) typically have a very substantial portion of their income in the form of dividends and cap gains, which is taxed at 15-20%.

One's marginal rate is ALWAYS higher than the effective. Secondly, every dollar paid in state tax is a deduction from federal.... hence, when you talk of a California tax of 13% and a federal marginal tax of 39.6%, even when you are paying last dollars (taxed at the highest rate), every dollar paid to California results in a deduction of federal tax of $.396, hence making the highest California effective rate really more like 8%.

How did you put it? You're just plain wrong.....

OK.... I suppose you could build a scenario, which almost no one would fall into, where a guy in California (maybe an actor) would have 20 -30 million earned income year (wages), but had no assets (hence no passive earnings) and, with his poor planning (the movie was a huge hit and he got all of his cash in one year) his income was so great that first $400-500K of income was insignificant to the denominator of his effective tax rate, his effective rate could be in the mid to upper 40s.... pretty far fetched, but I suppose possible.

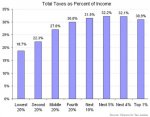

The effective tax rates of most income groups is in the high 20 to low 30%

[