- Joined

- Dec 23, 2009

- Messages

- 16,881

- Reaction score

- 2,980

- Location

- virginia

- Gender

- Male

- Political Leaning

- Private

well that is both true and really dishonest at the same time

How can the rule of law be dishonest? Like taxation is stealing?

well that is both true and really dishonest at the same time

comedy4all said:Oh yes let’s play the “some” and “not all” game.

comedy4all said:It is a possibility that “some” of the people that are considered rich got that way by stealing their money.

comedy4all said:Although the vast majority of them did it the legitimate way.

comedy4all said:I am also going to add my response to another thread, because I think that it applies here.

How can the rule of law be dishonest? Like taxation is stealing?

Its true because that is the factual reality

Its dishonest because its contrary to the clear intent of the constitution

It appears that you prematurely ended your post before you put up the verifiable evidence for your claims.

ITs called an opinion. And why do you demand proof from others when you never supply any in support of your opinions?

Just curious...what the heck would we call "trickle down economics"...that in itself is redistributing the wealth in this country.

You seem not to get that REDistribution is the government taking wealth and giving it to voters to buy votes

Trickle down does not require any government action whatsoever

Well the facade that is Trickle Down involves cutting taxes on the top..well the lost revenue is off set by raising taxes on everyone else(or increasing debt as we've seen)

That is redistributing the tax burden=redistributing money.

if there were no taxes on income it would still happen. Income redistribution cannot happen without government.

You seem to assume high taxes on the productive is a given

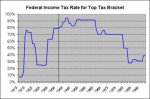

Well the reality is that those rates were the norm...the rates we have now are LOW

that is moronic. For more than half of this country's history we did not even have a tax on income. The current Obama rates have lasted longer than the Clinton tax hikes. Over the last 32 years, the clinton era was an aberration in terms of being TOO High

Clinton's horribly high taxes which really weren't that high..under which the economy grew dramatically

Clinton's horribly high taxes which really weren't that high..under which the economy grew dramaticallyView attachment 67135033 Clinton's horribly high taxes which really weren't that high..under which the economy grew dramatically

where is the 1790-1913 graph. And you haven't figured out that some of those high marginal tax rates have far far lower effective rates

BTW if you like 70% rates you should pay them too

where is the 1790-1913 graph. And you haven't figured out that some of those high marginal tax rates have far far lower effective rates

BTW if you like 70% rates you should pay them too

I find it very hard to believe that there was a 90% income tax (for ~20 years), on anyone. What is that tax bracket?

that was the top tax bracket...out of 24 tax brackets..

I believe it was on earnings over 200,000 bucks ( married separate), 400,000 ( married, joint) and , 300,000 ( head of household)

So if one made 400k (married, joint), they took home 40k? I don't believe that. What would be the point of working anything but a menial job that one doesn't have to care about.

Great argument..bravo turtle i expect nothing less from ya.

Anyways i'm not advocating for tax rates like that anyways.

The point being that our current tax bracket is LOW..trickle down itself was redistribution of wealth

First, anything above 400k would be taxed at 90% because we have progressive taxation.

But regardless as turtle mentioned earlier the effective tax rates were no where near as high as the marginal rates

tax revenue, as a percentage of GDP in 1955 ( under the old 20-90% marginal rates) was 7.3% for individuals, 4.5% for corporations

in 2011... it was 7.3% for individuals, 1.2% for corporations

the high for individuals was in 2000.. at 10.2% of GDP

the high for corporations was in 1945 at 7.2% of GDP

Historical Source of Revenue as Share of GDP

So if one made 200k, one took home 20k after federal income tax alone was deducted? I don't believe that. What would be the point of working anything but a menial job that one doesn't have to care about.

What was the tax bracket on 30k? Would I net the same?!

What do you think and why would he want to do that?