Wish I could figure out what you leftists believe the rich do with their money and why it is so important for the federal gov't to collect more from the rich and zero from the 45% who don't pay any FIT since taxes are so important to you?

It is quite telling that most of the people here who oppose the Trump tax cuts are probably paying more in FIT because of the cap on state and local taxes as deductions from their federal return. Sure never heard much from you people when you were fully deducting your high state and local taxes from your federal returns, taxes that Red State taxpayers didn't have.

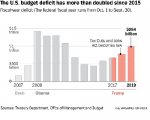

So you noticed that Trump's tax cuts include a back door tax increase on already high tax states. Very astute of you. But that's a valid reason to not like these tax cuts. Remember, the federal tax cut is temporary but the deduction is gone for good. So in 5 years when the cut expires, this "tax cut" is going to result in me paying more taxes. The corporations that rich people own still pay less though.

You want to know why liberals want to tax the rich. Well, there are two reasons. The history, and economic theory.

Let's rewind to the depression. That sucked. The government introduced a whole bunch of programs during the depression. This was an early attempt at stimulus spending, but really they were just trying to get people to not die. The government hired people directly and did public works projects. This was spearheaded by Keynes, who said that if you put some money in the pocket of people who really need it, it all goes back out into the economy right away, because they'll spend it on the goods and services that they really need. They'll pay rent and buy groceries, and then the landlord and the grocer spend that money, and the money circulates, stimulating the economy.

You asked what liberals think rich people are doing with their money. Well they don't spend it all. They might put some in a vault. They might invest it overseas. They might snort some extra coke. The corporations used their windfalls to buy back a bunch of stock. Buying back stock is a fancy way of saying buying investors back out. It's basically the market saying, we can't use this money, invest it somewhere else. This doesn't help the economy very much. But it does inflate stock prices. So they spend some of their money making a new bubble. In the extreme case, money can do zero circuits around the economy. The Treasury borrows money to give to a rich person who buys a Treasury bond. You can see how that doesn't really help the economy all that much.