-

This is a political forum that is non-biased/non-partisan and treats every person's position on topics equally. This debate forum is not aligned to any political party. In today's politics, many ideas are split between and even within all the political parties. Often we find ourselves agreeing on one platform but some topics break our mold. We are here to discuss them in a civil political debate. If this is your first visit to our political forums, be sure to check out the RULES. Registering for debate politics is necessary before posting. Register today to participate - it's free!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The trump tax cuts have given us 4, 5, 6 % growth and paid for themselves

- Thread starter Digger

- Start date

- Joined

- Apr 18, 2013

- Messages

- 94,171

- Reaction score

- 82,449

- Location

- Barsoom

- Gender

- Male

- Political Leaning

- Independent

Oh no, they didn't. It's almost like giving tax cuts to rich people doesn't help the economy very much.

GOP "trickle down" economics doesn't work? /s

It's a quid-pro-quo system.

Wealthy individuals/corporations give big campaign donations to Republicans, who in turn give huge tax breaks and financial/corporate deregulation in return.

This for example is what is currently happening at the EPA under Trump. Tossing out all EPA regulations that held campaign-donor fossil-fuel industries and major polluters in check.

- Joined

- Jan 28, 2012

- Messages

- 25,239

- Reaction score

- 24,032

- Location

- Phoenix, AZ

- Gender

- Male

- Political Leaning

- Independent

Oh no, they didn't. It's almost like giving tax cuts to rich people doesn't help the economy very much.

You're in kind of a mood today aren't you?

- Joined

- Oct 27, 2011

- Messages

- 101,826

- Reaction score

- 45,418

- Gender

- Male

- Political Leaning

- Conservative

Oh no, they didn't. It's almost like giving tax cuts to rich people doesn't help the economy very much.

Seems small business owners might disagree with you...if you believe polls, that is.

Small-business owners are highly engaged in the 2020 presidential election campaign, as 60% say they are paying "a lot" and 30% "some" attention to it. With near unanimity, they say they are likely to vote in the general election. Sixty percent approve of the job that Donald Trump is doing as president, and 52% think their business would be better off if he is reelected. They are somewhat less likely to say they would be better off if the Democratic nominee wins the election (41%).

These findings are from a Jan. 15-24 nationwide Square/Gallup online survey of small-business owners with annual revenues between $50,000 and $25 million.

Most small-business owners rate the financial condition of their business positively -- 56% say it is "excellent" and 38% "good" -- and 69% report that their business benefited from the 2017 tax reform law. More than seven in 10 say they reinvested over one-quarter of the savings that resulted from the tax law in their business.

Yet, other policies have had a less positive effect. Seventy percent of small-business owners say the cost of healthcare has had "a lot of" or "some" impact on their ability to hire and retain employees, and half say the same of changes to U.S. immigration policies since 2017.

Small-Business Owners Highly Engaged in 2020 Election

HumblePi

DP Veteran

- Joined

- Sep 3, 2018

- Messages

- 26,305

- Reaction score

- 18,830

- Gender

- Undisclosed

- Political Leaning

- Liberal

Seems small business owners might disagree with you...if you believe polls, that is.

Article from Nov. 2019

The Retail Apocalypse

If you thought last year was the low point for bricks-and-mortar retailers, think again. Sadly, 2019 proved to be exponentially more brutal, and Coresight Research predicts the number of store closures could reach a staggering 12,000 by the year's end, compared to just under 6,000 closures in 2018. From Payless to Party City, here are some of the most notable victims of the retail

apocalypse this year.

Companies That Closed Stores or Went out of Business in 2019 | Cheapism.com

Then there's the little thing about the extra trillion dollar deficit added to the national debt.

Seems small business owners might disagree with you...if you believe polls, that is.

Pivot from rich people to small business owners. Very clever. But you know that the tax cuts mostly went to rich people and huge corporations.

Now look at your numbers. More than 7 in 10 owners reinvested at least a quarter of their savings back into their business. That's not a very high bar. The converse way to say it is that more than 2 in 10 didn't even reinvest a quarter of it. And that is why tax cuts for rich people don't help the economy very much. They don't use the money to create jobs. They just get richer while the poor stay poor.

You're in kind of a mood today aren't you?

You are perceptive.

- Joined

- Oct 27, 2011

- Messages

- 101,826

- Reaction score

- 45,418

- Gender

- Male

- Political Leaning

- Conservative

Pivot from rich people to small business owners. Very clever. But you know that the tax cuts mostly went to rich people and huge corporations.

Now look at your numbers. More than 7 in 10 owners reinvested at least a quarter of their savings back into their business. That's not a very high bar. The converse way to say it is that more than 2 in 10 didn't even reinvest a quarter of it. And that is why tax cuts for rich people don't help the economy very much. They don't use the money to create jobs. They just get richer while the poor stay poor.

Can you read?

The article said 7 in 10 owners...keep in mind these are small business owners...reinvested "MORE" than a quarter of their savings back into their business....not "at least". And your "converse way to say it" is not substantiated by anything in that article. These small business owners are not "rich people", but their businesses certainly benefited from the tax cut. 69% of them say they have.

But hey...it appears you have a hard on for rich people. So it goes...

Can you read?

The article said 7 in 10 owners...keep in mind these are small business owners...reinvested "MORE" than a quarter of their savings back into their business....not "at least". And your "converse way to say it" is not substantiated by anything in that article. These small business owners are not "rich people", but their businesses certainly benefited from the tax cut. 69% of them say they have.

But hey...it appears you have a hard on for rich people. So it goes...

Oh, my bad. I stand corrected. If 70 something % invested more than a quarter, that means that 20 something % invested a quarter or less. You want to check my math for me?

I'm glad that 69% of small business owners appreciated their scraps. Of course, that means 31% didn't.

I know that you'd rather talk about all the little people who got scraps. But since the lion's share of the tax cut went to rich people and giant corporations, they are more relevant. It isn't me who has a hardon for rich people. I didn't design the tax cut.

Last edited:

- Joined

- Oct 27, 2011

- Messages

- 101,826

- Reaction score

- 45,418

- Gender

- Male

- Political Leaning

- Conservative

Oh, my bad. I stand corrected. If 70 something % invested more than a quarter, that means that 20 something % invested a quarter or less. You want to check my math for me?

I'm glad that 69% of small business owners appreciated their scraps. Of course, that means 31% didn't.

I know that you'd rather talk about all the little people who got scraps. But since the lion's share of the tax cut went to rich people and giant corporations, they are more relevant. It isn't me who has a hardon for rich people. I didn't design the tax cut.

LOL!!

You just can't accept that people and businesses are doing better since the tax reform, can you? "scraps" LOL!!

No problem. I'll leave you to your unending rage.

You are dismissed. (see my sig)

- Joined

- Mar 18, 2018

- Messages

- 47,641

- Reaction score

- 16,564

- Location

- San Diego

- Gender

- Male

- Political Leaning

- Other

I don't recall him setting any time table on when that was going to happen - he still has five years.Oh no, they didn't. It's almost like giving tax cuts to rich people doesn't help the economy very much.

- Joined

- Mar 18, 2018

- Messages

- 47,641

- Reaction score

- 16,564

- Location

- San Diego

- Gender

- Male

- Political Leaning

- Other

Your truths per post is abysmal. Indistinguishable from zero.GOP "trickle down" economics doesn't work? /s

It's a quid-pro-quo system.

Wealthy individuals/corporations give big campaign donations to Republicans, who in turn give huge tax breaks and financial/corporate deregulation in return.

This for example is what is currently happening at the EPA under Trump. Tossing out all EPA regulations that held campaign-donor fossil-fuel industries and major polluters in check.

LOL!!

You just can't accept that people and businesses are doing better since the tax reform, can you? "scraps" LOL!!

No problem. I'll leave you to your unending rage.

You are dismissed. (see my sig)

Yes, scraps. Aren't you aware?

Updated Estimates from ITEP: Trump Tax Law Still Benefits the Rich No Matter How You Look at It – ITEP

Half of the benefits go to the richest 5%. 72% goes to the richest 20%. Leaving the rest of us scraps.

Did The Rich Get All Of Trump's Tax Cuts?

"The rich received the lions share of the tax cuts."

Last edited:

- Joined

- Dec 9, 2009

- Messages

- 134,496

- Reaction score

- 14,621

- Location

- Houston, TX

- Gender

- Male

- Political Leaning

- Conservative

Oh no, they didn't. It's almost like giving tax cuts to rich people doesn't help the economy very much.

Still seeking attention I see, what a waste of time. anyone that claims that people keeping more of what they earn is an expense to the federal gov't and has to be paid for has zero credibility as they are totally void of even basic accounting and reality

Exaggerations aren't lies, they are predictions designed to make headlines, Think the American people give a damn about 4-5-6% GDP growth or the fact that the Trump GDP Growth is higher than anything Obama ever generated and was created through the private sector not Federal gov't spending? Keep showing that liberal ignorance on the components of GDP and actual results

- Joined

- Dec 9, 2009

- Messages

- 134,496

- Reaction score

- 14,621

- Location

- Houston, TX

- Gender

- Male

- Political Leaning

- Conservative

Yes, scraps. Aren't you aware?

Updated Estimates from ITEP: Trump Tax Law Still Benefits the Rich No Matter How You Look at It – ITEP

Half of the benefits go to the richest 5%. 72% goes to the richest 20%. Leaving the rest of us scraps.

Did The Rich Get All Of Trump's Tax Cuts?

"The rich received the lions share of the tax cuts."

Class envy, jealousy are what you and the left are noted for. It really bothers you that the people who are paying most of the taxes gets the biggest benefit from tax cuts. How does that hurt the country? You really have no idea where state and local governments get their money, do you?

- Joined

- Jun 23, 2005

- Messages

- 32,453

- Reaction score

- 22,690

- Gender

- Male

- Political Leaning

- Moderate

A tax cut will increase economic growth when taxes are high enough that they are impairing economic growth. If current tax rates are not high enough to impair economic growth, then cutting taxes doesn't lead to a sustained increase in GDP growth. This stuff isn't complicated.

The fact is, fiscal policy has very little to do with economic growth at the national level (or the state level for that matter). No one wakes up in the morning and thinks "My top marginal effective tax rate dropped 2 percentage points, I am going to hire 100 new workers.", or "I got a 1% tax increase on my top marginal rate, I am not buying that bass boat now." That just doesn't happen. Monetary policy has an impact, but you would be hard pressed to ever correlate any fiscal policy changes to economic growth.

The fact is, fiscal policy has very little to do with economic growth at the national level (or the state level for that matter). No one wakes up in the morning and thinks "My top marginal effective tax rate dropped 2 percentage points, I am going to hire 100 new workers.", or "I got a 1% tax increase on my top marginal rate, I am not buying that bass boat now." That just doesn't happen. Monetary policy has an impact, but you would be hard pressed to ever correlate any fiscal policy changes to economic growth.

- Joined

- Dec 9, 2009

- Messages

- 134,496

- Reaction score

- 14,621

- Location

- Houston, TX

- Gender

- Male

- Political Leaning

- Conservative

A tax cut will increase economic growth when taxes are high enough that they are impairing economic growth. If current tax rates are not high enough to impair economic growth, then cutting taxes doesn't lead to a sustained increase in GDP growth. This stuff isn't complicated.

The fact is, fiscal policy has very little to do with economic growth at the national level (or the state level for that matter). No one wakes up in the morning and thinks "My top marginal effective tax rate dropped 2 percentage points, I am going to hire 100 new workers.", or "I got a 1% tax increase on my top marginal rate, I am not buying that bass boat now." That just doesn't happen. Monetary policy has an impact, but you would be hard pressed to ever correlate any fiscal policy changes to economic growth.

That isn't entirely true as the state and local governments get the majority of their tax revenue from consumer spending whether it is from sales taxes, property taxes, excise taxes all of which are impacted by federal tax rates and payments. The American people cannot print money so when they send dollars to the federal gov't it is less dollars to spend in the state and local communities thus impacting the ability of the state and local governments to provide support to the citizens of the state on social programs.

- Joined

- Jun 23, 2005

- Messages

- 32,453

- Reaction score

- 22,690

- Gender

- Male

- Political Leaning

- Moderate

That isn't entirely true as the state and local governments get the majority of their tax revenue from consumer spending whether it is from sales taxes, property taxes, excise taxes all of which are impacted by federal tax rates and payments. The American people cannot print money so when they send dollars to the federal gov't it is less dollars to spend in the state and local communities thus impacting the ability of the state and local governments to provide support to the citizens of the state on social programs.

It gets spent anyway. It's not like the federal government hoards money. Much of what goes to the federal government ends up being wealth transfers from younger workers to older retires, and from urban areas to rural areas.

You really have to get all the way down to the major city level to see where government has much of an impact on economic growth. At the federal level, the only major impact is the federal reserve. I have never seen a business plan, a company financial meeting, or anything business related where federal fiscal policy ever had an impact on anything other than capital expenditure depreciation.

The reason why we have been stuck with anemic GDP growth in this country for the last decade has nothing to do with the federal government, its the terrible business culture in this country we have adopted over the last 20 years or so. For example, the average IT or Engineering group in a company these days will have more product managers, project managers, BAs, marketing coordinators, consultants and so on than actual engineers. This is why it takes forever to build anything anymore. There is hundreds of billions of dollars lost to rent seeking behavior in our private sector these days.

Last edited:

- Joined

- Dec 9, 2009

- Messages

- 134,496

- Reaction score

- 14,621

- Location

- Houston, TX

- Gender

- Male

- Political Leaning

- Conservative

It gets spent anyway. It's not like the federal government hoards money. Much of what goes to the federal government ends up being wealth transfers from younger workers to older retires, and from urban areas to rural areas.

You really have to get all the way down to the major city level to see where government has much of an impact on economic growth. At the federal level, the only major impact is the federal reserve. I have never seen a business plan, a company financial meeting, or anything business related where federal fiscal policy ever had an impact on anything other than capital expenditure depreciation.

It gets spent to create dependence and therein lies the problem. Money getting to the states is for federal mandated programs not individual personal responsibility issues.

sorry but you remain very poorly informed especially when it comes to state and local revenue neither of which you acknowledged or answered

- Joined

- Jan 2, 2006

- Messages

- 28,173

- Reaction score

- 14,269

- Location

- Boca

- Gender

- Male

- Political Leaning

- Independent

I don't recall him setting any time table on when that was going to happen - he still has five years.

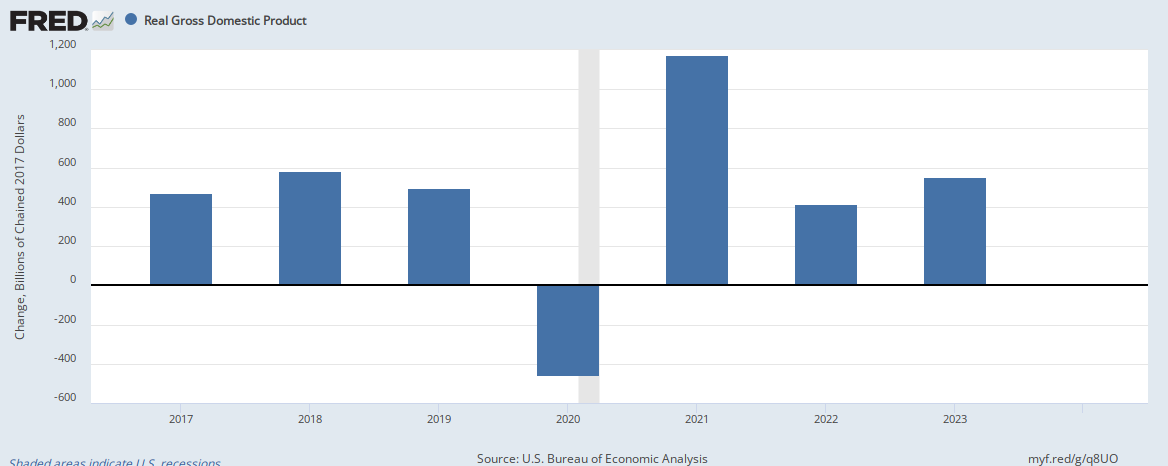

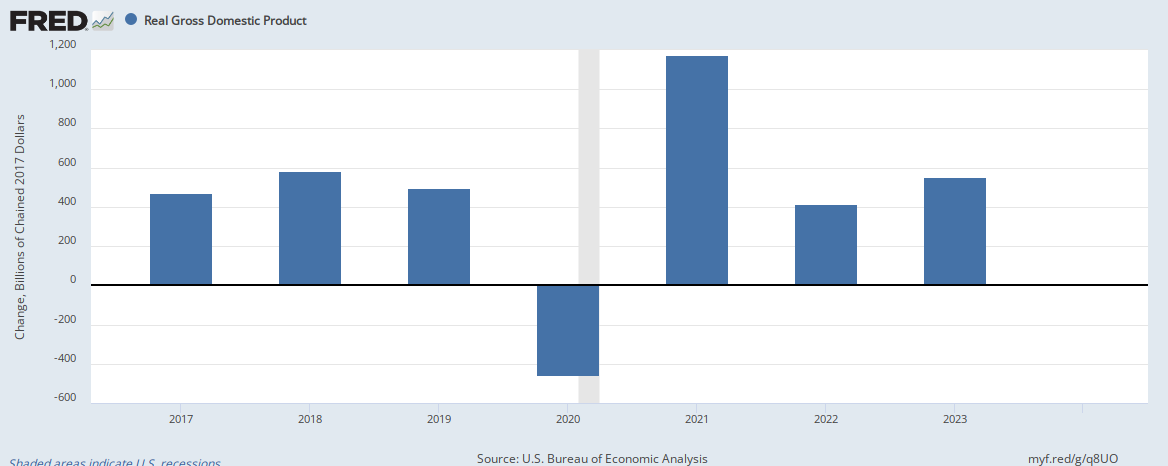

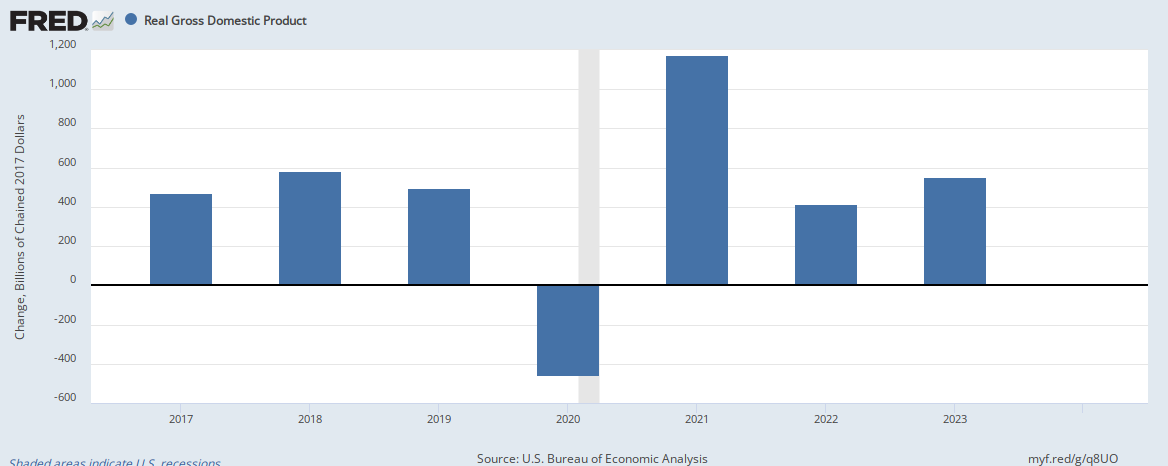

The initial jolt in stimulus is felt within the first year, and then the economy internalizes the gains. The data supports this statement:

The deficit is has grown by $400 billion under Trump's watch.

- Joined

- Mar 18, 2018

- Messages

- 47,641

- Reaction score

- 16,564

- Location

- San Diego

- Gender

- Male

- Political Leaning

- Other

With all due respect, I don't wish to continue tolerating your insults and blind homage to Obamanomics. A simple observation of the state of the economy and people's satisfaction with it and their personal affairs proves everything I've said. I have nothing further to say to you.The initial jolt in stimulus is felt within the first year, and then the economy internalizes the gains. The data supports this statement:

The deficit is has grown by $400 billion under Trump's watch.

- Joined

- Sep 3, 2014

- Messages

- 15,485

- Reaction score

- 16,421

- Location

- Pacific NW

- Gender

- Male

- Political Leaning

- Liberal

Oh no, they didn't. It's almost like giving tax cuts to rich people doesn't help the economy very much.

"Promises made, promises kept." :roll:

- Joined

- Jan 2, 2006

- Messages

- 28,173

- Reaction score

- 14,269

- Location

- Boca

- Gender

- Male

- Political Leaning

- Independent

I have nothing further to say to you.

The economy isn't going to magically grow from tax cuts 5 years after the initial phasing. There is nothing you can or will point to that supports your statement.

- Joined

- Dec 9, 2009

- Messages

- 134,496

- Reaction score

- 14,621

- Location

- Houston, TX

- Gender

- Male

- Political Leaning

- Conservative

The initial jolt in stimulus is felt within the first year, and then the economy internalizes the gains. The data supports this statement:

The deficit is has grown by $400 billion under Trump's watch.

Yes interest expense has almost doubled and the rest of the growth is due to entitlement spending as you continue to ignore reality. Chicago style politics of name calling and partisan attacks continue in every one of your posts. You obviously aren't in the 56.3% of the American public that supports the job Trump is doing, but I am thus you have zero credibility and remain in the minority

- Joined

- Jan 2, 2006

- Messages

- 28,173

- Reaction score

- 14,269

- Location

- Boca

- Gender

- Male

- Political Leaning

- Independent

Yes interest expense has almost doubled and the rest of the growth is due to entitlement spending as you continue to ignore reality.

Government revenue would have been $250 billion higher sans the Trump tax cuts.