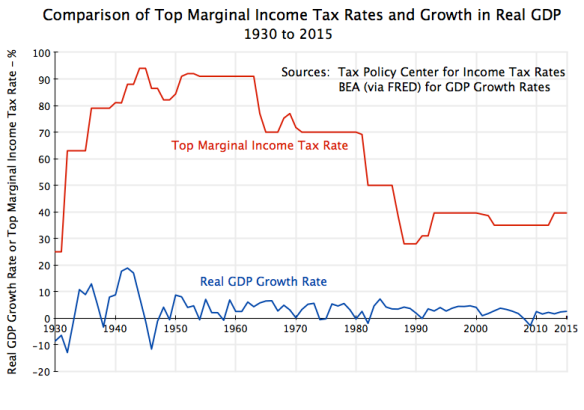

The video claims that Biden want to raise the capital gains tax to 43%. Back in the 1980's the cap gains rate was 60% for short term (less than one year) and 40% for long-term, and we had plenty of investment. The commentator's assertion that it will hurt investment is baseless. As Warren Buffett

famously stated, "Back in the 1980s and 1990s, tax rates for the rich were far higher, and my percentage rate was in the middle of the pack. According to a theory I sometimes hear, I should have thrown a fit and refused to invest because of the elevated tax rates on capital gains and dividends. I didn’t refuse, nor did others. I have worked with investors for 60 years and I have yet to see anyone — not even when capital gains rates were 39.9 percent in 1976-77 — shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off. And to those who argue that higher rates hurt job creation, I would note that a net of nearly 40 million jobs were added between 1980 and 2000. You know what’s happened since then: lower tax rates and far lower job creation."

Estates should also be taxed -- and have been historically taxed, with no negative economic consequences. The current rates are merely a boon to children who haven't done anything to earn their inheritance besides winning the sperm lottery.

Apart from a good job, the commentators are merely regurgitating long-held conservative -- pro-wealthy viewpoints on taxation, that have little bases in reality.

The rest of the video is about spending, not taxation.

If one wants to learn about Biden's tax plan without investing half an hour watching a biased video, I recommend this:

Joe Biden’s tax plan, explained - Vox

Summary:

Biden also wants to raise the corporate income tax rate from its current 21 percent to 28 percent — still lower than the 35 percent rate that existed pre-Trump.

:format(webp):no_upsca le()/cdn.vox-cdn.com/uploads/chorus_asset/file/19430294/Screen_Shot_2019_12_04_at_1.44.54_PM.png)