- Joined

- Mar 6, 2019

- Messages

- 25,997

- Reaction score

- 23,609

- Location

- PNW

- Gender

- Male

- Political Leaning

- Other

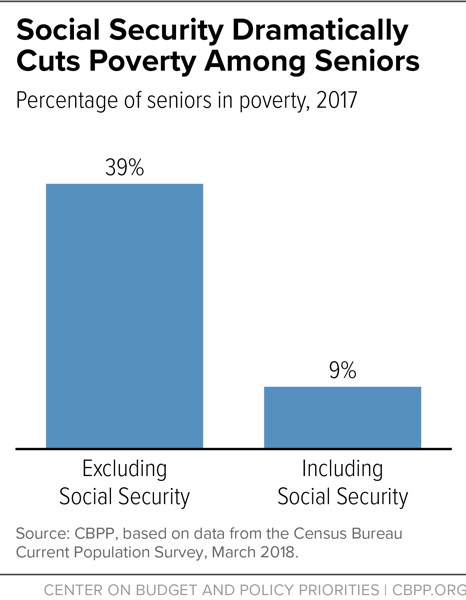

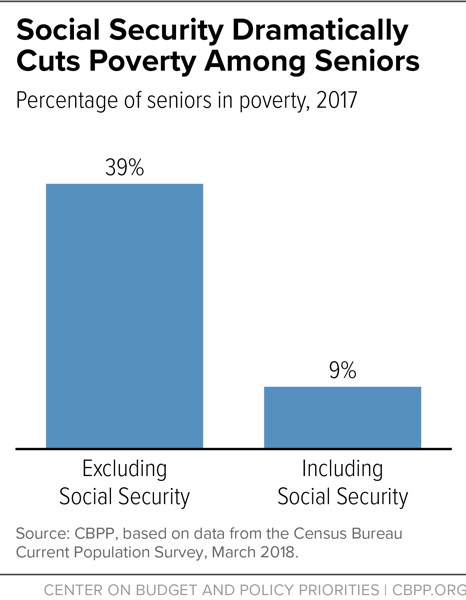

In some respects this is a political/economic philosophy thread. In the absence of social security the income inequality gap would be far worse. SS ameliorates it substantially, because it places a floor under 62 million Americans. The average payout is somewhere around $1400/ month - barely over the poverty rate for a couple - one of the lowest rates in the developed world. (The Max Benefit is about twice that.)

(CBPP: Ten Facts).

(CBPP: Ten Facts).

The philosophy behind SS is to provide a floor. It does that, but the floor is pretty low. Because it is not means-tested, administration costs are extremely low. In the other hand, those with significant income need it very little. Upping the taxable rate (i.e. incomes above $133k) will require a change in the payout formula. But that makes sense if the philosophy is a) social insurance and b) providing a floor above poverty.

This is particularly true for women, children and people of color.Social Security provides the majority of income to most elderly Americans. For about half of seniors, it provides at least 50 percent of their income, and for about 1 in 4 seniors, it provides at least 90 percent of income, across multiple surveys and the recent study that matches survey and administrative data.

The poverty rate among Black and Latino seniors is over 2.5 times as high as for white seniors. There is a significant racial retirement wealth gap, leading seniors of color to face more retirement insecurity than white seniors. African American and Latino workers are less likely to be offered workplace retirement plans and likelier to work in low-wage jobs with little margin for savings. Social Security helps reduce the economic disparities between white seniors and seniors of color.

The philosophy behind SS is to provide a floor. It does that, but the floor is pretty low. Because it is not means-tested, administration costs are extremely low. In the other hand, those with significant income need it very little. Upping the taxable rate (i.e. incomes above $133k) will require a change in the payout formula. But that makes sense if the philosophy is a) social insurance and b) providing a floor above poverty.

Last edited: