jonny5

DP Veteran

- Joined

- Mar 4, 2012

- Messages

- 27,581

- Reaction score

- 4,664

- Location

- Republic of Florida

- Gender

- Male

- Political Leaning

- Libertarian

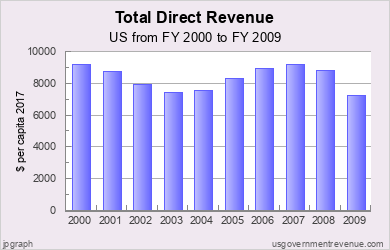

Those who point to Bush's tax-cuts and conclude they were causal to higher revenue are fooling themselves. If we look at those government revenue (adjusting for inflation and population growth) after the tax-cuts, which occurred in 2001 and 2003, what do we see? Revenue dropped after each of the tax-cuts.

Even after the housing bubble started (post 2004,) the revenue never recovered to pre-tax-cut levels. Then after the housing bubble broke revenue declined greatly.

That chart is per capita revenue. Actual revenue increased from 2 trillion to 2.5 trillion prior to the recession.