- Joined

- Dec 4, 2013

- Messages

- 36,634

- Reaction score

- 35,658

- Gender

- Male

- Political Leaning

- Liberal

Call Treasury and tell them there data is wrong

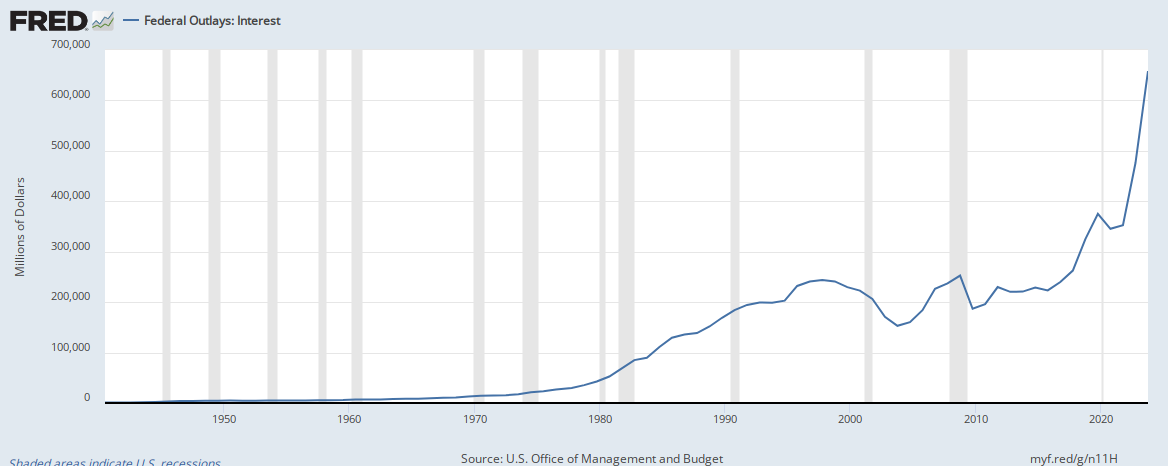

No matter who is president, no matter which party holds Congress, the debt is going up, up up. 10,000+ people per DAY retiring, wanting their SS and Medicare, along with all the other senior programs. Massive numbers of indigenous poor and poor immigrants stressing the system. Very low labor participation rates. The interest on the debt will continue to climb as we incur more and more debt. We are WAY past the point where a few cuts or austerity measures will make any appreciable difference. And minor tinkering is about all any president or Congressman would be willing to do. Anything REALLY big would be political suicide. So we're stuck borrowing 78 cents for every dollar we take in.

Good news is we can just keep on keepin' on, borrowing that is. We may be at 105% of GDP but Japan is well over 200%, so it looks like so long as we make the interest payments we're good to go. Yeeeeee-haaaaaw !!!!

No matter who is president, no matter which party holds Congress, the debt is going up, up up. 10,000+ people per DAY retiring, wanting their SS and Medicare, along with all the other senior programs. Massive numbers of indigenous poor and poor immigrants stressing the system. Very low labor participation rates. The interest on the debt will continue to climb as we incur more and more debt. We are WAY past the point where a few cuts or austerity measures will make any appreciable difference. And minor tinkering is about all any president or Congressman would be willing to do. Anything REALLY big would be political suicide. So we're stuck borrowing 78 cents for every dollar we take in.

Good news is we can just keep on keepin' on, borrowing that is. We may be at 105% of GDP but Japan is well over 200%, so it looks like so long as we make the interest payments we're good to go. Yeeeeee-haaaaaw !!!!

That's okay, austerity never works anyway.

You can't save your way out of a hole. On the other hand, maybe we could be spending our money more wisely, and perhaps not listening to the tax cut crowd.

Such as? How would you spend more wisely? The biggest items are Medicare, Social Security, military and interest on the debt. 3 of those 4 will undoubtedly increase due simply to demographics.

Our real problem is that the politicians who created all those benefits knew they would be long gone by the time the bill was due. But it got them the votes they wanted. Apparently people never tire of hearing they can get something for nothing. We're just suckers for Ponzi schemes.

BTW; I kinda agree with you that tax cuts won't help. The premise is that tax cuts stimulate spending, hence growth, producing more in new tax revenue than the cost of the cuts. That won't work anymore. Old people just don't spend much, except maybe eventually on health care. What we need is for the Millennials to all get married and have a bunch of kids. But that ain't gonna happen. So there is no massive group of consumers salivating to spend that tax money as fast as they can. They are more likely to hoard it for future health care costs, or if they are younger, pay down some debt. As it is, we're pretty saturated with consumer goods already.

Well, it's not just that. It's that right now, the top income brackets are becoming a liquidity trap. Old people don't spend much, but beyond a certain level of wealth, you *can't* spend enough.

Military spending could use some cuts. We're still trying to be the USA of 1945, which is sort of like being the France of 1918 in 1939.

The top brackets never did "spend enough". They have never been drivers of the economy. And I could agree with you on the idea of cutting military spending, with one caveat. If we were to drastically cut military spending, we would also have to drastically reduce the mission. Get our allies to pay more and do more. THAT is a very Trump position.

But overall not enough by far. Somehow I thought you would suggest cutting the military; it's an easy target. But it won't get us there by itself. Not even close. This math problem ain't that easy, is it?

I am all about cutting the mission. We have a track record of building bigger monsters than we dispose of. Perhaps we could stop with this obsession with being the world's cop.

As for SSI, it's unfixable, because neither party is interested in not pillaging it. We could also remove the cap on payroll taxes, but that isn't going to happen, either.

I am sitting here thinking it's unfixable in general.

I can give you and idea to help fix Social Security right off the bat.... remove the Social Security Wage Base restriction and subject all wage and salary income to the same FICA taxes. By my estimate, that alone would increase OASDI receipts by 16.5%.

All we have to do is convince the better off to vote for that.

Even if they don't, they're still only 6.5% of all wage earners.

Yeah, but who owns more congressmen? Them or us?

I can give you and idea to help fix Social Security right off the bat.... remove the Social Security Wage Base restriction and subject all wage and salary income to the same FICA taxes. By my estimate, that alone would increase OASDI receipts by 16.5%.

Ideally, Social Security incoming revenue/outgoing payments would be equal as ALL revenue collected by government is spent each year and the so called trust funds are simply government debts for which future taxpayers will be held liable as they become made part of the public debt instead of intra-government debt.

But, I do kind of agree with your basic idea, and perhaps there should be no cap at all on Social Security and Medicare taxation.

If we were to go that route, I would eliminate the employer co-pay and increase wages 7.65%.

Looking at the 1040 tax return for 2017, I would also eliminate losses from lines 13, 14, and 18, only to show gains, and then apply Social Security and Medicare taxes to the Total Income as shown on line 22.

Those working for a salary of $1 a year, or some very small amount relative to their total remuneration by other means would then become the primary providers of revenue to fund Social Security, and the maximum benefit should be capped at the median wage of the year one begins receiving benefits, with inflation increases applied each year thereafter.

The Social Security tax, currently 12.4% and Medicare tax currently 2.9%, or a total of 15.3% might then be easily adjusted to reflect where most spending is needed for those 2 programs, more going to Medicare and less going to Social Security as ALL income would be taxed, regardless of how it was acquired.

As long as government did not add more social spending as a result of the surplus incoming revenue, I would promote something along that line.

I see where you're going there... I don't know if it'd actually work in practice, though. First off, what assurance would you have that eliminating the employer co-pay would go back into wages? Secondly, I haven't run all the numbers yet... but just ballparking it, I don't think eliminating capital losses would come anywhere near what it'd take to compensate from the co-pay elimination.

I like where you're going, though.... not so much on loss elimination (I figure if business can write off losses, then individuals should be able to as well), but I do like your ideas on tax equity. Why not tax capital gains at the same rate we tax regular income? Just because you work for your money doesn't mean you should pay a higher rate than someone who has their money working for them.

If government were to require it be done employees should see their hourly rate increased by 7.65%.I see where you're going there... I don't know if it'd actually work in practice, though. First off, what assurance would you have that eliminating the employer co-pay would go back into wages? Secondly, I haven't run all the numbers yet... but just ballparking it, I don't think eliminating capital losses would come anywhere near what it'd take to compensate from the co-pay elimination.

I like where you're going, though.... not so much on loss elimination (I figure if business can write off losses, then individuals should be able to as well), but I do like your ideas on tax equity. Why not tax capital gains at the same rate we tax regular income? Just because you work for your money doesn't mean you should pay a higher rate than someone who has their money working for them.

If government were to require it be done employees should see their hourly rate increased by 7.65%.

Capital losses, or losses of any type are not income, and if any deduction is allowed for them it should be applied in determining the adjusted gross income. Social Security and Medicare taxes should be paid on all income prior to any deductions.

It was not my intent to eliminate losses, simply to remove them from the income portion of the form. They could then be applied in the adjusted gross income portion of the form.

Short term capital gains are taxed at the same rate, perhaps THEY should be taxed at a higher rate.

But I see nothing stopping the Federal government from applying a 15.3% tax on total income reported each year.I think you give the Federal Government powers not evident within the Constitution. They could certainly raise the the Federal minimum wage by 7.65% - but that doesn't necessarily mean it'd carry over to everyone making more than the Federal minimum... or to employees where the Federal minimum wage doesn't apply.

Personally, I would prefer everyone be treated equally by our tax laws. All forms of income totalled, NO deductions at all, and a single tax rate applied to everyone. And government have to live within the means of the revenue it collects each year in the budget it creates, eliminating spending and government employees when necessary.I don't see why Short and Long Term capital gains should be taxed any differently... or why either shouldn't be taxed at the same rate as ordinary income. Income is income, no matter how you earn it.

A Social Security number is assigned at birth today. Why would you not be eligible to receive benefits if you have paid into it? Many people receive benefits who have not paid into it.Let's say I was a Trust Fund baby... never worked a day in my life. Never even got a Social Security Number... why should I pay into Social Security if I'm not going to be eligible to receive benefits?

But I see nothing stopping the Federal government from applying a 15.3% tax on total income reported each year.

Personally, I would prefer everyone be treated equally by our tax laws. All forms of income totalled, NO deductions at all, and a single tax rate applied to everyone. And government have to live within the means of the revenue it collects each year in the budget it creates, eliminating spending and government employees when necessary.

That happens when the supply of people needing employment exceed the needs of businesses to employ.What can I say? Wage increases are a lot easier to avoid than taxes.

The burden will always be greater upon the poor.The basic problem with with having a flat rate is the simple fact that the poorer you are, the greater percentage of your income you need to spend on essentials - food, clothing, shelter, etc. Without progressive taxation, then doesn't that place a proportionately higher burden on the poor?

That happens when the supply of people needing employment exceed the needs of businesses to employ.

The burden will always be greater upon the poor.