jonny5

DP Veteran

- Joined

- Mar 4, 2012

- Messages

- 27,581

- Reaction score

- 4,664

- Location

- Republic of Florida

- Gender

- Male

- Political Leaning

- Libertarian

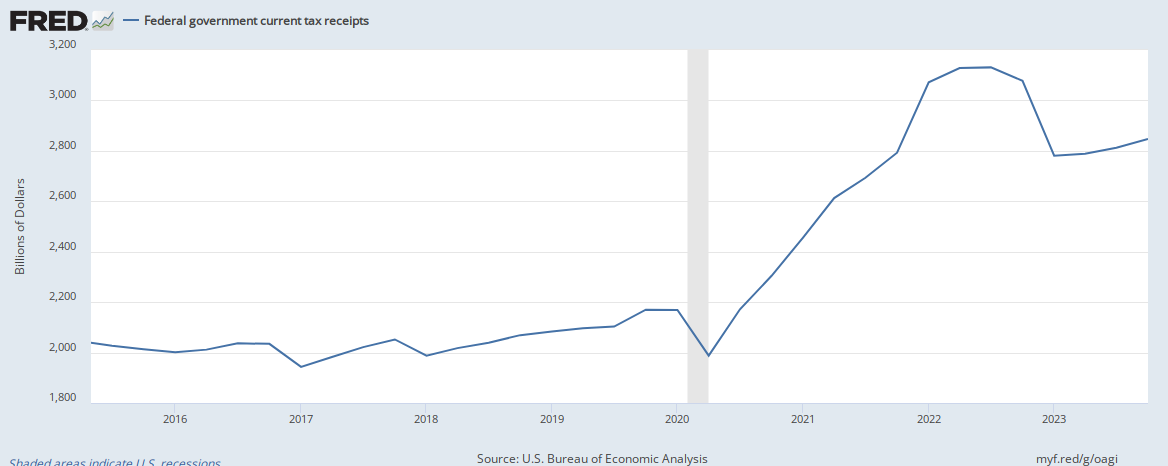

Taxes are up 2% or 51bn over same time last year, so no wonder the deficit keeps increasing.

Spending is up 9% or 255bn over same period last year.

-132bn mandatory social spending

-53bn DOD and VA

-37bn additional interest on the debt

https://www.cbo.gov/system/files/2019-06/55329-MBR.pdf

6 months since Democrats took over the House, and a couple month till FY2020, and still no budget, no approprations. The House budget committee has put out a framework to increase spending, thats it. Oh, also a hearing on budgetary effects of climate change 50 years from now.

Amounts withheld from workers’ paychecks rose by $30 billion (or 2 percent). That

change largely reflects increases in wages and salaries

Customs duties increased by $19 billion (or 78 percent), primarily because of new tariffs

imposed by the Administration during the past year.

Spending is up 9% or 255bn over same period last year.

-132bn mandatory social spending

-53bn DOD and VA

-37bn additional interest on the debt

https://www.cbo.gov/system/files/2019-06/55329-MBR.pdf

6 months since Democrats took over the House, and a couple month till FY2020, and still no budget, no approprations. The House budget committee has put out a framework to increase spending, thats it. Oh, also a hearing on budgetary effects of climate change 50 years from now.