The Trump tax cuts composed of both corporate tax reform (cutting the corporate tax rate from 35% to 21%), and across the board cuts to individual income tax brackets. Below is the

percentage point decline for each bracket. Also note that $5,650 increase in the standard deduction.

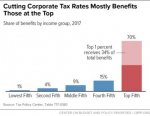

Claims that the Trump tax cuts go mostly to the “top 1%” are commonplace. Democratic Policy and Communications Committee co-chair

David Cicilline claims that “80%” of the Trump tax cuts go to “corporations and the top 1%.” Nancy Pelosi has claimed that 83% of the Trump tax cuts went to the top 1%.

A more useful way to analyze the Trump tax cuts is so look at how they benefit each income quintile relative to how much of the tax burden they shouldered before the cuts. Before the Trump tax cuts, the bottom 80% of income earners paid roughly 33% of all federal income taxes, but received 35% of the benefits from the Trump tax cuts. The top 1% paid 27% of all federal taxes, and received only 21% of the tax cut, according to the center-left

Tax Policy Center.

The Tax Policy Center found that more than

80 percent of taxpayers recieved a tax cut, with less than five percent receiving a tax increase. The five percent who saw increases were mostly wealthy people in coastal States who had their write-offs for mortgage interest and for state and local taxes capped. The average cut in taxes was $1,600. An analysis by the center-right

Tax Policy Center in 2018 yielded almost identical results when it came to the share paid by earners; that the top 1 percent of income earners would glean 20.5% of the tax cut benefits.

So, the top 1% are not receiving 80% or 83% of the benefits, they’re receiving roughly 21%. However, there actually is some slight truth to Cicilline and Pelosi’s claims, but only in one scenario, and they’re to blame for it. What Cicilline and Pelosi didn’t mention is that they’re specifically speaking about the year 2027, when the individual income tax cuts expire, and thus the majority of the benefits shift to corporations (whose reduced tax rates remain unchanged).

https://bongino.com/no-the-trump-tax-cuts-did-not-all-go-to-the-rich/