- Joined

- Dec 31, 2016

- Messages

- 11,375

- Reaction score

- 2,650

- Gender

- Male

- Political Leaning

- Independent

For starters, if you're trying to corner Trump on hypocrisy, you'll have to argue he implanted long term tax cuts for short term effects. If you're thinking about how the tax system should work in the long run, it doesn't matter that the economy is booming or not. You just put the tax cut in effect when you have the political support.

I am not trying to defend his tax plan, by the way. I have no opinion on whether it was right or wrong.

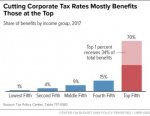

The support was strictly Bipartisan. The Corporate tax cuts benefit the wealthy about 9 to 1, and the wealthy were the primary benefactors of the personal tax cuts.