OK, let's roll the tape. Deficits in 2012 dollars from 1992-2001

1992 -454.1

1993 -387.5

1994 -303.4

1995 -237.7

1996 -152.6

1997 -30.4

1998 95.5

1999 171.2

2000 315

2001 166.1

So deficits came down every year. So what caused the deficits to come down? Mostly revenue increases:

1,706.9 2,161.0 -454.1

1,753.8 2,141.3 -387.5

1,879.0 2,182.4 -303.4

1,960.0 2,197.7 -237.7

2,063.4 2,216.0 -152.6

2,196.4 2,226.9 -30.4

2,374.8 2,279.3 95.5

2,490.1 2,318.9 171.2

2,691.3 2,377.3 315

2,578.5 2,412.4 166.1

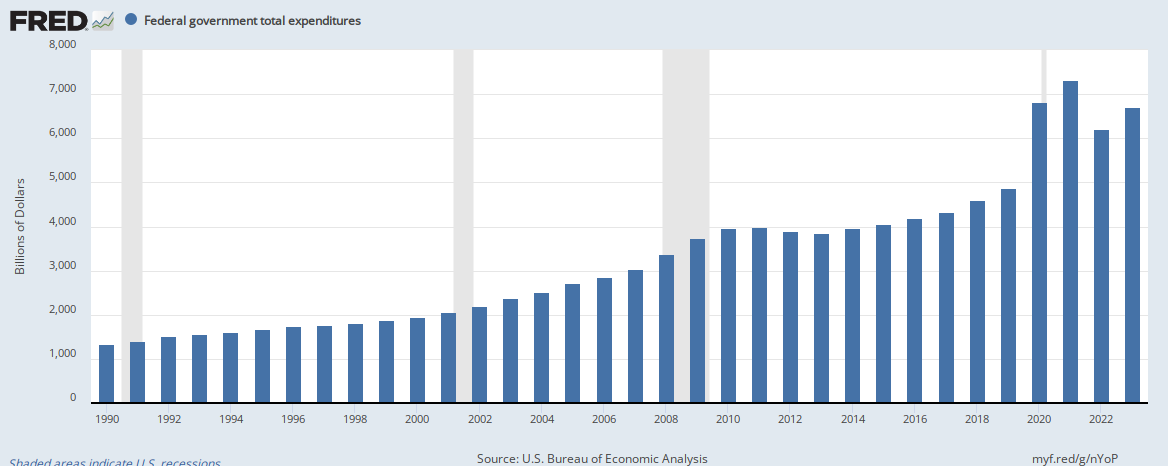

That middle column is spending (in 2012 dollars, first row is 1992 or the last Bush year) and you can see the spending restraint started before the GOP took over in January 1995.

I don't quite get it. You quote me giving the GOP partial credit, which is fair enough. Would it kill you to recognize that Clinton was legitimately interested in reducing the deficit, if nothing else because it just.....happened, and every step along they way he was on board with it.

It's also interesting that every time you guys talk about the Clinton years, you focus on the spending, and yet it's the revenue boom that did the heavy lifting for deficit reduction, and that was in part fueled with higher tax rates, including payroll taxes.

Bottom line is here's the total increase in inflation adjusted revenues by President, and I cut Bush II off at the peak in 2007, so giving him the MAXIMUM benefit of the debt and housing bubble. I also handicapped Obama by measuring it from the PEAK Bush II year of 2007 through 2017. If I started with 2009, that Obama line would read 40%

Reagan - 19%

Bush I - 1%

Clinton - 47%

Bush II - 9%

Obama - 11% (40%)

There's no secret about how our budget works. In good years, revenue should in fact outpace growth, or at least keep pace, because spending does. But every time the GOP cuts taxes, we see revenue growth slow to a trickle (and before you mention Reagan, he raised taxes every year post 1981), spending keeps pace with inflation and economic growth, and deficits go UP. Clinton raised rates, revenues exploded. Bush cut them and even through the biggest bubble in generations we saw about 1/5th the revenue growth under Clinton. Etc....

[BTW, I messed up the Obama line, and corrected it. Used nominal when I meant to use inflation adjusted. It's correct now. ]