- Joined

- Dec 31, 2016

- Messages

- 11,375

- Reaction score

- 2,650

- Gender

- Male

- Political Leaning

- Independent

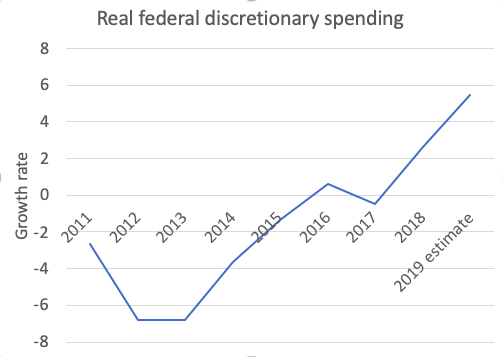

This website analyzes the budget and forecasts the deficit. The deficit is heading to well over a $Trillion.

Current US Federal Budget Deficit: Causes, Effects

The U.S. federal budget deficit for fiscal year 2020 is $1.103 trillion. FY 2020 covers October 1, 2019, through September 30, 2020. The deficit occurs because the U.S. government spending of $4.746 trillion is higher than its revenue of $3.643 trillion.

...

Many people blame the deficits on entitlement programs. But that's not supported by the budget. These enormous deficits are the result of three factors.

First, the attacks on 9/11 led to the War on Terror. It's added $2.4 trillion to the debt since 2001. It almost doubled annual military spending. It rose from $111.9 billion in 2003 to a peak of $150.8 billion in 2019. That includes the defense department budget and off-budget emergency spending, and increases for the Department of Veterans Affairs.

...

The Trump administration will set new records of defense spending. It is estimated to reach $989 billion. That adds spending for departments that support defense, such as Homeland Security, and the National Nuclear Security Administration.

U.S. military spending is greater than those of the next 10 largest government expenditures combined. It's four times greater than China's military budget, and 10 times bigger than Russia's defense spending. It's difficult to reduce the budget deficit without cutting U.S. defense spending.

...

Second is the impact of tax cuts. They immediately reduce revenue for each dollar cut. Proponents of supply-side economics argue that the government will recoup that loss over the long term by boosting economic growth and the tax base. But the National Bureau of Economic Research found that only 17% of the revenue from income tax cuts was regained. It also found that 50% of the revenue from corporate tax cuts was lost.

Current US Federal Budget Deficit: Causes, Effects

The U.S. federal budget deficit for fiscal year 2020 is $1.103 trillion. FY 2020 covers October 1, 2019, through September 30, 2020. The deficit occurs because the U.S. government spending of $4.746 trillion is higher than its revenue of $3.643 trillion.

...

Many people blame the deficits on entitlement programs. But that's not supported by the budget. These enormous deficits are the result of three factors.

First, the attacks on 9/11 led to the War on Terror. It's added $2.4 trillion to the debt since 2001. It almost doubled annual military spending. It rose from $111.9 billion in 2003 to a peak of $150.8 billion in 2019. That includes the defense department budget and off-budget emergency spending, and increases for the Department of Veterans Affairs.

...

The Trump administration will set new records of defense spending. It is estimated to reach $989 billion. That adds spending for departments that support defense, such as Homeland Security, and the National Nuclear Security Administration.

U.S. military spending is greater than those of the next 10 largest government expenditures combined. It's four times greater than China's military budget, and 10 times bigger than Russia's defense spending. It's difficult to reduce the budget deficit without cutting U.S. defense spending.

...

Second is the impact of tax cuts. They immediately reduce revenue for each dollar cut. Proponents of supply-side economics argue that the government will recoup that loss over the long term by boosting economic growth and the tax base. But the National Bureau of Economic Research found that only 17% of the revenue from income tax cuts was regained. It also found that 50% of the revenue from corporate tax cuts was lost.