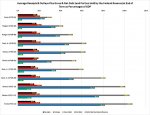

I've got to admit, I don't feel I have an adequate grasp on the theoretical implications of MMT... I'm kind of approaching this from a practical point of view, so in that light, I thought I'd post this chart on Federal Spending and Debt:

View attachment 67254013

The Black Bar represents average receipts as a percentage of GDP for each 4-year term.

The Red Bar represents average outlays - when it's greater than the Black Bar, we're running a deficit, when it's lower, a surplus.

The Gray Bar is the total Debt (as a percentage of GDP) at the end of each term.

The Blue Bar represents the Net Debt held by the Public. The difference between the Gray Bar and the Blue Bar is the portion of the Debt held in Government accounts (ie, Social Security, Medicare, etc.)

The Green Bar represents the portion of the Net Debt held by the Federal Reserve... as it increases, it keeps interest rates down and as it decreases, interest rates go up.

The two key measurements are the Net Debt (Blue Bar) and the Debt held by the Federal Reserve (Green Bar)... The Blue Bar represents the part of the Debt out there on the markets, so it competes with private sector borrowing and drives up interest rates as it increases. This effect can be moderated by increasing the Green Bar, but the higher the Green Bar gets, the more uncertainty exists within the Bond Markets... why would you buy Bonds if the Federal Reserve could just dump part of it's supply out on the market at any time and undercut your position?

Now as far as I can tell, the main plank of MMT is that Government deficits (the different between the Red Bar and the Black Bar) should be financed by the Federal Reserve expanding the money supply and exchanging that "new money" for marketable Government debt (thus expanding the Green and Blue Bars). The run-up in the Green Bar during Obama I via QE is a prime example of this. But doesn't this just increase uncertainty in the Bond market and make interest rates increasingly unstable? It seems to me that the higher the Fed's holdings are relative to what's out there in the market, the more it's ability to "fine-tune" interest rates becomes constrained.... even a slight move on it's part would tend to have a disproportionate effect on interest rates.