- Joined

- Dec 9, 2009

- Messages

- 134,496

- Reaction score

- 14,621

- Location

- Houston, TX

- Gender

- Male

- Political Leaning

- Conservative

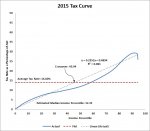

Chart away, as those charts are meaningless. What are you doing to establish wage equality and how does raising taxes on the rich do that?U.S. Household Incomes: A 51-Year Perspective

by Jill Mislinski, 10/16/18

To give us a better idea of the underlying trends in household incomes, we've also prepared a chart of the real percentage growth since 1967. Note in particular the growing spread between the top quintile (and especially the top 5%) and the other four quintiles. The growth spread began in the mid-1980s during the Reagan administration, the era of Supply Side Economics (aka "Reaganomics" and Trickle-Down Economics). As this chart illustrates, tax and other policy changes to benefit the wealthier households didn't have the heavily promoted trickle-down effect.

View attachment 67253711View attachment 67253712

https://www.advisorperspectives.com...6/u-s-household-incomes-a-51-year-perspective

Sent from my SAMSUNG-SM-G930A using Tapatalk