I shall respond with this argument:

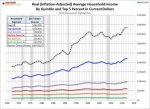

View attachment 67253553

and this one:

-------

How to Disagree, by Paul Graham

If we're all going to be disagreeing more, we should be careful to do it well. What does it mean to disagree well? Most readers can tell the difference between mere name-calling and a carefully reasoned refutation, but I think it would help to put names on the intermediate stages. So here's an attempt at a disagreement hierarchy...

DH1. Ad Hominem.

An ad hominem attack is not quite as weak as mere name-calling. It might actually carry some weight. For example, if a senator wrote an article saying senators' salaries should be increased, one could respond:

Of course he would say that. He's a senator.

This wouldn't refute the author's argument, but it may at least be relevant to the case. It's still a very weak form of disagreement, though. If there's something wrong with the senator's argument, you should say what it is; and if there isn't, what difference does it make that he's a senator?

Saying that an author lacks the authority to write about a topic is a variant of ad hominem—and a particularly useless sort, because good ideas often come from outsiders. The question is whether the author is correct or not. If his lack of authority caused him to make mistakes, point those out. And if it didn't, it's not a problem.

How to Disagree

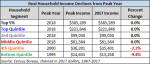

View attachment 67253554