- Joined

- Jan 2, 2006

- Messages

- 28,174

- Reaction score

- 14,270

- Location

- Boca

- Gender

- Male

- Political Leaning

- Independent

I'm not surprised, your chart only goes to 2015

:wassat1:

It goes back to 1947.....

I'm not surprised, your chart only goes to 2015

:wassat1:

It goes back to 1947.....

He thinks your chart stops at 2015. For some reason he is unable to grasp that the graph extends about 3 years past the 2015 tick mark.

Blah blah blah blah. Nobody ****ing cares what you think.

Since when does accuracy of ones statement matter? :lamo

It matters if it was mostly due to interest expense!!! For fiscal year 2018, the line item expense grew by $62 billion while the fiscal deficit grew by $124 billion.

In fiscal year 2017, total revenue was $3.644 trillion.

In fiscal year 2018, total revenue was $3.654 trillion... or a $10 billion increase! That's 0.27% That doesn't even begin to make up for the loss of purchasing power due to inflation (BTW, do you know how to calculate that loss? Nope).

How does this work out in your head??? Donny promises to balance budgets, cut taxes, grow the economy, and all we get is a $790 billion deficit, 3% rGDP growth for ONE year, and $1 trillion deficits as far as the eye can see.

Thanks Donny! :thumbdown

You posted the wrong Treasury data. That's not their fault you are too ignorant to know what these data sets actually measure.

Blah blah blah, nobody ****ing cares.

This is not my belief. You are just lying again because you've lost and it's all you have to offer along with hypocrisy and ignorance.

No it is not!!!! To me, it is important federal revenue increase just on the basis of inflation alone. Then we have to take on the fact that our country continues to grow, and that government will grow as a result. You may not agree... but that's too bad. That is the reality. And when we slash our ability to generate sufficient revenue to reduce the deficit in growth times, we will be equally ****ed when the next recession hits.

No i do not. If you increase taxes on the most wealthy individuals, they won't face an impending budgetary constraint requiring reduced consumption. You don't know what i want, but like to talk about it.

Why do you continue to ignore my statements, quote me, and then absurdly go on a rant about what i (kushinator) want? That's not a response... it's a waste of time. But i do have fun pointing this out to you and the forum.

This is the one honest (segment) thing you've written.

You lose again.

The which party has control of congress argument fails. Perhaps you'd like to try again?

People were allowed to buy houses that they couldn't afford. For a long time, people made money buying houses that they couldn't afford. Of course, sooner or later the bubble had to burst. That's why there has to be effective regulation.

Here's how it works: You can afford a 200,000 house, but, with creative financing, you can buy one for $400,000, so you do. The expectation is that in a couple of years, either house will increase in value by 20%.

Now that $200,000 house is worth $40,000 more, a nice profit.

But that $400,000 house is worth $80,000 more. You sell the house, and pocket the money, less realtor's fees. The mortgage broker makes money, the realtor makes money, the customer makes money, it's a win win, right?

Meanwhile, those questionable mortgages were sold as good investments, which they were until they weren't.

Many people did win, until the whole house of cards crashed. Is it the fault of the individual home buyer?

:yawn:

I don't see anything significant.

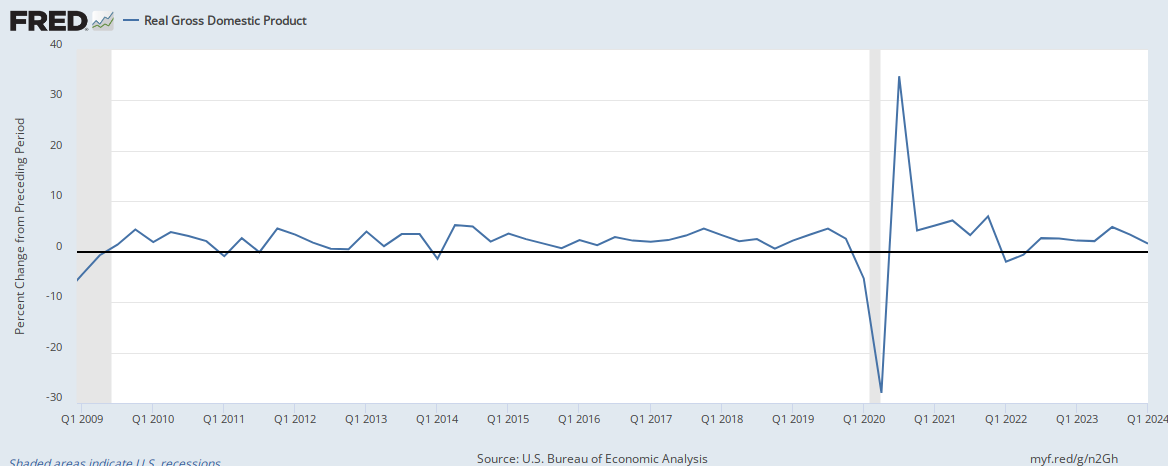

Your unofficial data is pure trash. The Federal Reserve Economic Database is second to none, and sources everything from their appropriate origins.

For example, GDP data is complied by the Bureau of Economic Analysis and is reported on a quarterly basis. As you can clearly observe, FRED imports the BEA database directly. Mutpl.com isn't an accredited database.

Do you have enough courage to admit your failure in both knowledge and reasoning?

I'm not surprised, your chart only goes to 2015

There were many causes of the financial crisis and a lot of people to blame, the left wants it solely on Bush and that is a lie

He doesn't know how to read a graph.

Barney Frank admitted in 2012 that he had acted stupidly in 2005 by supporting Fannie and Freddie when conservative lawmakers told him bad dealings in those entities were threatening to bring down Wall Street.

Blah blah blah blah. Nobody ****ing cares what you think.

Since when does accuracy of ones statement matter? :lamo

It matters if it was mostly due to interest expense!!! For fiscal year 2018, the line item expense grew by $62 billion while the fiscal deficit grew by $124 billion.

In fiscal year 2017, total revenue was $3.644 trillion.

In fiscal year 2018, total revenue was $3.654 trillion... or a $10 billion increase! That's 0.27% That doesn't even begin to make up for the loss of purchasing power due to inflation (BTW, do you know how to calculate that loss? Nope).

How does this work out in your head??? Donny promises to balance budgets, cut taxes, grow the economy, and all we get is a $790 billion deficit, 3% rGDP growth for ONE year, and $1 trillion deficits as far as the eye can see.

Thanks Donny! :thumbdown

You posted the wrong Treasury data. That's not their fault you are too ignorant to know what these data sets actually measure.

Blah blah blah, nobody ****ing cares.

This is not my belief. You are just lying again because you've lost and it's all you have to offer along with hypocrisy and ignorance.

No it is not!!!! To me, it is important federal revenue increase just on the basis of inflation alone. Then we have to take on the fact that our country continues to grow, and that government will grow as a result. You may not agree... but that's too bad. That is the reality. And when we slash our ability to generate sufficient revenue to reduce the deficit in growth times, we will be equally ****ed when the next recession hits.

No i do not. If you increase taxes on the most wealthy individuals, they won't face an impending budgetary constraint requiring reduced consumption. You don't know what i want, but like to talk about it.

Why do you continue to ignore my statements, quote me, and then absurdly go on a rant about what i (kushinator) want? That's not a response... it's a waste of time. But i do have fun pointing this out to you and the forum.

This is the one honest (segment) thing you've written.

You lose again.

Yes and Jaime Gorelick and Franklin Raines, big Democratic supporters benefited with huge bonuses

Don't need any stats as tax cuts or people keeping more of what they earn isn't an expense thus don't have to be paid for.

Have you ever looked at a financial statement? The biggest operating expenses of any business is payroll and that payroll has to be paid for. Do you believe the American taxpayers are employees of the Federal Gov't? If they are then their pay is an expense, if not it isn't so what is there to pay for?

What part of a financial statement don't you understand? Taxpayers aren't employees of the federal government thus aren't an expense. Why is this so hard for you to understand? Expenses are paid for not keeping one's own money thus tax cuts have no reason to be paid forYou are avoiding the issue again, and then doubling down on trying to look at the Federal Government as something else. All of your questions cannot possibly be arrived at from my comments in this thread (and others) to date. Moreover, you are trying to imply things based on a political argument and absent economic reasoning.

What I have tried to do is layer my posts with empirical data and analytics from various sources including what you like to use. Like the Treasury, or CBO, or White House reported numbers, the Fed, etc. The moment you respond with not needing stats and trying to change the argument you are conceding the debate.

So I'll ask again... what stats do you have to support that tax cuts have paid for themselves?

And that has nothing to do with turning the government into a business or turning the taxpayer into an employee of the government.

What part of a financial statement don't you understand? Taxpayers aren't employees of the federal government thus aren't an expense. Why is this so hard for you to understand? Expenses are paid for not keeping one's own money thus tax cuts have no reason to be paid for

Sent from my SAMSUNG-SM-G930A using Tapatalk

It does not matter how many times you repeat this as if you've discovered gold. The government is not a business.

Back to the matter at hand, what stats do you have to support that tax cuts have paid for themselves?

It does not matter how many times you repeat this as if you've discovered gold. The government is not a business.

Back to the matter at hand, what stats do you have to support that tax cuts have paid for themselves?

able 3.2. Federal Government Current Receipts and Expenditures

[Billions of dollars] Seasonally adjusted at annual rates

Last Revised on: December 21, 2018 - Next Release Date January 30, 2019

2016

Q1 3,447.2

Q2 3,448.4

Q3 3,491.8

Q4 3,514.4

2017

Q1 3,572.4

Q2 3,538.8

Q3 3,590.3

Q4 3,533.6

2018

Q1 3,428.3

Q2 3,456.2

Q3 3,543.2

There were many causes of the financial crisis and a lot of people to blame, the left wants it solely on Bush and that is a lie

We all lose again. How much longer can the government keep paying the interest on that burgeoning debt? Meanwhile, hyper partisans just want to blame the other party for an endemic problem than neither party is willing to address.And you don't know how to post data, pretty charts but no dollars on it just percentage changes and quarterly change means nothing, dollar changes means everything. Trump 2 trillion dollars in 2 year, Obama 4.2 trillion in 8, those are real numbers and real impact on the American people and our economy

Bush GDP Growth 10.2 trillion to 14.7 trillion

Obama 14.7 trillion to 18.9 trillion

Trump 18.9 trillion to 20.9 trillion with fourth qtr. projections added or 1.7 trillion thru the third qtr. 2018

You lose again

Bea.gov

No, gov't isn't a business and they don't own the cash that the taxpayers earn. They are giving the taxpayers nothing as there is no cash outlay because of tax cuts thus there is nothing to pay for.

You are showing how easy it is to indoctrinate far too many people. for some reason you believe there is a correlation between tax revenue and gov't expenses believing that tax cuts cause expenses to rise and that couldn't be further from the truth. Tax cuts have nothing to do with expenses other than making people less dependent on gov't thus should reduce expenses.

I've noticed.Be careful this person has a massive ego and is arrogant, when proven wrong he becomes dangerous and a stalker

So do I, what's your point? We're talking about something that's happened in the last few quarters - a mere blimb on 70 years worth of data.:wassat1:

It goes back to 1947.....

I'm not sure who the "left" is or why they solely blame Bush. I don't solely blame Bush, and have posted nothing to indicate I do.