- Joined

- Dec 16, 2011

- Messages

- 74,388

- Reaction score

- 32,634

- Location

- Florida

- Gender

- Male

- Political Leaning

- Liberal

When will you learn?

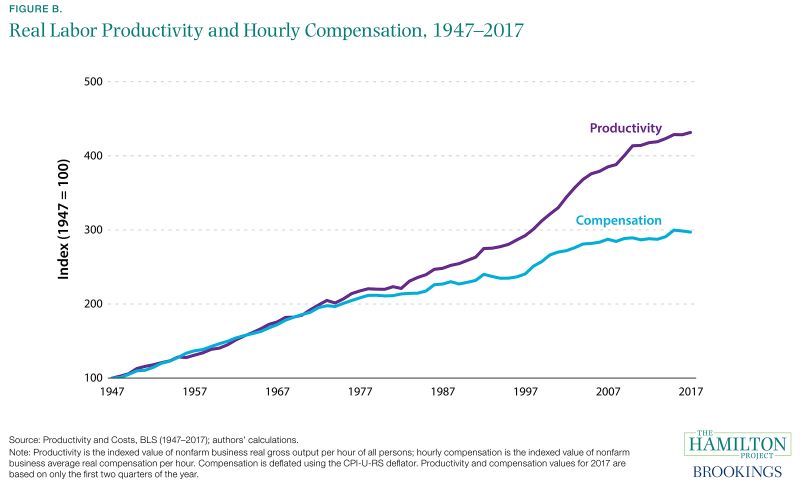

If you cap wealth, the super wealthy will take their wealth elsewhere. If the super wealthy stop generating wealth YOU DO NOT AUTOMATICALLY GET WEALTHY. NO ONE gets wealthy. See...the reason the super rich get super rich is because they are busting their ass and EARNING it. And NOTHING is stopping you from earning your OWN. But you dont get to take someone elses **** just because THEY make it and you dont/cant/wont. And if you decide to try, and have enough idiots in congress to support the idea, then the super rich will simply take their ball and go home. And then you will be DOUBLY ****ed. No...triply ****ed. Because you wont have their wealth, you wont have anyone to take care of you, and you wont have anyone to blame for your failures.

Who is talking about capping wealth? What high top income tax rates do is encourage corporations to find other uses for their profits than executive compensation. No one needs or can spend $10 or $20 million in a year. It is absurd to pay that much.