- Joined

- Dec 4, 2013

- Messages

- 36,634

- Reaction score

- 35,661

- Gender

- Male

- Political Leaning

- Liberal

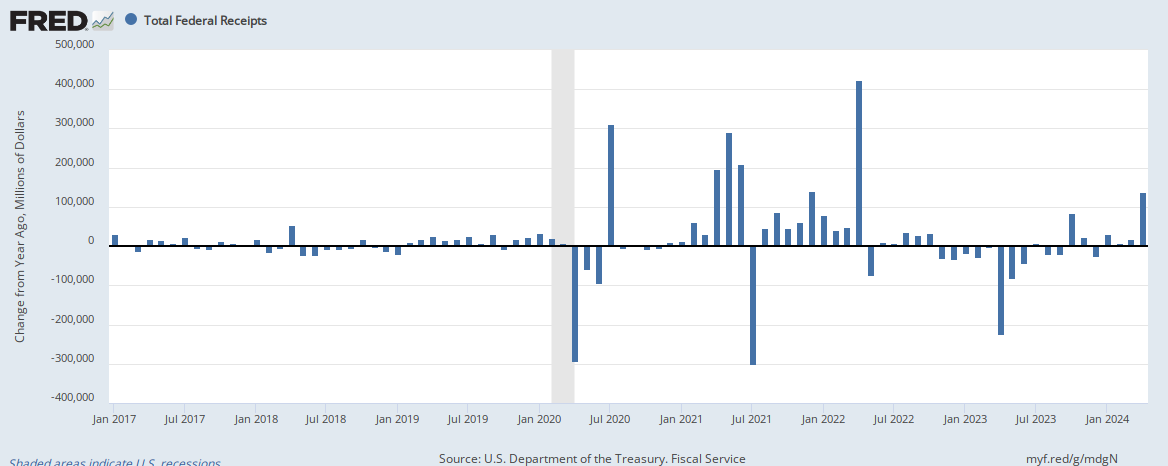

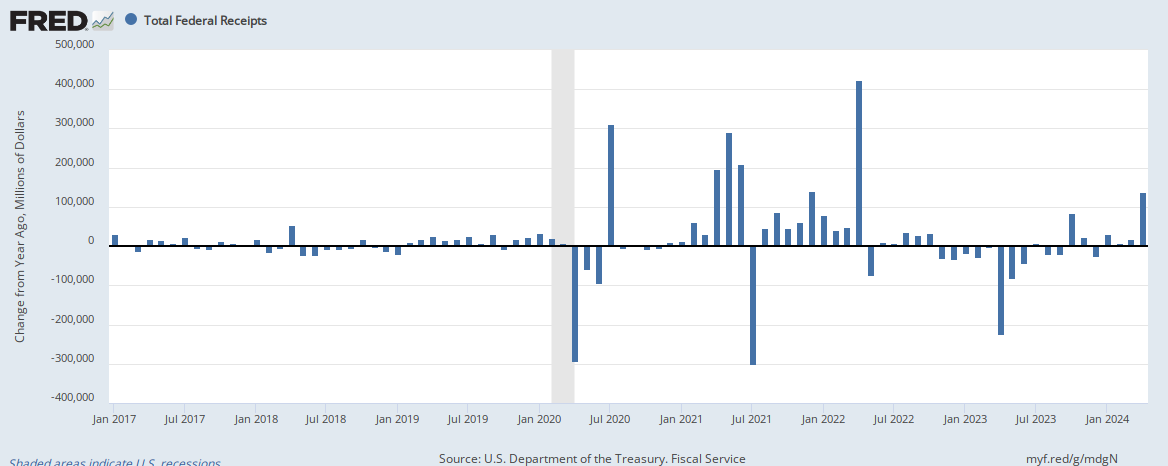

To further my case that the article the OP was quoting from hotair.com, was cherry-picking -- out of 10 months in 2018, seven had lower revenue than the corresponding month in 2017. In fact, October was the first month since April, when individuals paid their 2017 income taxes (e.g. old rates), that revenue increased.

[h=2]Government revenue since the recent tax reform[/h]

[h=2]Government revenue since the recent tax reform[/h]

Last edited: