jonny5

DP Veteran

- Joined

- Mar 4, 2012

- Messages

- 27,581

- Reaction score

- 4,670

- Location

- Republic of Florida

- Gender

- Male

- Political Leaning

- Libertarian

no.. there is not plenty of evidence. In fact I linked to that very fact.. that there is little evidence to show that tax cuts pay for themselves. Its not about whether I "agree" or disagree"

.. its really about facts and logic and the science of statistics.

Your evidence is "wrong".. because you evidence assumes that correlation means causation...

In other words.. because there is an increase in the economy.. it MUST be because of the tax cuts...

When in reality it can be all sorts of other things.

Let me explain the power and the weakness of correlation.

Okay.. your evidence exhibits the weakness of correlation.

Lets say you eat a Chinese dinner.. and get into a car accident right afterward.

that's a positive correlation.. Chinese dinner... then car accident.

that means its possible that Chinese dinners cause car accidents. But.. statistically we cannot assume this is true because there could be intervening variables \

Lets say that we ate a Chinese dinner 100 times and got into a car accident 98 times right after the Chinese dinner... that would be a very strong positive correlation.. and yep it could be that Chinese dinners cause car accidents.

But again, you cannot assume that.. .because the reason you see a correlation between Chinese dinners and car accidents.. is actually because where you go to eat your Chinese dinner is a one way street and you keep going the wrong way on it.

That's the weakness of correlation as a statistic when you see a positive correlation.

Now.. here is the power of correlation as a statistic... when you see NO correlation.

So.. Lets say that you have a Chinese dinner and you get into a car accident. a positive correlation... so you study it.. and you eat 99 more Chinese dinners.. do everything exactly the same.. and you don't end up with another car accident. In other words.. when its studied enough. there no statistical correlation.

this means that you can be reasonably assured that eating a Chinese dinner has no effect on getting into an accident.

that's the power of correlation.

So.. lets look at your evidence. You have a quarter or so where there is increased growth in the economy... and the passing of the tax cuts. So.. yes.. in a snapshot there is a correlation between passing the tax cuts and growth. BUT just like the Chinese dinner.. its based on a small sample. Which means that its validity is very weak.

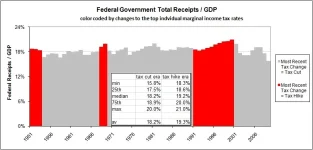

NOW. when you study the effect of tax cuts historically,,, and there has been plenty of history of the US cutting taxes... the evidence shows that cutting taxes.. does not correlate with those taxes paying for themselves.

(Just like when you study more instances of eating Chinese dinners.. there is no correlation).

So.. that's why my evidence is valid... while yours is not.

Its not because of my feelings.. its because of the science of statistics.

Ok you win by shear amount of words.