The point you need to make is that monetary policy did not contribute.

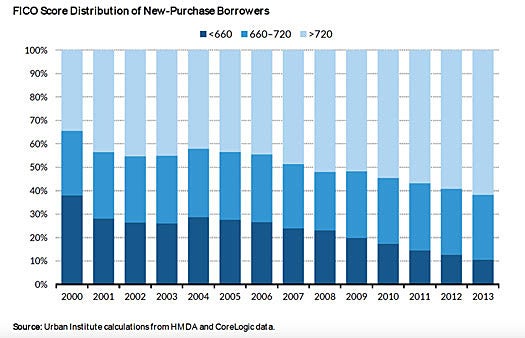

There it is again, you telling me to disprove your narrative. Phat, read this as slowly as possible: "rising rates caused the defaults" is your narrative to prove. Interest rates had zero to do defaults of 2005 and 2006 loans. that was the period of "dramatically lower lending standards". Its not even arguable but you continue to ignore. These loans were so bad, they were defaulting before any reset. I showed you Early Payment Defaults for subprime loans were stable for 5 years, 2000-2004, then almost doubling in 2005. Then 2006 EPDs defaulted at double the 2005 rate. And I've already told you that "2005 defaults" refers to 2005 loans and 2006 defaults refers to 2006 loans. So you don't get to pretend that 2006 defaults in the graph were for any other year. And to continue to cling to your narrative in spite of the facts, you convinced yourself that 5/1 loans reset after the first year.

let me explain it clearly for you. The Bush Mortgage Bubble was people buying houses they could not afford even with introductory teaser rates. Hence Bush and the fed telling you "dramatically lower lending standards". This flood of unqualified buyers drove up prices. This flood of unqualified buyers could not exist without Bush preempting all state laws against predatory lending and Bush's regulators letting it happen.

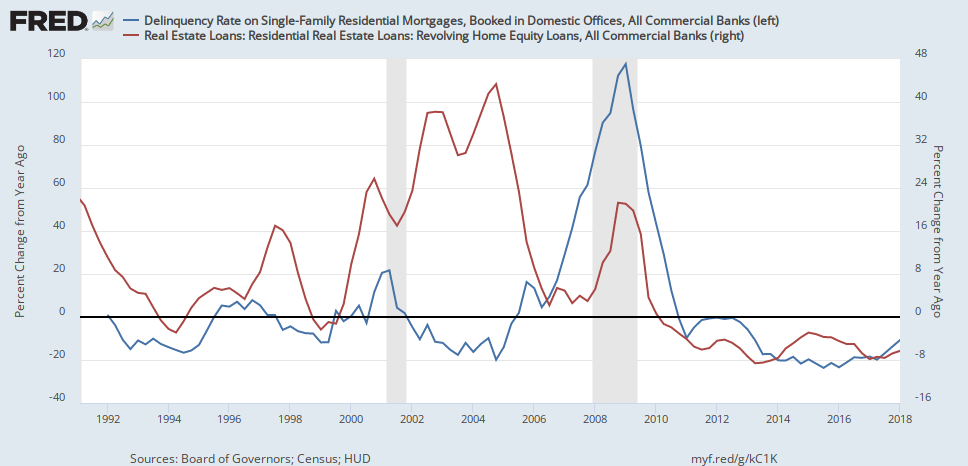

Your point was that monetary policy didn't matter. I showed that HELOCs grew when rates fell and tapered when rates rose. Why do you continue to ignore that point?

I have to chuckle, you complain I ignore your empty rhetoric but you ignore the facts I've posted that has disproven your "rising rates caused the defaults" narrative.

The Fed tightening cycle began in the middle of 2004, yet home prices did not start falling until mid 2007. When did the Fed recently start raising rates? The end of 2015. I'd say we're going to start seeing shockwaves at the end of this year. Still, the tightening cycle has been gentler than the last, so perhaps it will take a bit longer.

Say this out loud. Home prices were still going up as overall mortgage defaults started going up mid 2005 and subprime EPD started shooting up. A flood of unqualified buyers causes that. Not the LIBOR rate, not the Fed rate and not the mortgage rate. And I'm pretty sure you've ignored that I've told you that the Bush Mortgage Bubble popped in late 2006. Remember, I've already posted "Thus, the reports at the end of 2006 from lenders such as Ownit, New Century, and Novastar that an unusually high share of their loans were becoming delinquent almost immediately were a cause for alarm." Now read this

The collapse of the subprime mortgage market in late 2006 set in motion a chain reaction of economic and financial adversity that has spread to global financial markets, created depression-like conditions in the housing market, and pushed the U.S. economy to the brink of recession.

The Heritage Foundation | The Heritage Foundation

Once the subprime market collapsed, the others followed. And any shockwaves we see will be from Trump crashing the economy with his trade war.