- Joined

- Jul 1, 2011

- Messages

- 67,218

- Reaction score

- 28,530

- Location

- Lower Hudson Valley, NY

- Gender

- Male

- Political Leaning

- Independent

[h=1]Russia cuts Treasury holdings in half as foreigners start losing appetite for US debt[/h]

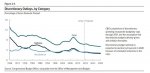

[FONT="]Foreign governments pulled back their purchases of longer-term U.S. debt as trade tensions escalated around the world.[/FONT]

[FONT="]The declines are relatively small so far for notes and bonds — just shy of $5 billion each for March and April, the most recent months for which Treasury data are available — but it signals a potentially troubling trend.[/FONT]

https://www.cnbc.com/2018/06/18/rus...igners-start-losing-appetite-for-us-debt.html

[FONT="]One of the most glaring declines has come from Russia, which sliced its holdings of U.S. debt nearly in half from March to April, from $96.1 billion to $48.7 billion. Russia's Treasury ownership peaked at $108.7 billion in May 2017.[/FONT][FONT="]In all, foreigners held $6.17 trillion of the total $14.84 trillion of Treasury debt outstanding through April. The national debt including intragovernmental holdings has swelled to more than $21 trillion.[/FONT]

[FONT="]Russia isn't the only country cutting back in its U.S. holdings.[/FONT]

[FONT="]China, the largest owner of U.S. debt, reduced its level by $5.8 billion in April to $1.18 trillion, while Japan, the second largest, cut its holdings by $12.3 billion to $1.03 trillion. Ireland, the U.K. and Switzerland also pulled back.[/FONT]

This is how it begins. The reluctance of foreign nations to buy our debt means higher interest rates and higher costs to service our debt.