- Joined

- Feb 7, 2012

- Messages

- 58,383

- Reaction score

- 26,446

- Location

- Mentor Ohio

- Gender

- Male

- Political Leaning

- Libertarian

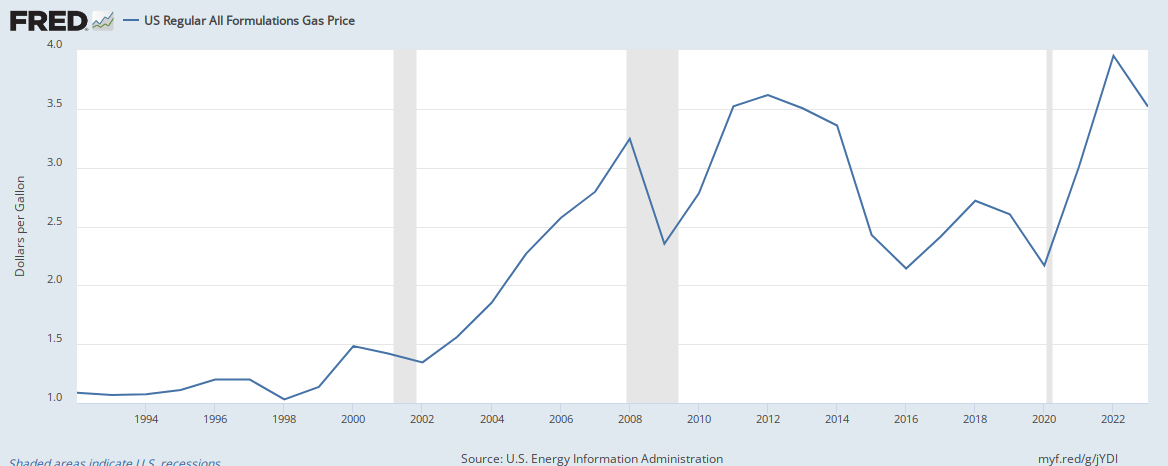

Too much money in the economy is why the Fed is raising interest rates...

No, the FED is raising interest rates because they cant keep them at zero forever. Today it is 1.75% which is still historically low. These increases were planned, not the result of tax cuts :roll: