You obviously aren't listening. And you are delusional. The deficit was artificially higher because, despite conservative opposition, Bush bailed out banks.

Nope, not even close

The federal government ran a surplus during the Clinton years. Bush wrecked the surplus, and ran a deficit starting in 2002, both by spending (two wars, Medicare Part D etc) and by tax cuts (which eviscerated revenues).

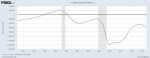

We can see the revenue portion here. Receipts dropped a bit in 2002, rose because of the real estate and financial bubbles, dropped during the recession, then gradually started to climb again.

Revenues dropped more than $440 billion in 2008 and 2009. That accounted for almost half the increase in the deficit during that time.

Bailing out

the banks cost the federal government almost nothing. It didn't bail out Bear Stearns or Lehman, it let them collapse. It forced JPM and BofA to bail out other failing institutions. It allowed some investment banks (like Goldman) to reorganize as bank holding companies, not bail them out.

TARP initially allocated (not spent, but just appropriated) $700bn in 2008. Dodd-Frank, passed in 2010, cut that to $475bn. Paulson forced all the banks to borrow a ton of cash via TARP, but only a short-term basis, in order to prop up confidence in the US financial sector. TARP funds were largely used to shore up the US auto industry, a move that prevented about 1 million US jobs from destruction. The end result is that TARP funds were distributed over several years, and in the end only lost $15bn (mostly to GM).

The AIG bailout in late 2008 was for $85 billion. While that's an immense amount of scratch to you and me, and some of it went to Goldman, it's bupkis in the context of a $3 trillion budget. (And a fair amount of it was repaid later.)

The stimulus act didn't pass until 2009. It didn't go to the banks. It cost $832bn and...

half of that was tax cuts.

Pre and post deficit isn't better and it is only close because of the Republican congress making some minute cuts.

Sorry, that is also incorrect.

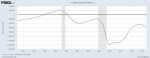

Now, I will say that few Obama policies had a direct impact on cutting the deficit. Of those, the sequestration was NOT a Republican idea. It was a bipartisan maneuver, which was designed by all parties to suck so much that it would force (the Republican...) Congress to make a deal. Instead, they kept playing games, and sequestration took effect.

Sequestration cut around $80bn per year. That is only about a

2% cut in federal spending, and it didn't start until FY2013. It also doesn't explain what we actually see, which is a reduction in the deficit

a full year before the sequestration cuts, which is well-timed to the tapering off of the stimulus act and gradual increases in tax receipts.

And yes, I'm listening.... to lots of people. You're in the minority right now. I see little indication that the majority of Republican voters are hammering on Trump or Congress to cut the deficit. If that was the case, they'd be freaking out over a tax cut that increases it by $1.5 trillion.