-

This is a political forum that is non-biased/non-partisan and treats every person's position on topics equally. This debate forum is not aligned to any political party. In today's politics, many ideas are split between and even within all the political parties. Often we find ourselves agreeing on one platform but some topics break our mold. We are here to discuss them in a civil political debate. If this is your first visit to our political forums, be sure to check out the RULES. Registering for debate politics is necessary before posting. Register today to participate - it's free!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tax Reform

- Thread starter Glowpun

- Start date

- Joined

- Jun 2, 2017

- Messages

- 21,986

- Reaction score

- 4,959

- Location

- In your head

- Gender

- Male

- Political Leaning

- Other

Question: 1. What are the stipulations of the tax reform?

2. Who benefits? Who loses?

To be answered when congress gets their **** together.

joG

DP Veteran

- Joined

- Jul 27, 2013

- Messages

- 43,839

- Reaction score

- 9,655

- Gender

- Undisclosed

- Political Leaning

- Independent

Question: 1. What are the stipulations of the tax reform?

2. Who benefits? Who loses?

....Who knows?

- Joined

- Oct 4, 2011

- Messages

- 27,204

- Reaction score

- 13,299

- Location

- CT

- Gender

- Male

- Political Leaning

- Undisclosed

To be answered when congress gets their **** together.

Ah, so this is a POST violent revolution thought experiment....

- Joined

- Jun 2, 2017

- Messages

- 21,986

- Reaction score

- 4,959

- Location

- In your head

- Gender

- Male

- Political Leaning

- Other

Ah, so this is a POST violent revolution thought experiment....

Basically, I would really like it if they could get out of recess. Help finish this Harvey business, then get to the Tax reform. However picking & choosing are not specific in this instance.

- Joined

- Oct 27, 2011

- Messages

- 101,915

- Reaction score

- 45,449

- Gender

- Male

- Political Leaning

- Conservative

Question: 1. What are the stipulations of the tax reform?

2. Who benefits? Who loses?

I think we should wait and see if the GOP Elites actually intend to pass any kind of tax reform.

Oh...we've been hearing some positive talk from some of them, but they haven't even started work on it.

I fully expect this to end up like that Obamacare thing: Some of them blather about how they wanted to repeal...blah, blah, blah. Other found "things they didn't like about the replace part". Result: No action.

Fact is...the GOP Elites don't want to do ANYTHING they told their voters they want to do and they don't want to do ANYTHING Trump told his voters he wants to do.

Fact is...those GOP Elites are getting too much money from lobbyists and their money men to start doing stuff that hurts those guys.

- Joined

- Sep 10, 2016

- Messages

- 22,399

- Reaction score

- 11,866

- Gender

- Male

- Political Leaning

- Independent

Question: 1. What are the stipulations of the tax reform?

2. Who benefits? Who loses?

Answer to #1: The wealthy will get the best tax breaks and the poor will get the least (if any) and they are the ones that desperately need it, especially if the GOP repeals Obamacare.

Answer to #2: The wealthy will benefit the most and the poor and middle classes will lose.

Trump's idea of tax reform should just be renamed for what he really wants it to be. The "Reward the wealthy with more tax breaks, while stiffing the middle class and the poor" bill.

- Joined

- Oct 27, 2011

- Messages

- 101,915

- Reaction score

- 45,449

- Gender

- Male

- Political Leaning

- Conservative

Answer to #1: The wealthy will get the best tax breaks and the poor will get the least (if any) and they are the ones that desperately need it, especially if the GOP repeals Obamacare.

Answer to #2: The wealthy will benefit the most and the poor and middle classes will lose.

Trump's idea of tax reform should just be renamed for what he really wants it to be. The "Reward the wealthy with more tax breaks, while stiffing the middle class and the poor" bill.

Just wondering...

How much do the poor pay in taxes? Will a tax cut REALLY help them?

- Joined

- Sep 10, 2016

- Messages

- 22,399

- Reaction score

- 11,866

- Gender

- Male

- Political Leaning

- Independent

Just wondering...

How much do the poor pay in taxes? Will a tax cut REALLY help them?

Depends on whether the GOP get their way on repealing the ACA. Cutting off the ACA and letting companies go back to lifetime caps on health insurance either to benefit the wealthy like the GOP was trying to do with Trump's support sure won't help the poor, that's for sure.

- Joined

- Oct 27, 2011

- Messages

- 101,915

- Reaction score

- 45,449

- Gender

- Male

- Political Leaning

- Conservative

Depends on whether the GOP get their way on repealing the ACA. Cutting off the ACA and letting companies go back to lifetime caps on health insurance either to benefit the wealthy like the GOP was trying to do with Trump's support sure won't help the poor, that's for sure.

So...you really don't have answers to my questions.

Okay.

- Joined

- Sep 10, 2016

- Messages

- 22,399

- Reaction score

- 11,866

- Gender

- Male

- Political Leaning

- Independent

So...you really don't have answers to my questions.

Okay.

I answered you. You just didn't like my answer.

- Joined

- Apr 25, 2014

- Messages

- 6,665

- Reaction score

- 6,278

- Gender

- Male

- Political Leaning

- Other

Answer to #1: The wealthy will get the best tax breaks and the poor will get the least (if any) and they are the ones that desperately need it, especially if the GOP repeals Obamacare.

Answer to #2: The wealthy will benefit the most and the poor and middle classes will lose.

Trump's idea of tax reform should just be renamed for what he really wants it to be. The "Reward the wealthy with more tax breaks, while stiffing the middle class and the poor" bill.

It's really hard to give tax breaks to those who pay relatively little taxes in the first place.

- Joined

- Oct 27, 2011

- Messages

- 101,915

- Reaction score

- 45,449

- Gender

- Male

- Political Leaning

- Conservative

I answered you. You just didn't like my answer.

Your "answer" had nothing to do with my questions.

Or...are you saying that repealing Obamacare will INCREASE taxes on the poor?

(we ARE talking about taxes, you know)

- Joined

- Jan 2, 2013

- Messages

- 19,259

- Reaction score

- 6,899

- Gender

- Undisclosed

- Political Leaning

- Conservative

Answer to #1: The wealthy will get the best tax breaks and the poor will get the least (if any) and they are the ones that desperately need it, especially if the GOP repeals Obamacare.

ll.

Considering that ~45 % of taxpayers pay no federal income tax, how can they get a tax break ? Unless you are proposing a negative tax.

( and btw-I 'm not for any kind of tax rate decrease for the upper percentiles)

- Joined

- Jan 25, 2008

- Messages

- 41,536

- Reaction score

- 31,126

- Location

- Southern England

- Gender

- Male

- Political Leaning

- Slightly Liberal

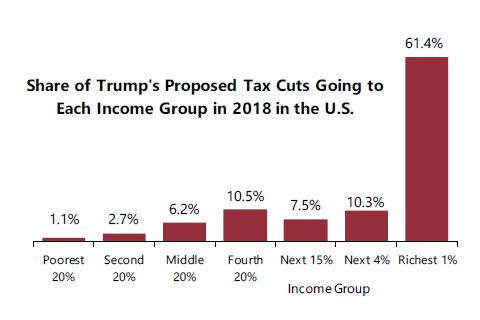

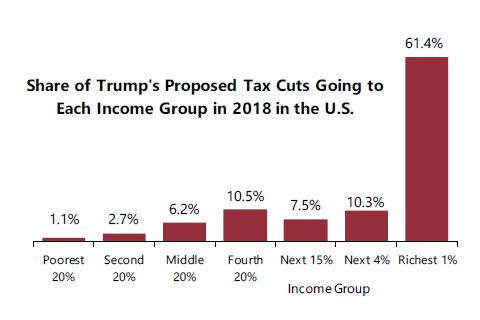

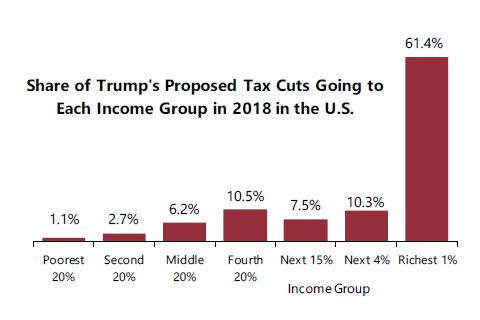

Trump tax reforms in a simple graph.

- Joined

- Jun 23, 2009

- Messages

- 133,631

- Reaction score

- 30,937

- Location

- Bagdad, La.

- Gender

- Male

- Political Leaning

- Very Conservative

Trump tax reforms in a simple graph.

Good job at blowing it all out of proportion.

- Joined

- Dec 4, 2013

- Messages

- 36,623

- Reaction score

- 35,637

- Gender

- Male

- Political Leaning

- Liberal

NYT: The False Promises in President Trump’s Tax PlanQuestion: 1. What are the stipulations of the tax reform?

2. Who benefits? Who loses?

The question we should be asking: Considering the growth in income inequality in America, why do rich people need more tax cuts -- especially when it increases the debt by so much?A recent analysis of Mr. Trump’s proposals by the nonpartisan Urban-Brookings Tax Policy Center generously assumed that policy makers would end popular write-offs, including the deduction for state taxes, to offset the cost of the cuts. Even then, the analysis showed that the proposed Trump tax cuts would lift after-tax income for the top 1 percent of taxpayers by at least 11.5 percent (or an average annual tax cut of $175,000), compared with a barely perceptible 1.3 percent for taxpayers in the middle (or $760 in average tax savings).

Over all, the cuts, paired with loophole closers, would cost at least $3.4 trillion in revenue in the first 10 years and $5.9 trillion over the following decade.

Last edited:

- Joined

- Oct 12, 2005

- Messages

- 281,619

- Reaction score

- 100,389

- Location

- Ohio

- Gender

- Male

- Political Leaning

- Libertarian - Right

Answer to #1: The wealthy will get the best tax breaks and the poor will get the least (if any) and they are the ones that desperately need it, especially if the GOP repeals Obamacare.

Answer to #2: The wealthy will benefit the most and the poor and middle classes will lose.

Trump's idea of tax reform should just be renamed for what he really wants it to be. The "Reward the wealthy with more tax breaks, while stiffing the middle class and the poor" bill.

duh, tax breaks tend to benefit ACTUAL tax payers the most and those who aren't really paying income taxes the least.

want to change that? demand the bottom 50% start paying at least their share of the income taxes

- Joined

- Jan 2, 2006

- Messages

- 28,174

- Reaction score

- 14,270

- Location

- Boca

- Gender

- Male

- Political Leaning

- Independent

want to change that? demand the bottom 50% start paying at least their share of the income taxes

What is their share?

- Joined

- Oct 12, 2005

- Messages

- 281,619

- Reaction score

- 100,389

- Location

- Ohio

- Gender

- Male

- Political Leaning

- Libertarian - Right

What is their share?

well it can be seen two ways

1) they should pay the same share of the income tax as their share of the national income/ which the last time I checked is about 12-13%

2) or they can pay 50% since they are 50% of the population

- Joined

- Jan 2, 2006

- Messages

- 28,174

- Reaction score

- 14,270

- Location

- Boca

- Gender

- Male

- Political Leaning

- Independent

1) they should pay the same share of the income tax as their share of the national income/ which the last time I checked is about 12-13%

How is this even possible? Not on a legal basis, but how does the IRS determine which income group should pay what taxes? It should also be mentioned that everyone who earns a legit paycheck, no matter their income level, pays FICA taxes which come very close to your 12%-13% arbitrary figure. Arbitrary you ask? Are income levels or poverty demographics static?

Let's not forget that such a policy would be contractionary. Anytime the economy slowed, it would increase taxes on lower income individuals, further steapining the downturn.

they can pay 50% since they are 50% of the population

Have you ever considered higher income earners, over the medium to long term, would earn less in terms of both income and absolute net wealth, in the name of appealing to impartiality? :lol:

- Joined

- Dec 4, 2013

- Messages

- 36,623

- Reaction score

- 35,637

- Gender

- Male

- Political Leaning

- Liberal

well it can be seen two ways

1) they should pay the same share of the income tax as their share of the national income/ which the last time I checked is about 12-13%

2) or they can pay 50% since they are 50% of the population

So, you reject the concept that has been around and functional for over 100 years, namely the progressive income tax? The basis of the progressive income tax is two-fold. 1) There are those who work but earn so little that they have little or no funds left over after paying for food, shelter and other necessary items including payroll taxes*. There are those who earn so much that they have abundance.

2) Taxing the wealthy more tends to reduce income inequality, that has been concentrating income and wealth into a tiny fraction at the top, ever since top rates were cut starting over 30 years ago.

The recognition behind the progressive income tax is that the tax burden can better more easily be absorbed by those with abundance than those living hand-to-mouth.

But getting to the idea floated year-after-year by Republicans, namely, that Congress should pass massive tax cuts that benefit the wealthiest (all while complaining about deficits and debt,) is that those tax-cuts end up increasing deficits and debt, that they then use as an excuse to cut programs for those that benefited the least from the tax-cuts.

The tax-cuts proposed by Trump will have no economic benefit. We have seen this movie before during the Bush43 years -- massive tax-cuts for the wealthy, that promised economic benefits and job gains, that never materialized. Cutting corporate taxes never before resulted in higher wages for workers or increased investment spending. It just enriched shareholders, who are mostly the top 1%.

*even those that Romney said pay no income taxes, still pay payroll taxes to Medicare and Social Security. Those that earn their income from interest, dividends and capital gains -- the richest among us, do not earn their money from salary and therefore pay no payroll taxes.

Last edited:

- Joined

- Jan 24, 2013

- Messages

- 20,738

- Reaction score

- 6,290

- Location

- Sunnyvale California

- Gender

- Male

- Political Leaning

- Liberal

So, you reject the concept that has been around and functional for over 100 years, namely the progressive income tax? The basis of the progressive income tax is two-fold. 1) There are those who work but earn so little that they have little or no funds left over after paying for food, shelter and other necessary items including payroll taxes*. There are those who earn so much that they have abundance.

2) Taxing the wealthy more tends to reduce income inequality, that has been concentrating income and wealth into a tiny fraction at the top, ever since top rates were cut starting over 30 years ago.

The recognition behind the progressive income tax is that the tax burden can better more easily be absorbed by those with abundance than those living hand-to-mouth.

But getting to the idea floated year-after-year by Republicans, namely, that Congress should pass massive tax cuts that benefit the wealthiest (all while complaining about deficits and debt,) is that those tax-cuts end up increasing deficits and debt, that they then use as an excuse to cut programs for those that benefited the least from the tax-cuts.

The tax-cuts proposed by Trump will have no economic benefit. We have seen this movie before during the Bush43 years -- massive tax-cuts for the wealthy, that promised economic benefits and job gains, that never materialized. Cutting corporate taxes never before resulted in higher wages for workers or increased investment spending. It just enriched shareholders, who are mostly the top 1%.

*even those that Romney said pay no income taxes, still pay payroll taxes to Medicare and Social Security. Those that earn their income from interest, dividends and capital gains -- the richest among us, do not earn their money from salary and therefore pay no payroll taxes.

Here is a idea, why not update the irs's ability to process tax data so that they can eliminate the need for tax deductions?

- Joined

- Oct 12, 2005

- Messages

- 281,619

- Reaction score

- 100,389

- Location

- Ohio

- Gender

- Male

- Political Leaning

- Libertarian - Right

How is this even possible? Not on a legal basis, but how does the IRS determine which income group should pay what taxes? It should also be mentioned that everyone who earns a legit paycheck, no matter their income level, pays FICA taxes which come very close to your 12%-13% arbitrary figure. Arbitrary you ask? Are income levels or poverty demographics static?

Let's not forget that such a policy would be contractionary. Anytime the economy slowed, it would increase taxes on lower income individuals, further steapining the downturn.

Have you ever considered higher income earners, over the medium to long term, would earn less in terms of both income and absolute net wealth, in the name of appealing to impartiality? :lol:

remind those who don't know, what "FICA taxes" are supposed to pay for

- Joined

- Oct 12, 2005

- Messages

- 281,619

- Reaction score

- 100,389

- Location

- Ohio

- Gender

- Male

- Political Leaning

- Libertarian - Right

So, you reject the concept that has been around and functional for over 100 years, namely the progressive income tax? The basis of the progressive income tax is two-fold. 1) There are those who work but earn so little that they have little or no funds left over after paying for food, shelter and other necessary items including payroll taxes*. There are those who earn so much that they have abundance.

2) Taxing the wealthy more tends to reduce income inequality, that has been concentrating income and wealth into a tiny fraction at the top, ever since top rates were cut starting over 30 years ago.

The recognition behind the progressive income tax is that the tax burden can better more easily be absorbed by those with abundance than those living hand-to-mouth.

But getting to the idea floated year-after-year by Republicans, namely, that Congress should pass massive tax cuts that benefit the wealthiest (all while complaining about deficits and debt,) is that those tax-cuts end up increasing deficits and debt, that they then use as an excuse to cut programs for those that benefited the least from the tax-cuts.

The tax-cuts proposed by Trump will have no economic benefit. We have seen this movie before during the Bush43 years -- massive tax-cuts for the wealthy, that promised economic benefits and job gains, that never materialized. Cutting corporate taxes never before resulted in higher wages for workers or increased investment spending. It just enriched shareholders, who are mostly the top 1%.

*even those that Romney said pay no income taxes, still pay payroll taxes to Medicare and Social Security. Those that earn their income from interest, dividends and capital gains -- the richest among us, do not earn their money from salary and therefore pay no payroll taxes.

you miss a point that needs repeating

the reason why progressive income taxes are so popular is that they allow politicians to pander to the many while only increasing the taxes on a few. If voting was based on what you paid, progressive income taxes would die a quick death.

the problem with progressive income taxes is that they encourage politicians to make more and more promises in order to win votes and that in turn requires more government spending. When those who are doing the voting in of spendthrift politicians and those voters don't get massive tax hikes to pay for what they want, they have no incentive to reign in big spending politicians. Its easy for a politician to say-as Obama did-lets have Obamacare and we will jack up the taxes on the top 5% to pay for it. Why would the other 95% be opposed? they are getting something that others pay for.

and sooner or later-as Dame Thatcher said-the problem with socialism is you run out of other peoples' money.

many of those think that its "unfair" that some do well and the tax system should afflict the comfortable to slake the envy of the class warriors. that sadly is a main driving force behind things like the death tax and high progressive income taxes. but we keep coming back to a basic truth. Your existence should not create a just claim on what someone else has or earns