- Joined

- Dec 4, 2013

- Messages

- 36,610

- Reaction score

- 35,612

- Gender

- Male

- Political Leaning

- Liberal

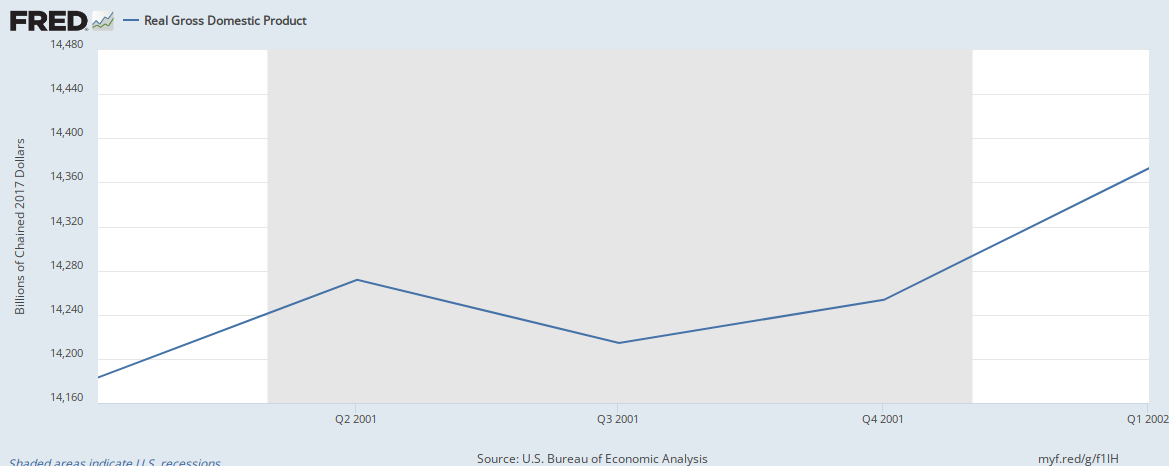

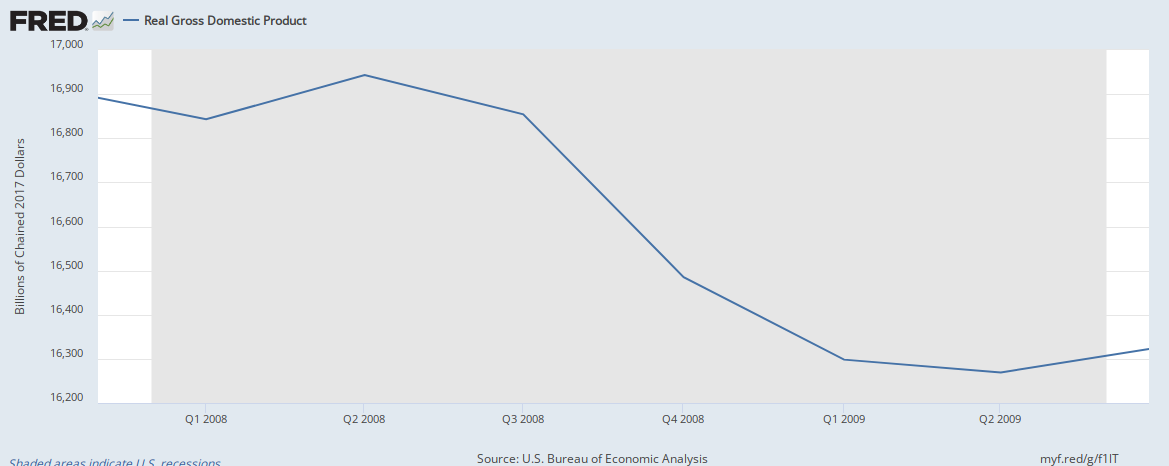

Let's not pretend that you are offering a serious debate. Comparing the slight recession of 2001 -- that lasted slightly more than two quarters, as anything comparable to the Great Recession?And there was a recession in 2000/2001 and no the Democrats were QUITE proud of their increased spending including cutting Bush out of the budget process completely in 2009. And thus the HUGE 9%, and only that low because Bush threatened to veto any higher and then 18% spending increases signed into law by Obama. And what did we get for all that increased spending, a budget deficit that jumped from $161B to $1,400B and staying over $1,000B for the next four years. You point your finger and blame Bush for the one year $400B and how the surpluses went away yet here you excuse the Democrats saying "oh they had a recession". You also ignore that the Democrats took control of the government 11 months before that recession started and what congresses can do is pass measures to help mitigate and soften the effects of a recession and give some measure of confidence to the markets and business. Such as the Republicans did in the 2000/2001 slowdown recession. The Democrats on the other hand were ranting about their huge spending increases, higher taxes, more regulations bigger government all around and that shut down the markets and investors and business expansion and hiring, thus we had a Great Recession/Depression as you like to call. And even when their stimulus failed the did nothing to get us into a full recovery.

The rest has been litigated before. The spending increase in 2009 and the subsequent deficit was entirely attributable to the Great Recession.

Again, please don't pretend that you are seriously debating instead of just engaging in partisan hackery.