- Joined

- Jan 2, 2006

- Messages

- 28,174

- Reaction score

- 14,270

- Location

- Boca

- Gender

- Male

- Political Leaning

- Independent

Given the contractory effects of tax hikes on the economy, it's pretty clear what the problem is-spending.

This isn't clear, as there hasn't been any evidence presented that confirms the bold.

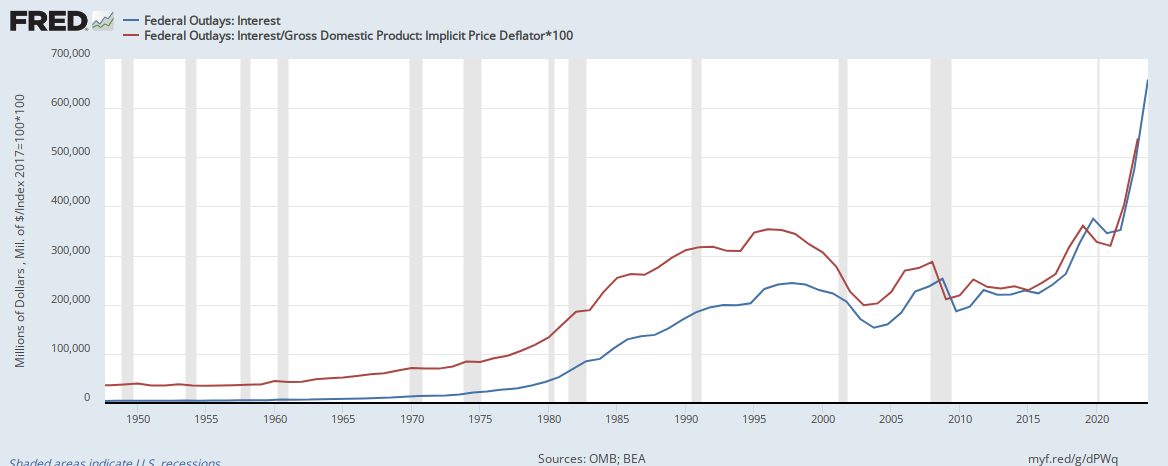

Note how that interest number keeps gobbling up more of the pie.

These are not pie charts, they are are reconstructions of CBO data by Veronique De Rugy, who is an adjunct scholar @ Cato.

A rather weak post.

Also- Note the explosion in major health care programs. Now image that number if Democrats get their wish- single payer.

Also, note the aging of the U.S. population along with the decline in birth rate.