- Joined

- Nov 28, 2011

- Messages

- 23,280

- Reaction score

- 18,288

- Gender

- Undisclosed

- Political Leaning

- Other

NYT:

https://www.nytimes.com/2017/04/26/us/politics/trump-tax-cut-plan.html

Politico:

Trump tax plan heavy on promises, light on details - POLITICO

• 3 tax brackets (10%, 25%, 35%)

• Corporate at 15%, including Trumps businesses (i.e. HUGE tax break for Trump personally)

• Corp taxes will be for all size businesses

• HUGE tax breaks for the rich

• Standard deduction is doubled, $24k for couples

• Almost every itemization is eliminated -- basically everything except charitable donations, mortgage interest, and new child care credit

• Estate tax repealed (see above re wealthy)

• AMT repealed (see above re wealthy, AND a huge tax break for Trump's own family)

• No border tax in this plan

• One-time tax for companies repatriating cash to the US

• "Some" help for child care, via tax credits

• If it can't be shown to be a revenue-neutral cut, then it can only be in effect for 10 years

• Lots of missing details

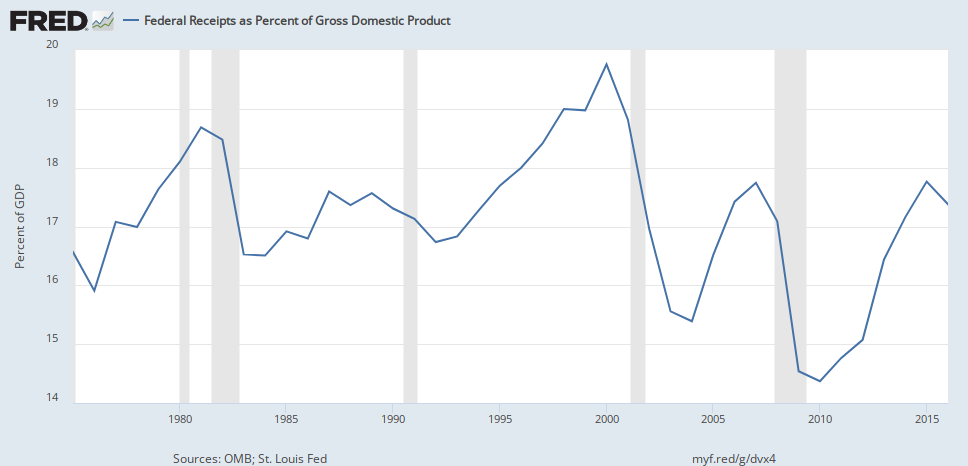

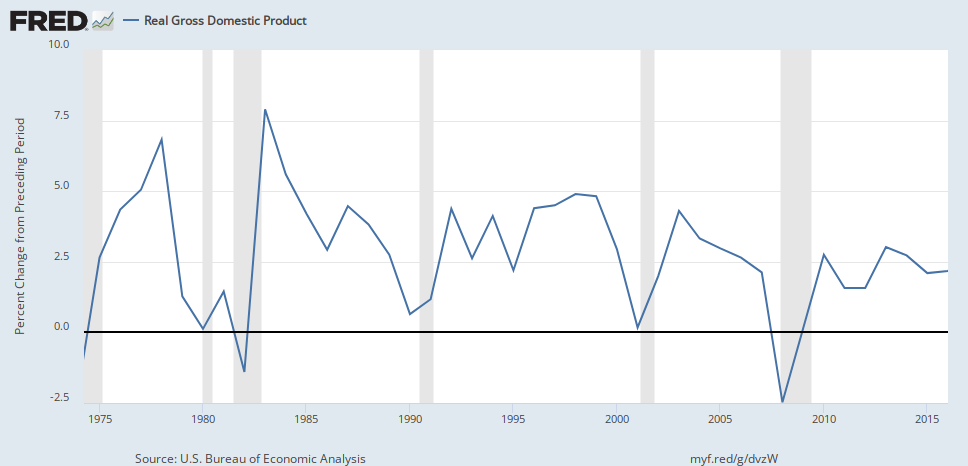

Although obviously this hasn't been scored yet, it looks like it will be a massive tax cut, which will mean a huge tax shortfall, adding trillions to the deficit over 10 years.

It probably will spark some growth, but it is all but impossible that it will generate enough growth to replace the lost revenues.

Opening gambit? DOA? We'll see soon enough.

https://www.nytimes.com/2017/04/26/us/politics/trump-tax-cut-plan.html

Politico:

Trump tax plan heavy on promises, light on details - POLITICO

• 3 tax brackets (10%, 25%, 35%)

• Corporate at 15%, including Trumps businesses (i.e. HUGE tax break for Trump personally)

• Corp taxes will be for all size businesses

• HUGE tax breaks for the rich

• Standard deduction is doubled, $24k for couples

• Almost every itemization is eliminated -- basically everything except charitable donations, mortgage interest, and new child care credit

• Estate tax repealed (see above re wealthy)

• AMT repealed (see above re wealthy, AND a huge tax break for Trump's own family)

• No border tax in this plan

• One-time tax for companies repatriating cash to the US

• "Some" help for child care, via tax credits

• If it can't be shown to be a revenue-neutral cut, then it can only be in effect for 10 years

• Lots of missing details

Although obviously this hasn't been scored yet, it looks like it will be a massive tax cut, which will mean a huge tax shortfall, adding trillions to the deficit over 10 years.

It probably will spark some growth, but it is all but impossible that it will generate enough growth to replace the lost revenues.

Opening gambit? DOA? We'll see soon enough.