-

This is a political forum that is non-biased/non-partisan and treats every person's position on topics equally. This debate forum is not aligned to any political party. In today's politics, many ideas are split between and even within all the political parties. Often we find ourselves agreeing on one platform but some topics break our mold. We are here to discuss them in a civil political debate. If this is your first visit to our political forums, be sure to check out the RULES. Registering for debate politics is necessary before posting. Register today to participate - it's free!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trump Tax Plan Is Out (sorta)

- Thread starter Visbek

- Start date

- Joined

- Jul 7, 2015

- Messages

- 39,369

- Reaction score

- 10,021

- Location

- California

- Gender

- Male

- Political Leaning

- Liberal

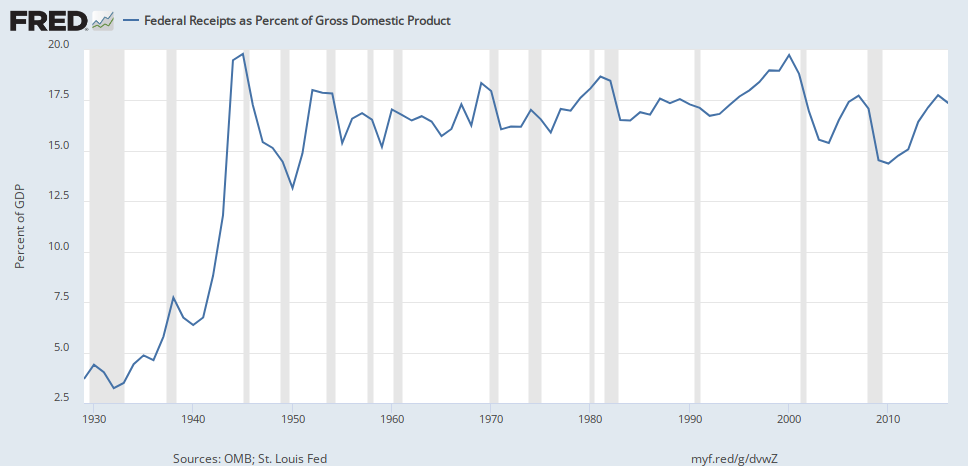

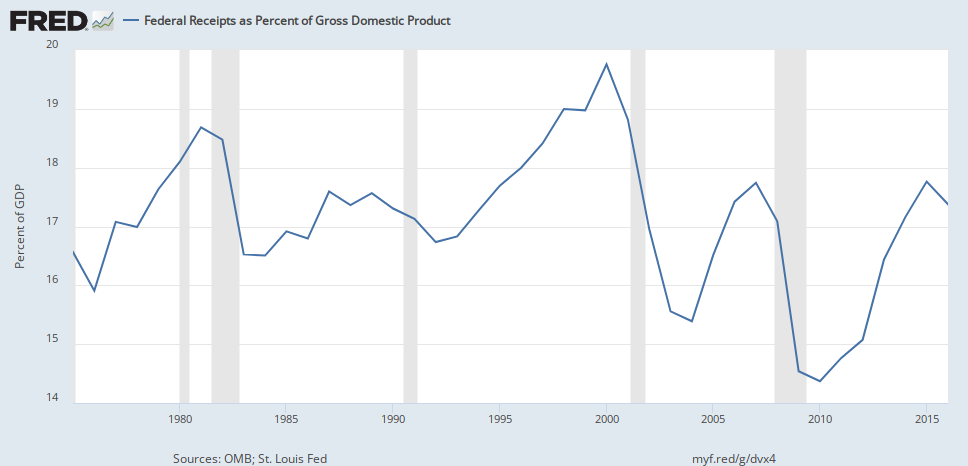

Since 1930:

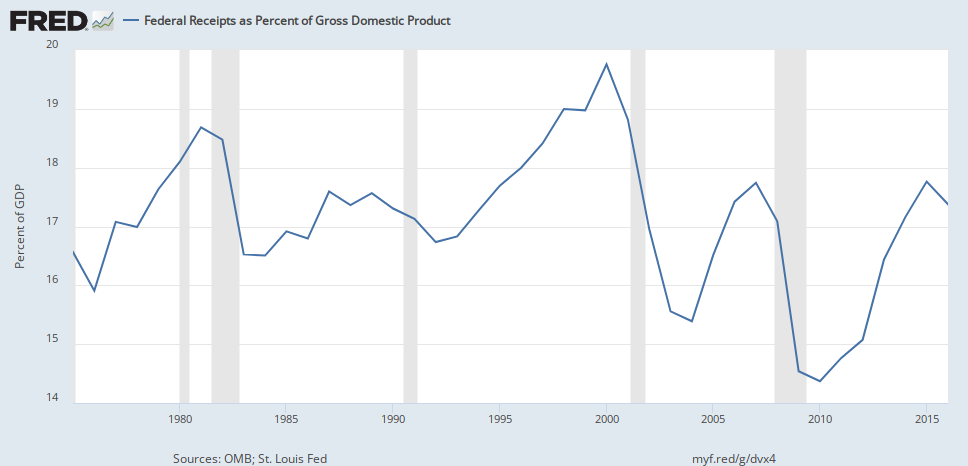

From 1975 to the present:

IIRC: Reagan's major tax cut was in 1981. Revenues plunged starting in 1982, though part of that was because of the recession. He increased taxes in 1982 and 1984, and decreased them again in 1986.

Tax revenues didn't really start increasing until 1993... when Clinton increased taxes.

They declined a bit in 2000, but really plummeted in 2001, when the Bush tax cuts kicked in. They increased when the real estate bubble was in full swing, and obviously dropped again when the recession hit.

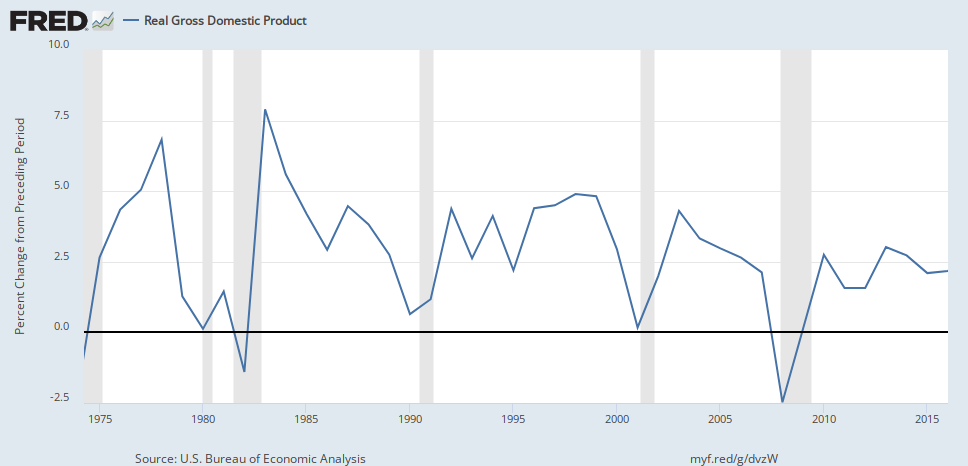

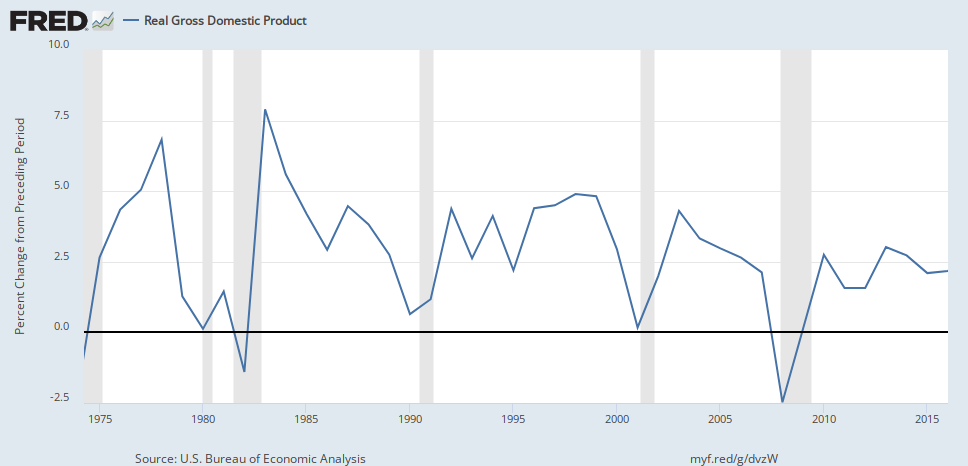

Those tax increases also don't seem to correlate to massive growth:

E.g. Reagan had a terrible start of his term, with a great year in '83 (one year after a mild tax increase and at a time when he was spending big bucks on defense... and running up the deficit), and less stellar growth in the second half. Clinton, who raised taxes slightly, had a pretty good term until the end (Dot Com crash). Bush 43 had slightly less growth; Obama had a terrible start, and mediocre growth, despite leaving the Bush tax cuts in place and only slightly increasing taxes on the wealthy during his term.

Obviously, such crude correlations have their limits, and determining causality isn't easy. I'm sure I can find far more information if you like, but for the most part, it's pretty obvious that tax cuts do not spark enough growth to make up for the lost revenue.

Tax cuts were a great idea when the top marginal rate was 90%.

Now that the superrich pay often pay a much lower rate than i do, tax cuts won't do much except further advantage financial momentum. That became pretty obvious after the pathetic blip of growth that President Bush 2's costly tax cut gave us.

celticwar17

DP Veteran

- Joined

- Feb 17, 2011

- Messages

- 6,540

- Reaction score

- 2,524

- Gender

- Male

- Political Leaning

- Libertarian

Since 1930:

From 1975 to the present:

IIRC: Reagan's major tax cut was in 1981. Revenues plunged starting in 1982, though part of that was because of the recession. He increased taxes in 1982 and 1984, and decreased them again in 1986.

Tax revenues didn't really start increasing until 1993... when Clinton increased taxes.

They declined a bit in 2000, but really plummeted in 2001, when the Bush tax cuts kicked in. They increased when the real estate bubble was in full swing, and obviously dropped again when the recession hit.

Those tax increases also don't seem to correlate to massive growth:

E.g. Reagan had a terrible start of his term, with a great year in '83 (one year after a mild tax increase and at a time when he was spending big bucks on defense... and running up the deficit), and less stellar growth in the second half. Clinton, who raised taxes slightly, had a pretty good term until the end (Dot Com crash). Bush 43 had slightly less growth; Obama had a terrible start, and mediocre growth, despite leaving the Bush tax cuts in place and only slightly increasing taxes on the wealthy during his term.

Obviously, such crude correlations have their limits, and determining causality isn't easy. I'm sure I can find far more information if you like, but for the most part, it's pretty obvious that tax cuts do not spark enough growth to make up for the lost revenue.

Are you really going to be THAT dishonest.... you are conveniently associating revenue plunges with tax cuts a year to two years before the actual cut happened. Anyway, Reagan both increased spending At cut taxes due to the cold war... of course there is going to be deficits. You saw during the clinton years that Clinton raised taxes but then got stonewalled by the brand new republican house in 1995 who ran specifically on halting government spending(lead by Newt Gingrich). And to give Clinton what credit he deserves, he was not an ideologue like Obama was... Clinton turned into a Fiscal conservative as soon as the political wind blew that way.

THE GOVERNMENT DOESN'T RUN THE ECONOMY!!! The economy is it's own separate entity, that grows based on how well American companies are competing with the rest of the world and how well they are innovating with new technology. That has a significantly more to do with the state of growth in our economy than ANYTHING else. The government is a vampire sucking on the economy and we hope it's in a place where it's a symbiotic relationship... where the blood sucking vampire returns some nutrients back after processing(sort of like a cow actually, even though we feed he cow tons and tons of food every year and poops it out as waste... we do it because we like beef, and we think beef is an essential part of our diet), but since the vampire/cow is a middleman(A huge bureaucratic unmotivated unincentivized middleman) it is fundamentally wasteful and only should be used for the bare minimum of vampire beef you need to survive.

- Joined

- Nov 28, 2011

- Messages

- 23,272

- Reaction score

- 18,276

- Gender

- Undisclosed

- Political Leaning

- Other

What on Earth are you talking about?Are you really going to be THAT dishonest.... you are conveniently associating revenue plunges with tax cuts a year to two years before the actual cut happened.

Yes, of course. That doesn't change the fact that Reagan promised they would pay for themselves, and was wrong.Anyway, Reagan both increased spending At cut taxes due to the cold war... of course there is going to be deficits.

I never said it did. In fact, I explicitly said: "Obviously, such crude correlations have their limits, and determining causality isn't easy."THE GOVERNMENT DOESN'T RUN THE ECONOMY!

However, government policies do impact tax rates; and those promoting these huge deficit-causing cuts claim that they will pay for themselves, by spurring growth

Yeah, not so much. Government spending is over 1/3 of the US GDP right now.The economy is it's own separate entity....

That's not right either.The government is a vampire sucking on the economy

If it was collecting paper dollars for taxes, and burning them in a sacrificial fire, then yes it'd be bad for the economy.

And sure, some of its spending has small multipliers, notably military.

Other spending is economically beneficial, especially programs like Social Security, Medicare and unemployment insurance. All of that gets spent pretty much right away. Other programs help keep people out of dire poverty, which certainly seems to me like it's beneficial. Even lots of wealthy people are concerned that too much inequality is bad for the economy, and realize that government-based redistribution and progressive taxation is the best way to tamp down some of the worst economic effects of those imbalances.

Business is obviously important as well, but let's get real. Quite a few businesses don't give a crap about their employees, or even their own customers. They certainly aren't interested in fixing inequality.

- Joined

- Jan 24, 2017

- Messages

- 24,693

- Reaction score

- 24,052

- Gender

- Male

- Political Leaning

- Progressive

Reagan's signature tax package passed in 1986, half way through his second term. The reason tax revenue sucked in the first couple of years of the 80's was because nobody had a job. Inflation was in the double digits and the prime was bouncing around 20%. Banks, much like in the mid 2000's, were up to their eyeballs in real estate and everyone saw the plunge coming. In fact, the only reason Reagan was able to get his tax plan through is because the Democrats couldn't even defend their plans any more. They were just looking for someone to pass the mess off to.

According to Hauser's Law, average revenue as a % of GDP is 17.9%

Reagan Years

In '82 18.6%

In '83 16.9%

In '84 16.8%

In '85 17.2%

In '86 16.7%

In '87 17.8%

In '88 17.6%

In '89 17.7%

Avg: 17.4%

Clinton Years

In '92 16.9%

In '93 16.9%

In '94 20.3%

In '95 18%

In '96 18.2%

In '97 18.6%

In '98 18.4%

In '99 17.8%

Avg: 18.1%

All calculations made from data found here: Rate Limited

All in all Clinton's was slightly higher. With Reagan's average being a half a % below the average, and Clintons slightly above the average. In total we cannot conclude that tax cuts stimulate revenue. The data isn't there to make that statement.

- Joined

- Mar 27, 2014

- Messages

- 63,578

- Reaction score

- 33,585

- Location

- Tennessee

- Gender

- Male

- Political Leaning

- Undisclosed

Reagan's signature tax package passed in 1986, half way through his second term. The reason tax revenue sucked in the first couple of years of the 80's was because nobody had a job. Inflation was in the double digits and the prime was bouncing around 20%. Banks, much like in the mid 2000's, were up to their eyeballs in real estate and everyone saw the plunge coming. In fact, the only reason Reagan was able to get his tax plan through is because the Democrats couldn't even defend their plans any more. They were just looking for someone to pass the mess off to.

ERTA (1981) was a huge tax cut - the biggest tax cut by far for the period 1968 through at least 2006, over $150B per year in 1992 dollars. That's at least a big part of why revenue sucked in those early years. TRA 86 included some genuine tax reform, but was roughly revenue neutral.

This is a useful summary of the revenue impact of various tax plans in the 20th century from post WWII through 2006.

https://www.treasury.gov/resource-center/tax-policy/tax-analysis/Documents/WP-81.pdf

- Joined

- Sep 16, 2012

- Messages

- 49,540

- Reaction score

- 55,176

- Location

- Tucson, AZ

- Gender

- Male

- Political Leaning

- Conservative

According to Hauser's Law, average revenue as a % of GDP is 17.9%

Reagan Years

In '82 18.6%

In '83 16.9%

In '84 16.8%

In '85 17.2%

In '86 16.7%

In '87 17.8%

In '88 17.6%

In '89 17.7%

Avg: 17.4%

Clinton Years

In '92 16.9%

In '93 16.9%

In '94 20.3%

In '95 18%

In '96 18.2%

In '97 18.6%

In '98 18.4%

In '99 17.8%

Avg: 18.1%

All calculations made from data found here: Rate Limited

All in all Clinton's was slightly higher. With Reagan's average being a half a % below the average, and Clintons slightly above the average. In total we cannot conclude that tax cuts stimulate revenue. The data isn't there to make that statement.

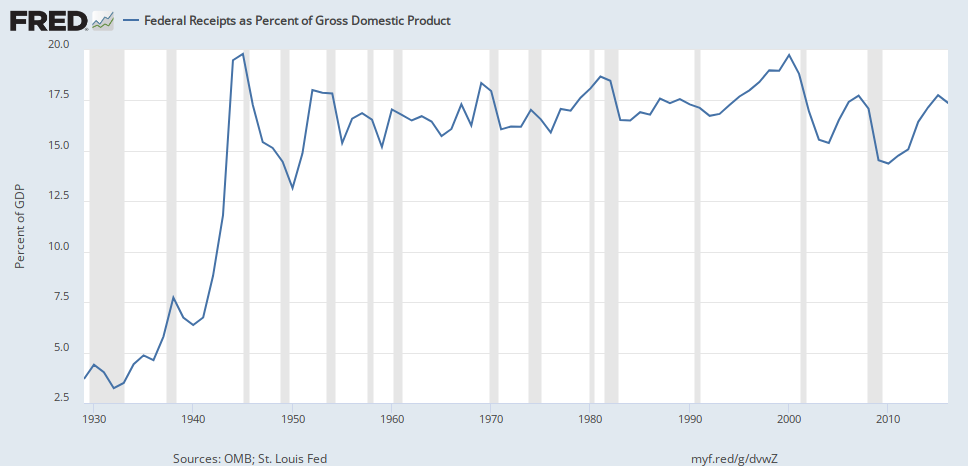

You should go back farther. That 18% of GDP average has been the rule since just after WWII. It's been in that range when the rates reached 95% and when they topped at 28%. It's been that way when we had 16 brackets and when we had 2 brackets.

- Joined

- Nov 28, 2011

- Messages

- 23,272

- Reaction score

- 18,276

- Gender

- Undisclosed

- Political Leaning

- Other

More news: Business Insider lists the deductions Trump wants to eliminate, Marketwatch adds a few as well.

Trump tax cut plan eliminated itemized tax deductions - Business Insider

Americans may soon kiss these lucrative individual tax deductions goodbye - MarketWatch

• State and local taxes (property taxes, state income taxes, sales taxes)

• Alimony

• Gambling losses

• Student loan interest payments

• Education expenses

• Job-related expenses

• Home office expenses

• Travel-related expenses

• Losses due to theft

It's going to take a bit of time to figure out how these changes will affect different income brackets.

Retirement plans will NOT change (e.g. deductions for IRAs).

Trump tax cut plan eliminated itemized tax deductions - Business Insider

Americans may soon kiss these lucrative individual tax deductions goodbye - MarketWatch

• State and local taxes (property taxes, state income taxes, sales taxes)

• Alimony

• Gambling losses

• Student loan interest payments

• Education expenses

• Job-related expenses

• Home office expenses

• Travel-related expenses

• Losses due to theft

It's going to take a bit of time to figure out how these changes will affect different income brackets.

Retirement plans will NOT change (e.g. deductions for IRAs).

- Joined

- Jan 24, 2017

- Messages

- 24,693

- Reaction score

- 24,052

- Gender

- Male

- Political Leaning

- Progressive

You should go back farther. That 18% of GDP average has been the rule since just after WWII. It's been in that range when the rates reached 95% and when they topped at 28%. It's been that way when we had 16 brackets and when we had 2 brackets.

Yeah, that Hauser's Law implicates the idea that Federal Receipts in the US, are roughly always the same, regardless of marginal rates and brackets. I'd be interested in looking at the economic data of the 1920's. It's probably the one decade (of the 20th century) that I haven't analyzed intensely.

- Joined

- Mar 27, 2014

- Messages

- 63,578

- Reaction score

- 33,585

- Location

- Tennessee

- Gender

- Male

- Political Leaning

- Undisclosed

Yeah, that Hauser's Law implicates the idea that Federal Receipts in the US, are roughly always the same, regardless of marginal rates and brackets. I'd be interested in looking at the economic data of the 1920's. It's probably the one decade (of the 20th century) that I haven't analyzed intensely.

I sort of agree, but that "roughly always the same" hides some pretty significant swings, actually. From the 19% of Clinton for the last years of his 2nd term, to the less than 16% during some of the Bush years is 3% of GDP or about $540 billion per year in receipts. That's a significant number. Heck, 1% of GDP at over $180 billion in receipts is significant.

- Joined

- Jan 24, 2017

- Messages

- 24,693

- Reaction score

- 24,052

- Gender

- Male

- Political Leaning

- Progressive

I sort of agree, but that "roughly always the same" hides some pretty significant swings, actually. From the 19% of Clinton for the last years of his 2nd term, to the less than 16% during some of the Bush years is 3% of GDP or about $540 billion per year in receipts. That's a significant number. Heck, 1% of GDP at over $180 billion in receipts is significant.

Agreed, 1% of GDP is a ton of money. "Roughly always the same" when you zoom out from a 100 year perspective on the largest economy in the world, you miss the details of HUD getting cut so, a few billionaires can eat a 2nd dessert. The devil is in the details.

Sent from my iPhone using Tapatalk

- Joined

- Dec 2, 2012

- Messages

- 7,362

- Reaction score

- 1,342

- Gender

- Undisclosed

- Political Leaning

- Libertarian

Why not a tax on company shares and stock prices.

we already do in the form of capital gains on an individual.

- Joined

- Dec 16, 2011

- Messages

- 74,299

- Reaction score

- 32,538

- Location

- Florida

- Gender

- Male

- Political Leaning

- Liberal

Reagan's signature tax package passed in 1986, half way through his second term. The reason tax revenue sucked in the first couple of years of the 80's was because nobody had a job. Inflation was in the double digits and the prime was bouncing around 20%. Banks, much like in the mid 2000's, were up to their eyeballs in real estate and everyone saw the plunge coming. In fact, the only reason Reagan was able to get his tax plan through is because the Democrats couldn't even defend their plans any more. They were just looking for someone to pass the mess off to.

LOL The Fed raised interest rates through the roof and that is what killed the economy under Carter. The PRIME rate was 20%! in 1980. All because OPEC tripled oil prices and drove up the cost of everything and the FED saw that as inflation! All St. Reagan had to do was get those rates lower and spend Govt. money like no other before him to get the economy going again. It wasn't rocket science although that was a part of the wild spending. Even David Stockton thinks the tax cuts he helped implement were a mistake and the ultimate cause of our huge debt today. Cutting tax rates reduces revenue, even questioning that fact implies incredible stupidity and a tribalist view of reality where facts have no meaning.

David Stockman Trashes Reaganomics, Bush Tax Cuts, And Hank "Incompetent, Reckless" Paulson - Business Insider

Last edited:

- Joined

- Sep 30, 2011

- Messages

- 4,207

- Reaction score

- 2,615

- Gender

- Male

- Political Leaning

- Undisclosed

I'm sure I can find far more information if you like, but for the most part, it's pretty obvious that tax cuts do not spark enough growth to make up for the lost revenue.

Especially tax cuts to those with low marginal propensity to consume (ie, the wealthy).

- Joined

- Dec 4, 2013

- Messages

- 36,610

- Reaction score

- 35,612

- Gender

- Male

- Political Leaning

- Liberal

The bottom line is that Trump moved the goalpost once again. He promised that he'd introduce a tax plan within 100 days. That's the equivalent of the term paper being due -- and handing in the paper outline.

What was released was a one page sketch that has no detail. A full tax plan is thousands of pages long, crafted by an army of accountants. This was trying to pawn off a single page PowerPoint presentation as a doctoral dissertation.

what we do know is that this plan lowers taxes on the rich greatly and throws a few crumbs to the middle class as cover, which widely slashes revenue.

Hopefully, this is DOA in Congress but one never knows with GOP control.

What was released was a one page sketch that has no detail. A full tax plan is thousands of pages long, crafted by an army of accountants. This was trying to pawn off a single page PowerPoint presentation as a doctoral dissertation.

what we do know is that this plan lowers taxes on the rich greatly and throws a few crumbs to the middle class as cover, which widely slashes revenue.

Hopefully, this is DOA in Congress but one never knows with GOP control.

- Joined

- Dec 4, 2013

- Messages

- 36,610

- Reaction score

- 35,612

- Gender

- Male

- Political Leaning

- Liberal

Some estimates have this adding over $2.5T to our deficit. Trump MAGA. :doh

It's trillions added to what's already projected based upon Trump's campaign proposal. The garbage released yesterday isn't detailed enough to form a projection. Added debt is as high as $10T.

- Joined

- Dec 4, 2013

- Messages

- 36,610

- Reaction score

- 35,612

- Gender

- Male

- Political Leaning

- Liberal

Today's NYT Editorial"

President Trump’s Laughable Plan to Cut His Own Taxes

As a rule, Republican presidents like offering tax cuts, and President Trump is no different. But the skimpy one-page tax proposal his administration released on Wednesday is, by any historical standard, a laughable stunt by a gang of plutocrats looking to enrich themselves at the expense of the country’s future.

...

MaggieD

DP Veteran

- Joined

- Jul 9, 2010

- Messages

- 43,244

- Reaction score

- 44,664

- Location

- Chicago Area

- Gender

- Female

- Political Leaning

- Moderate

Well this is what Hillary accused come to pass - he's using a government office to profit from it personally. Anyone who even attempts that should be removed automatically. But if he doesn't manage to pass this, he'll probably resign since profiteering is his only reason to seek the presidency in the first place

If someone who didn't stand to benefit had proposed this, i could critique it in a serious way, but as it stands, it should only be ****ted on

Also, it's light on details because his last proposal to pay for it by gutting everything except a massive hike to already bloated beyond comprehension military was deemed DoA by his own party

OMG. If you don't think every single congressman benefits from tax cuts for the wealthy, you live in a dream world.

- Joined

- Feb 23, 2015

- Messages

- 26,517

- Reaction score

- 26,637

- Location

- New York State, USA

- Gender

- Male

- Political Leaning

- Slightly Liberal

Yeah, this will definitely add trillions to the debt.

But remember according to the Trumpsters debt and deficits don't matter when there's an (R) in the WH. But when a (D) is prez then deficits will be the ruination of the country and our great, great, great, great grandchildren will be paying for the evil (D) president's debt. lol

But remember according to the Trumpsters debt and deficits don't matter when there's an (R) in the WH. But when a (D) is prez then deficits will be the ruination of the country and our great, great, great, great grandchildren will be paying for the evil (D) president's debt. lol

- Joined

- Jan 21, 2013

- Messages

- 25,357

- Reaction score

- 11,557

- Location

- Post-Trump America

- Gender

- Male

- Political Leaning

- Moderate

NYT:

https://www.nytimes.com/2017/04/26/us/politics/trump-tax-cut-plan.html

Politico:

Trump tax plan heavy on promises, light on details - POLITICO

• 3 tax brackets (10%, 25%, 35%)

• Corporate at 15%, including Trumps businesses (i.e. HUGE tax break for Trump personally)

• Corp taxes will be for all size businesses

• HUGE tax breaks for the rich

• Standard deduction is doubled, $24k for couples

• Almost every itemization is eliminated -- basically everything except charitable donations, mortgage interest, and new child care credit

• Estate tax repealed (see above re wealthy)

• AMT repealed (see above re wealthy, AND a huge tax break for Trump's own family)

• No border tax in this plan

• One-time tax for companies repatriating cash to the US

• "Some" help for child care, via tax credits

• If it can't be shown to be a revenue-neutral cut, then it can only be in effect for 10 years

• Lots of missing details

Although obviously this hasn't been scored yet, it looks like it will be a massive tax cut, which will mean a huge tax shortfall, adding trillions to the deficit over 10 years.

It probably will spark some growth, but it is all but impossible that it will generate enough growth to replace the lost revenues.

Opening gambit? DOA? We'll see soon enough.

Trump continues to masquerade as a conservative and will cave to the Democrats when the time comes. We saw it happen twice already... Why should this time be anything different?

- Joined

- Dec 4, 2013

- Messages

- 36,610

- Reaction score

- 35,612

- Gender

- Male

- Political Leaning

- Liberal

The architects of this plan are Steven Mnuchin and Gary Cohn, both multimillionaires or billionaires and former Goldman Sachs bankers. One cannot downplay that people like Mnuchin, Cohn, and Trump would greatly benefit personally from this plan.OMG. If you don't think every single congressman benefits from tax cuts for the wealthy, you live in a dream world.

These people have crafted a plan that is self-serving their own financial interests and not the interests of the middle-class or the nation as a whole. Trump's claim that it will "create jobs" and Mnuchin saying that it "will pay for itself," is trickle down buffoonery.

- Joined

- Apr 25, 2014

- Messages

- 6,665

- Reaction score

- 6,278

- Gender

- Male

- Political Leaning

- Other

If you want to talk about making sure the rich actually have to pay taxes at the bracket rates rather than an effective rate lower than most middle class people, I'll listen. But I'm not sure what you're saying here.

You literally cannot tax income "like capital gains" because capital gains involve profit from the sale of property, and you most certainly do not "sell" income for profit. You earn income.

He's talking rates.

- Joined

- Nov 28, 2011

- Messages

- 23,272

- Reaction score

- 18,276

- Gender

- Undisclosed

- Political Leaning

- Other

It's one thing for a federal legislator to write a tax cut that slightly reduces their own taxes.OMG. If you don't think every single congressman benefits from tax cuts for the wealthy, you live in a dream world.

It's another for Trump to propose a massive cut to his own taxes.

• His corporate tax rate will go from ~35% to 15%

• He will be able to pass through his personal income, i.e. he will avoid the top 35% bracket and get taxed at 15% instead

• His low rate will be assured because AMT will be gone

• He will continue to receive deductions for the mortgages on any real estate he owns

• The estate tax removal will be a huge

This is also a pretty vague plan; it's nowhere near actual legislation. I suspect that once more details are presented, someone will put together a rough estimate of how much someone like Trump is likely to save as a result of the changes.

IMO this is another reason why we should see more details about Trump's own taxes.

- Joined

- Nov 28, 2011

- Messages

- 23,272

- Reaction score

- 18,276

- Gender

- Undisclosed

- Political Leaning

- Other

Because he's writing a tax cut for his own benefit? :mrgreen:Trump continues to masquerade as a conservative and will cave to the Democrats when the time comes. We saw it happen twice already... Why should this time be anything different?

I do think this is more of an opening gambit than a serious proposal. Deficit hawks will really lose it once we have some cost estimates. However, it seems highly unlikely that Trump will be the one to propose a massive middle-class tax cut, without the other breaks for the wealthy. IMO he is acting more like a traditional Republican, than either a working-class populist or Democratic stooge when it comes to taxes.