- Joined

- May 12, 2014

- Messages

- 6,815

- Reaction score

- 4,420

- Gender

- Male

- Political Leaning

- Liberal

Here was the original statement...

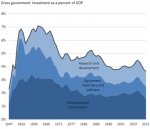

"he Depression was actually ended, and prosperity restored, by the sharp reductions in spending, taxes and regulation at the end of World War II, exactly contrary to the analysis of Keynesian so-called economists."

How much clearer can it be? that is EXACTLY what that graph shows.

Leave it to you to put forth yet another ankle-deep analysis. Do you seriously believe that one graph explains how our economy rebounded after WWII? If so, that's idiotic. And your source couldn't be a bigger ideologue if he called his article a manifesto.

Jaeger and I are discussing this very issue in another thread. The reduction in government spending was countered by sharp increases in investment, exports, and consumption. None of that was caused by the drop in government spending, it was just the natural result of a country that was already geared up to produce a ton, and wanted to consume again after five years of rationing. That, plus a very helpful G.I. Bill, which allowed soldiers a bit to start with, a chance to go to college, and a program that allowed for a sixfold increase in housing expenditures.