- Joined

- Jan 24, 2017

- Messages

- 24,677

- Reaction score

- 24,036

- Gender

- Male

- Political Leaning

- Progressive

Buckle up for another 4 years of crushing deficits. Republicans repeat the fallacy that cutting taxes increases revenue and will undoubtedly use that to extract more money out of our economy. Cutting taxes does not increase revenues. Any job growth seen during a period of low taxes is not significant enough to offset missed revenues on high income earners. Trump's tax plan is more of what Americans are tired of, bells and whistles if you're in the club, skidmarks if you're on the asphalt.

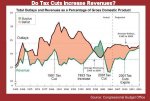

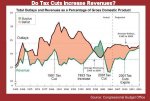

It's important to note that GDP grows. Factors in GDP growth are inflation as well as a growing economy. So, tax cuts or no tax cuts, the GDP can perform as an independent function. Excepting economic downturns, the GDP trends upwards. And as GDP trends upwards so will revenues.

Conservatives will advocate for tax cuts by pointing to places in time when tax cuts coincided with an economic recovery or boom. Tax cut advocates will argue that the tax cuts have a direct correlation with increased revenues. An exception to the rule emerges when you compare revenue increases following the Bush and Reagan tax cuts against the revenue increase following Bill Clinton’s tax increase on the wealthiest Americans. Bill Clinton's revenue climbs and peaks at higher levels than Bush's around the year '00. And then it begins its descent. As a % of GDP Post-Reagan and post-Bush federal revenues actually fall below the 50 year average. Which begs the question. How much did these tax cuts cost us? :doh

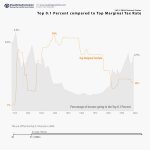

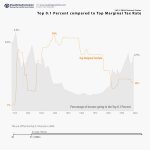

Over a longer period of time we can see that periods of low taxes on top income earners have no correlation with an increase in job creation or GDP growth. This comes into stark view when you consider we have added most jobs during periods of time when our top marginal rates were much higher than they are today. And today our job creation is at a rate so abysmal it's not worth mentioning.

The Fallacy of Reaganomics. Republicans point to Reagan as the stalwart champion of modern fiscal conservatism. However upon examining the data we see that Reagan made some errors in judgement when slashing taxes. The deficit under Reagan reached $207 billion in 1983, two years after Reagan passed the Economic Recovery Tax Act of 1981 which reduced taxes, effectively reducing tax revenue. His last budget deficit was $152 billion dollars. So, during his term he had a net increase of doubling the deficit. The Economic Recovery Tax Act of 1981, cut the top marginal tax rates from 70% to 50% and the bottom rate from 14% to 11% in addition to cutting capital gains, estate and corporate taxes. This combined with increased defense spending led to Reagan running the aforementioned deficits. In other words, Reagan did exactly what conservatives who idolize him are currently criticizing Obama for. Tax cut advocates argue this lays the groundwork for the robust economy following, while ignoring the Fed decreases interest rates during this period.

The Bush Tax Cuts. Under the Economic Growth and Tax Reconciliation Act Bush lowered the top marginal rate to 35%. Just like with Reagan, tax cut advocates claim that the Bush tax cuts stimulated the economy. But there is little correlation between the two. Advocates for tax cuts ignore the effect of the housing bubble. (Ironically the bubble would later burst and cause catastrophe, of which we are still feeling.) The same tax cut advocates act as if a Clinton tax revenue boom in the 90s was a lucky happenstance initiated by the internet revolution. While ignoring the housing bubble when crediting the Bush tax cuts for growth.

Bruce Bartlett who held senior positions in the Reagan and Bush administrations explains, "It would have been one thing if the Bush tax cuts had at least bought the country a higher rate of economic growth, even temporarily. They did not. Real G.D.P. growth peaked at just 3.6 percent in 2004 before fading rapidly. Even before the crisis hit, real G.D.P. was growing less than 2 percent a year." A former member of one of the most conservative administrations of all times has to depart from current conservative thought, which illustrates how far the propaganda has gone.

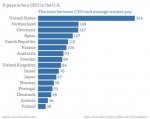

So, great, tax cuts have little to do with rising revenues. But, can we find a relationship somewhere else in our economy? Why, I thought you'd never ask. :lol: What you can find is a direct correlation between tax cuts and income/wealth inequality.

Huh? wasn't that sposta.. hm.. trickle... down..? Y'don't say Donnie.. Supply-side economics, which is a fancy way of saying, cut taxes on the rich and it frees up the money to be invested back into the economy. Benefits of which then "trickle down" onto us peasants and peons. However, data proves that in eras of supply side, wages decrease.

It's important to note that GDP grows. Factors in GDP growth are inflation as well as a growing economy. So, tax cuts or no tax cuts, the GDP can perform as an independent function. Excepting economic downturns, the GDP trends upwards. And as GDP trends upwards so will revenues.

Conservatives will advocate for tax cuts by pointing to places in time when tax cuts coincided with an economic recovery or boom. Tax cut advocates will argue that the tax cuts have a direct correlation with increased revenues. An exception to the rule emerges when you compare revenue increases following the Bush and Reagan tax cuts against the revenue increase following Bill Clinton’s tax increase on the wealthiest Americans. Bill Clinton's revenue climbs and peaks at higher levels than Bush's around the year '00. And then it begins its descent. As a % of GDP Post-Reagan and post-Bush federal revenues actually fall below the 50 year average. Which begs the question. How much did these tax cuts cost us? :doh

Over a longer period of time we can see that periods of low taxes on top income earners have no correlation with an increase in job creation or GDP growth. This comes into stark view when you consider we have added most jobs during periods of time when our top marginal rates were much higher than they are today. And today our job creation is at a rate so abysmal it's not worth mentioning.

The Fallacy of Reaganomics. Republicans point to Reagan as the stalwart champion of modern fiscal conservatism. However upon examining the data we see that Reagan made some errors in judgement when slashing taxes. The deficit under Reagan reached $207 billion in 1983, two years after Reagan passed the Economic Recovery Tax Act of 1981 which reduced taxes, effectively reducing tax revenue. His last budget deficit was $152 billion dollars. So, during his term he had a net increase of doubling the deficit. The Economic Recovery Tax Act of 1981, cut the top marginal tax rates from 70% to 50% and the bottom rate from 14% to 11% in addition to cutting capital gains, estate and corporate taxes. This combined with increased defense spending led to Reagan running the aforementioned deficits. In other words, Reagan did exactly what conservatives who idolize him are currently criticizing Obama for. Tax cut advocates argue this lays the groundwork for the robust economy following, while ignoring the Fed decreases interest rates during this period.

The Bush Tax Cuts. Under the Economic Growth and Tax Reconciliation Act Bush lowered the top marginal rate to 35%. Just like with Reagan, tax cut advocates claim that the Bush tax cuts stimulated the economy. But there is little correlation between the two. Advocates for tax cuts ignore the effect of the housing bubble. (Ironically the bubble would later burst and cause catastrophe, of which we are still feeling.) The same tax cut advocates act as if a Clinton tax revenue boom in the 90s was a lucky happenstance initiated by the internet revolution. While ignoring the housing bubble when crediting the Bush tax cuts for growth.

Bruce Bartlett who held senior positions in the Reagan and Bush administrations explains, "It would have been one thing if the Bush tax cuts had at least bought the country a higher rate of economic growth, even temporarily. They did not. Real G.D.P. growth peaked at just 3.6 percent in 2004 before fading rapidly. Even before the crisis hit, real G.D.P. was growing less than 2 percent a year." A former member of one of the most conservative administrations of all times has to depart from current conservative thought, which illustrates how far the propaganda has gone.

So, great, tax cuts have little to do with rising revenues. But, can we find a relationship somewhere else in our economy? Why, I thought you'd never ask. :lol: What you can find is a direct correlation between tax cuts and income/wealth inequality.

Huh? wasn't that sposta.. hm.. trickle... down..? Y'don't say Donnie.. Supply-side economics, which is a fancy way of saying, cut taxes on the rich and it frees up the money to be invested back into the economy. Benefits of which then "trickle down" onto us peasants and peons. However, data proves that in eras of supply side, wages decrease.