- Joined

- Dec 13, 2015

- Messages

- 9,594

- Reaction score

- 2,072

- Location

- France

- Gender

- Male

- Political Leaning

- Centrist

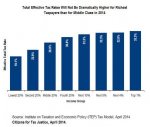

The caption is best understood by this infographic from the Tax Policy Center:

Which means quite simply that (due to a ridiculous flat-rate taxation of top revenues) more Income escapes taxation and moves upwards to build the Wealth of a comparatively select few (from here):

My Point: Is this the sort of nation you want for your children, and your children's children? One where the far greater share of the Wealth-pie (that we all work to generate in our economy) goes to an aberrationally minuscule percentage of American families?

Well, it is the one they have now and will be getting in the future as well ...

Which means quite simply that (due to a ridiculous flat-rate taxation of top revenues) more Income escapes taxation and moves upwards to build the Wealth of a comparatively select few (from here):

My Point: Is this the sort of nation you want for your children, and your children's children? One where the far greater share of the Wealth-pie (that we all work to generate in our economy) goes to an aberrationally minuscule percentage of American families?

Well, it is the one they have now and will be getting in the future as well ...

Last edited: