- Joined

- Nov 18, 2016

- Messages

- 48,268

- Reaction score

- 25,537

- Gender

- Male

- Political Leaning

- Liberal

GOOD ! Fiscal stimulus doesn't work

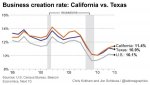

Funny, because that only seems to hold if a Democrat is in the whitehouse. When a Republican is in the whitehouse, then all of a sudden it's "strong leadership for a change". Now those same Tea Partiers can't wait to spend on infrastructure spending "To make America great again". Now, the headlines say: "Trump Tax and Spending Plans Will Boost Global Economy", LOL:

OECD Says Trump Tax and Spending Plans Will Boost Global Economy