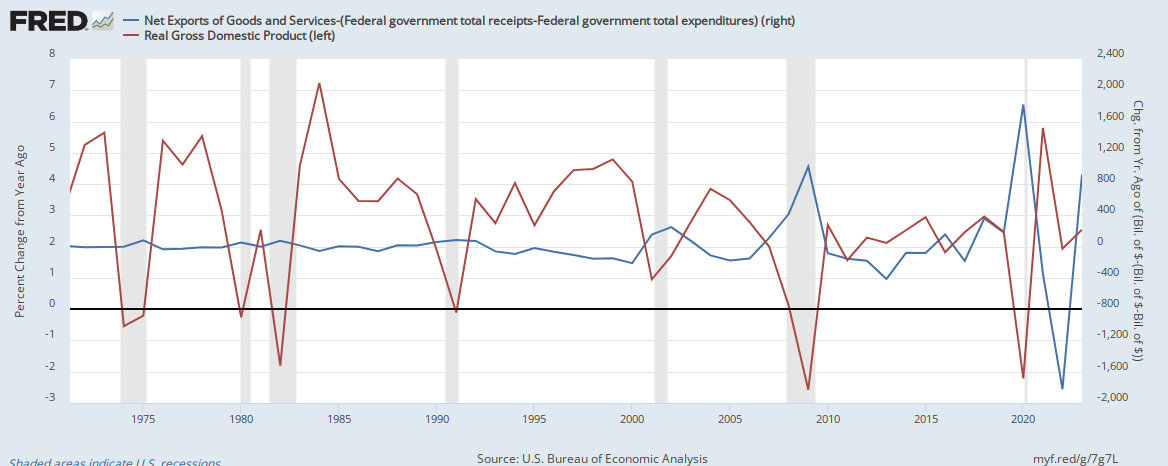

My point is that saved dollars (and dollars that buy U.S. bonds) don't get reinvested. And there are trillions held in bonds, which is essentially dead money, which are the result of trade deficits. Without deficit spending, we are asking domestic investment and output to pay for people and countries to sit on that money.

The proceeds of U.S. bond sales are spent into the real economy.

But this isn't re-investment of existing funds, it is just more deficit spending. The Chinese held a pile of

x dollars, and now they hold a pile of

x bonds; meanwhile, once the proceeds are deficit-spent into the economy, it is the

government's net position that has changed, not China's.

It is easier to see if you imagine the Fed buying those bonds instead of the Chinese - everybody is in the exact same financial position, and it is now clear that the dollars that are spent back into our real economy came from our government increasing it's own liabilities. The only difference is that instead of the Chinese holding bonds, the Fed holds bonds. Our dollars lost to trade deficits really don't come back at all, and they aren't reinvested in our economy.

Now, if you remove deficit spending (past and present) from that example, the funds that end up in China's hands

must come from our domestic economy. And those dollars come from active bank loans, so if China, Japan et al sit on, say, $6 trillion of our national debt, then our private sector must be paying interest on $6 trillion in bank loans that aren't doing anything productive. Even the interest is leaving the country.

And it never gets "paid off", not unless we start running trade surpluses.

You are continuing to ignore the gains from trade, and that they benefit (not impede) the U.S. economy.

No, I just think they are two distinct issues.

I understand that if we export $3 trillion and import $4 trillion, we are employing more people than if we export $1.5 trillion and import $2.5 trillion. I'm not saying that international trade is not a good thing on balance. But still, in each case, $1 trillion of our national income is leaking out of the economy, and isn't being spent on domestic production. It's still a gap that must be filled. If new investment fills that gap, great, we still grow. But as I said above, $1 trillion is being held outside of our economy, and it isn't doing any good for our economy, and there are maintenance costs related to that money.